- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Minimum usage to keep Chase and CapOne happy?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Minimum usage to keep Chase and CapOne happy?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

My Cap1 limit is $6.5k $70 Tmobile bill and sometimes $15 added to it but I never leave a balance on and only put those bills after statement closes, transfered $4,500 0% balance transfer fee to one of my cards and paid it off that month before the due date. Applied for a credit increase and got denied because cards usuage has been to low and than next month when I apply again for a CLI, Ill prob get account usage has been too high....lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@HeavenOhio wrote:I didn't realize that your BF had recently been subjected to AA for protracted high balances. If there's such a thing as a silver lining, those high balances will serve as a cushion of sorts for the time being against any lack of usage concerns.

The letter listed high balances and several things that did not apply to him at all, including having a Chase card in default, bankruptcy, or a payment plan, and did not make much sense. Again, he does not care about the credit line, just not want to do anything that causes him a problem with Goldman Sachs that would make getting an Apple Card more of an issue.

There's no downside to upgrading your Capital One card. Upgrades from the Platinum seem to be completely independent from anything involved in underwriting.

Great. I will probably do that after his Freedom card reports its second month with a $0 balance.

While I agree with the advice in the other thread about not poking the Chase bear, requesting a product change once you feel comfortable isn't very likely to raise eyebrows. It's not like asking for a CLI or a new card.

Less concerned about Chase with respect to their own cards, just do not want them to cause a problem with getting his current goal card (an Apple Card) and then maybe a B&H financing card. Does not seem like it would make sense to switch it to a Freedom Unlimited (missing the signup bonus), given that, he will probably close it once it does not really have a big impact on his average account age.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

I don't know if you'll find the info below helpful.

My QuickSilver has a $10k limit. It sees nominal use each month (Spotify and similar). The limit has not changed since I got the card several years ago.

My United card ($35k) sits idle except for United tickets. My Hyatt card (~$20k) sits largely idle after my wife and I meet our target spend for Hyatt status for the year. My Freedom Unlimited card (~$20k) sits largely idle while we're using the Hyatt card. Chase has not changed any of the limits.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

I have high limits on all my major cards, but I put a minimum of $25/month on each card every month. And each of them will get at least a 3 figure spend in a month a few times a year. Never had AA on any of the cards. However, at those stated limits, your risk of AA (CLD) I think would be less.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

Sigh..lol

You can have a very small reoccurring charge on the Cap One and be just fine OP. There's no minimum amount needed to keep limits. The goal is keeping it active.

I've put a $2 to $3 monthly charge on my Cap one set to autopay for over 3 years now. The limit is still the same as it was when I set up the reoccurring bill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Gmood1 wrote:Sigh..lol

You can have a very small reoccurring charge in the Cap One and be just fine OP. There's no minimum amount needed to keep limits. The goal is keeping it active.

I've put a $2 to $3 monthly charge on my Cap one set to autopay for over 3 years now. The limit is still the same as it was when I set up the reoccurring bill.

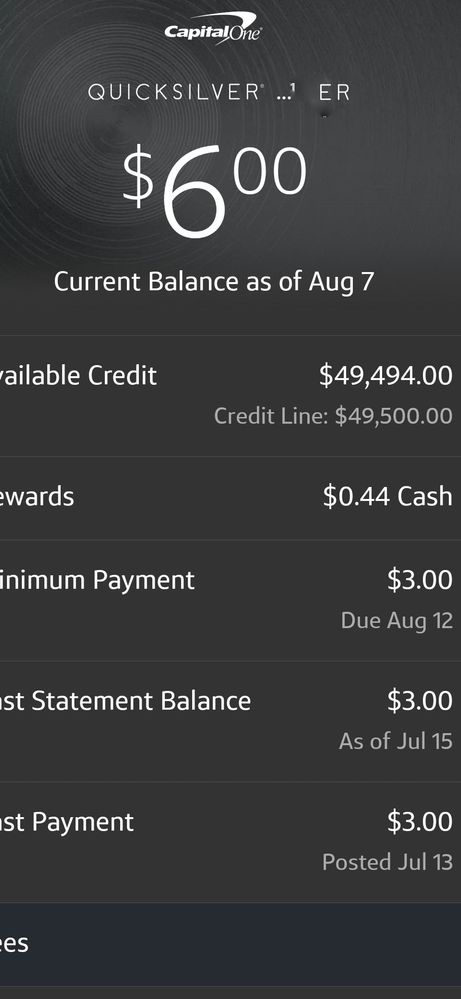

Why didn't they just make it an even $50k? ![]()

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@OmarGB9 😆

I tried, was never able to get it rounded off. I just round it up in my head instead.😂

I'm still debating on what world wide trip I can use the cash back on. I've been building it up for years now. 😁

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Gmood1 wrote:@OmarGB9 😆

I tried, was never able to get it rounded off. I just round it up in my head instead.😂

I'm still debating on what world wide trip I can use the cash back on. I've been building it up for years now. 😁

Also, how did you get that high of a limit??? I think that's the highest Cap One limit I've ever seen! ![]()

ETA: lol, whatever you do, don't spend it all in one place. ![]()

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

As the saying goes, there's always more than one way to skin a cat. lol

I consolidated several Cap one cards about 4 years ago. Making this one my highest and oldest CC.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

I can't comment on Chase, unfortunately, I don't meet 5/24 but I've been with Capital One for over six years now and I've never heard of a min spend requirement. There have been months where I've charged 4K+ and others where I've spent $200.00 (or less) and I've actually gotten several auto increases. As long as the card is being used you'll be fine. Just my two cents.

Starting FICO 8s | 06/2018: EX 601 ✦ EQ 605 ✦ TU 590

Starting FICO 8s | 06/2018: EX 601 ✦ EQ 605 ✦ TU 590Current FICO 8s | 9/2022: EX 732 ✦ EQ 739✦ TU 743

2023 Goal Score: 760+

Business Cards: