- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Merging Credit Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Merging Credit Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Merging Credit Cards

Hello all. I am new to these forums.

I am getting married soon and my fiance and I are have a disagreement when it come to credit. We both have excellent credit scores and we are both very carefull on how we spend our money. We both have a Discover. She is insisting that once we are married I cancel my Discover card and become a joint holder on hers. I am hesitant to do so because my Discover has a higher limit (paid off every month) and I don't want my credit score to drop because I close the card. She says we only need one Discover and it will be better for my score because she has a 10 year history where I only have 2. She does not want to become a joint user on my card because she is afraid that her score will drop because she will have too much available credit with both of our cards.

Here is my question:

Should I close my card and join hers or should we both just keep our seperate cards?

Thank you very much for any and all help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Merging Credit Cards

@Anonymous wrote:Hello all. I am new to these forums.

I am getting married soon and my fiance and I are have a disagreement when it come to credit. We both have excellent credit scores and we are both very carefull on how we spend our money. We both have a Discover. She is insisting that once we are married I cancel my Discover card and become a joint holder on hers. I am hesitant to do so because my Discover has a higher limit (paid off every month) and I don't want my credit score to drop because I close the card. She says we only need one Discover and it will be better for my score because she has a 10 year history where I only have 2. She does not want to become a joint user on my card because she is afraid that her score will drop because she will have too much available credit with both of our cards.

Here is my question:

Should I close my card and join hers or should we both just keep our seperate cards?

Thank you very much for any and all help.

1. Keep both of your cards and become AU on each other's account. They will both report on both of your CRs and your scores will go up.

2. Scores never drop with more available credit.

3. If you only want to use one card, use one. That doens't mean you have to close the other.

Charles Schwab Amex Platinum NPSL | Chase Sapphire Reserve 51k | Hilton Aspire 46k | Citi AAdvantage Executive 23k | Aviator Red 18k | Fidelity Rewards 18k | Capital One Venture X 11k | World of Hyatt 10k | | Discover It

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Merging Credit Cards

I don't think there is such a thing as "too much credit" as long as a person (or couple) is responsible with it. If your utilization is fine, there is no real reason to close one of the cards. If you do carry balances, closing a card would be worse for your score, because your % would rise, which could lower the score. Closing a card would not hurt your score unless it increased your overall utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Merging Credit Cards

Thank you very much for your quick reply.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Merging Credit Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Merging Credit Cards

I'm not sure if closing one of the cards would increase our overall utilization because we pay expenses with our cards. We spread them out over our cards and then pay them off every month. If we close one card then we will have to put more on another card. we never carry a balance. Is this what you mean by utilization?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Merging Credit Cards

Yes, utilization is the amount of balances you carry (that get reported to the CRAs) relative to your total amount of credit available. If you PIF, you don't really have to worry about it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Merging Credit Cards

Since jointly you might run into some categories that between the 2 of you would spend more than $1500 in the quarter so I would keep both so that when that is going to happen you can maximize having $3k in that quarter to earn the 5% back on plus if you become joint on hers you will no longer receive your free TU fico you do now, only the primary gets the fico score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Merging Credit Cards

I'm not quite sure I understand the scenario you are proposing. How is $3k on one card better or worse that $1.5K on two? Thank you for the information on the credit score though. I had not realized that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Merging Credit Cards

@Anonymous wrote:I'm not quite sure I understand the scenario you are proposing. How is $3k on one card better or worse that $1.5K on two? Thank you for the information on the credit score though. I had not realized that.

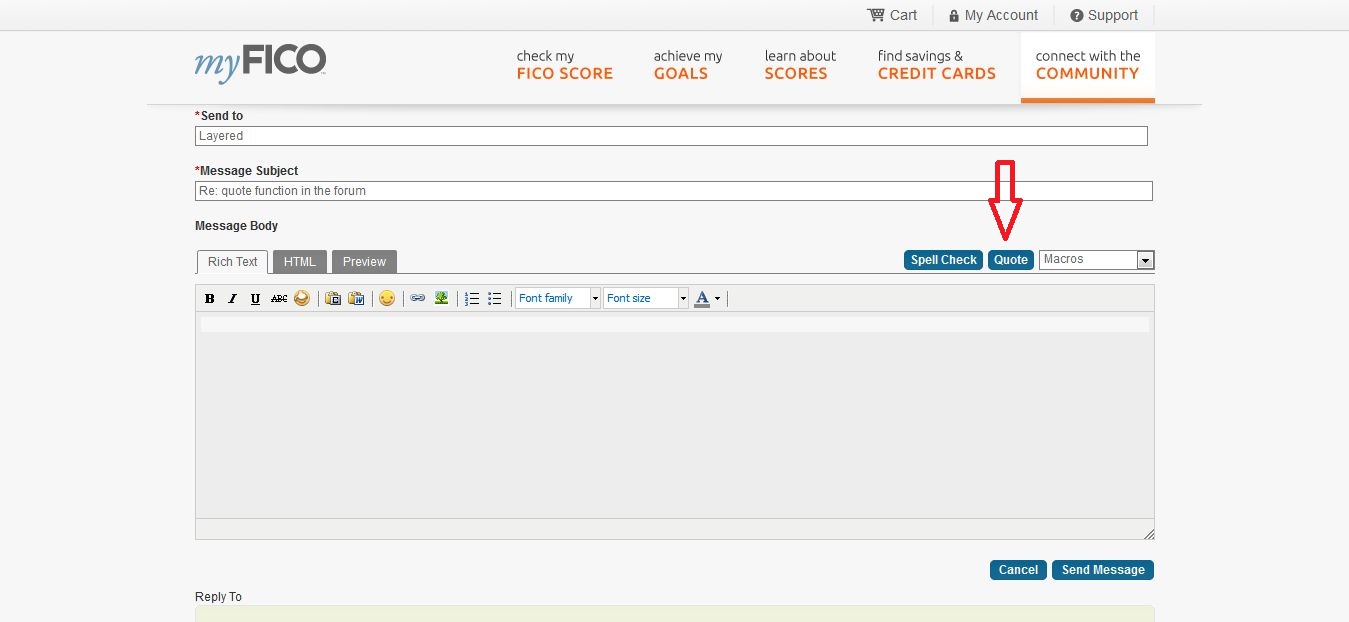

Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the Spell Check button -- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.