- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Minimize Score Damage From Closing A Card?!?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Minimize Score Damage From Closing A Card?!?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minimize Score Damage From Closing A Card?!?

I had a question and wanted to get thoughts on others who likely obsess over this stuff like I do. So anyway, last year when my scores crossed into the "we'll tolerate him" space (having lived in the subworld for a while), i went crazy. I got a bunch of new cards because i could - rookie mistakes, but i know better now. In that year though my scores have continued to rise and I'm finally going to break the 700 mark. Might be low for some, but coming from 550's 2.5 years ago, I'm excited.

This has appeared on my two most recent apps ... "too many open credit cards" or "too many open consumer accounts". I can take the hint, so I'm downsizing. I'm weeding out all the cards I get no perk from or core value from, but am concernered about just closing several accounts -- I imagine the wrong cards closing at just the wrong time will cause just the right amount of damage. I currently have 21 credit cards (gasps!!! lol), and I'm reducing my total count to 14 (for now...then I'll scrape another 5-6 off there over a year after that).

Here is what i'm evaluating when considering if it should be closed:

A) - How long has this account been opened?

B) - What percentage of my total credit lines does this card account for? (such as $15k CL vs $110k total lines)

C) - Does this card bring any real value cashback or rewards (especially when they can convert to cash or gift cards)?

D) - Does this card provide an option to PC to a better card later if I wanted to?

E) - Can i roll the credit line to another card to avoid the dip in total credit lines?

Right now I'm leaning towards closing some of the younger cards, but I've read that a closed account still ages so not super worried about it aging (if true), but mainly reducing the number of cards, with as little impact to total available credit so i dont take an overly unnecessary point drop. I know they will rebound, but I'll be cranky while its down. Is there anything you have to share that i should factor into considerations before i start this chaos. Thoughts?

Todays Stats: 21 open Revolving Accounts, 1 Installment, 1 Auto , EXP 658 w/ 1Coll+1Neg, TU 684 w/1Coll+1Neg, EQ 707 w/0 Coll/Neg, total credit $125k, 2% Card Util, 14% Total util, AAoA 2.8Yrs*****

GOAL Stats: 5>10 open Revolvers, 1 Installment, 1 Auto, 0 Neg/Coll/Lates, Util >15%, Credit Lines > $90k *The Neg & Coll accounts from TU/EXP will be getting removed from my reports in the next 30 days so i know those will bounce to just under 700ish. then its just to garden

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimize Score Damage From Closing A Card?!?

I would imagine they'll drop but I'm sure soon they'll bounce back. I say close them and give 6 months to recover.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimize Score Damage From Closing A Card?!?

A. This plays into AAOA, age doesn't matter once it's open and reporting, except the initial hit you take for the new account reporting and lowering your AAOA a bit. Now I would focus on keeping at least the oldest active and the one with the highest CL.

B. Your cards each play a factor, they have the single CL factored in for utilization on just that card in question and then overall your total CLs affect your overall utilization so Example: having 21 cards at $2k each would be $42k total CL, but lets 3 of those cards are reporting a $1000 balanace each, that means those 3 all have an individual utlization of 50% but with all 21 combined it would be 7% utl across total limits being used.

C. Cash back and rewards are less important for some especially if the card has an AF, if it has a low APR, good BT offers, or other benefits that aren't being duplicated like Travel insurance, purchase protection, price protection, i.e.

D. Sometimes PC'ing sounds good but only a real benefit if the lender keeps the card history or if it's a good option that it can PC to.

E. Not all lenders will let you move the whole line, leaving a little behind hence leaving the original card still open or you close losing some of the limit.

With you leaning towards the younger cards, I would sit down with a spreadsheet (yep I'm ol school) tally the benefits the newer cards have over what the older cards don't

Reducing the number of cards will have more of an affect if you have balances reporting on the cards that you have picked to keep open, if it's going to end up changing your limit overall.

Your AAOA at 2.8 years is at a good place, reducing your cards won't affect that since you still have the 10 years of reporting but if you close the earlier cards, 10 years from now you will get a hit.

Do what's best for you overall, I went through closing some and just didn't care, they were store cards and seemed like a lot of my letters were saying too many retail cards instead of too many bankcards. Some lenders were hitting them differently because alot of my cards were not actual bank revolvers. I stopped seeing that when I removed myself as AU on a few of my moms and DH retail cards.

Good Luck...I'm hoping I gave an unobjective view at your overall game plan. With me seeing how quick my scores have rebounded off small changes and big ones, I let the worry go for now ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimize Score Damage From Closing A Card?!?

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimize Score Damage From Closing A Card?!?

I've always just closed cards when I wanted to and to date it has never hurt my score. Once you have several cards in good standing, the impact of closing some really seems to be nominal. The exception would be if closing would make your utilization go up significantly. Otherwise, I see no point in waiting or delaying the closures, as it doesn't seem to matter much.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimize Score Damage From Closing A Card?!?

@RM21 wrote:

If the plan benefits you overall, then you do what you have to do. I hope it all works out.

Word....lol Agreed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimize Score Damage From Closing A Card?!?

@kdm31091 wrote:I've always just closed cards when I wanted to and to date it has never hurt my score. Once you have several cards in good standing, the impact of closing some really seems to be nominal. The exception would be if closing would make your utilization go up significantly. Otherwise, I see no point in waiting or delaying the closures, as it doesn't seem to matter much.

thanks for the feedback. I figured the numerous other accounts would easily suffocate out any real damage one/few closing could cost, but i think I've got a few more months before those other cards reach the age where they are "more able" to absorb the hit, so it made me a bit aprehensive at first. thanks again

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimize Score Damage From Closing A Card?!?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimize Score Damage From Closing A Card?!?

@credit_is_crack wrote:I had a question and wanted to get thoughts on others who likely obsess over this stuff like I do. So anyway, last year when my scores crossed into the "we'll tolerate him" space (having lived in the subworld for a while), i went crazy. I got a bunch of new cards because i could - rookie mistakes, but i know better now. In that year though my scores have continued to rise and I'm finally going to break the 700 mark. Might be low for some, but coming from 550's 2.5 years ago, I'm excited.

This has appeared on my two most recent apps ... "too many open credit cards" or "too many open consumer accounts". I can take the hint, so I'm downsizing. I'm weeding out all the cards I get no perk from or core value from, but am concernered about just closing several accounts -- I imagine the wrong cards closing at just the wrong time will cause just the right amount of damage. I currently have 21 credit cards (gasps!!! lol), and I'm reducing my total count to 14 (for now...then I'll scrape another 5-6 off there over a year after that).

Here is what i'm evaluating when considering if it should be closed:

A) - How long has this account been opened?

B) - What percentage of my total credit lines does this card account for? (such as $15k CL vs $110k total lines)

C) - Does this card bring any real value cashback or rewards (especially when they can convert to cash or gift cards)?

D) - Does this card provide an option to PC to a better card later if I wanted to?

E) - Can i roll the credit line to another card to avoid the dip in total credit lines?

Right now I'm leaning towards closing some of the younger cards, but I've read that a closed account still ages so not super worried about it aging (if true), but mainly reducing the number of cards, with as little impact to total available credit so i dont take an overly unnecessary point drop. I know they will rebound, but I'll be cranky while its down. Is there anything you have to share that i should factor into considerations before i start this chaos. Thoughts?

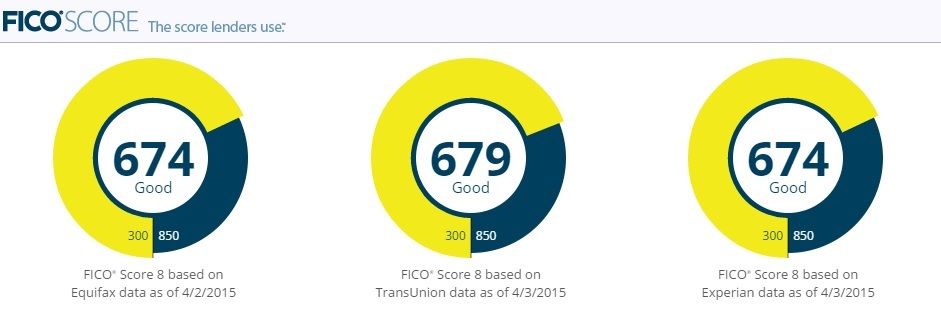

Todays Stats: 21 open Revolving Accounts, 1 Installment, 1 Auto , EXP 658 w/ 1Coll+1Neg, TU 684 w/1Coll+1Neg, EQ 707 w/0 Coll/Neg, total credit $125k, 2% Card Util, 14% Total util, AAoA 2.8Yrs*****

GOAL Stats: 5>10 open Revolvers, 1 Installment, 1 Auto, 0 Neg/Coll/Lates, Util >15%, Credit Lines > $90k *The Neg & Coll accounts from TU/EXP will be getting removed from my reports in the next 30 days so i know those will bounce to just under 700ish. then its just to garden

I've never experienced a comment like that even though I have a similar number of accounts. Maybe it's because you have 21 reporting and I have 19. Maybe there's something about the number 20 in their algorithm.

If I were you I'd close just one account... pick one that's not too old, has a small limit, ,and is not among the cards you really like.

I did that with a Comenity Eddie Bauer account and a Synchrony Walmart mastercard, and neither closing had any adverse effect.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimize Score Damage From Closing A Card?!?

@Bowzer wrote:

OP, you might also consider moving CL's on any accounts with the same lender. If you have two cards with the same lender see if you can move over the CL, keep the best one and close the other. This will help you keep most of your CL's in tact but also trim the cards down.

we're on the same page Bowzer! When i first went on my lunatic spree last year, one deciding factor for me was to go with banks that offered reallocations to help speed up the building process lol

USAA - 3Cards, Not Allowed to merge

Chase - 3Cards, ALLOWS (just closed 1 last week, and will close another rolling this limits around)

Amex - 2Cards, ALLOWS (waiting until DEC for 13months to either CLI my BCE and if denied then this one was specifically opened to roll into the BCE)

PenFed - 2Cards, ALLOWS (had 3, rolled 1 already so 2 cards at $10k and $15k)

Citi - 2Cards, ALLOWS (just rolled my TY into my DC thru EO) last week

i then have 1 card with BOA, Barclays, Discover and Synchrony. The plan is to keep rolling them into each other until i have 1 card per prime bank - but with good limits. sounds like you've explored these options as well so i definitely know where you're coming from. I'll have 4 closed out in the next 30 days so i'll be down on overall count, but only a dip of $700 total lines by rolling them around