- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Minimum usage to keep Chase and CapOne happy?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Minimum usage to keep Chase and CapOne happy?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Anonymous wrote:

@Gmood1 wrote:Sigh..lol

You can have a very small reoccurring charge on the Cap One and be just fine OP. There's no minimum amount needed to keep limits. The goal is keeping it active.

I've put a $2 to $3 monthly charge on my Cap one set to autopay for over 3 years now. The limit is still the same as it was when I set up the reoccurring bill.

Have you been charging so little for a long time? A few of us were caught up in CLD action by Cap One for having high limits and low spend (NOT no spend), seems that you missed out! I went from $35k to $10K even though I was spending in the low hundreds a year

There have been cases where CLDs are happening with spend, even with high scores and low overall utilization, so 2 or 3 transactions a year I don't think will cut it if you want to avoid CLDs. Even my spend doesn't guarantee squat.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Anonymous wrote:In other news, I found the upgrade link in another thread, checked and it offers him Venture One, Venture, and QuickSilver. Is there any reason at all not to upgrade right now (he would take the QuickSilver)?

Grab the Quicksilver yesterday. No reason not to upgrade.

To compare to the Venture cards, both have redemption restrictions that the QS doesn't have. The VentureOne doesn't earn as much per dollar as the QS. And the Venture's annual fee necessitates spending 19k before breaking even with the QS.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

IME Chase does not require that much spend to be happy.

Amex likes high spend and PIF.

Cap One likes high spend, PIF or not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@HeavenOhio wrote:Grab the Quicksilver yesterday. No reason not to upgrade.

To compare to the Venture cards, both have redemption restrictions that the QS doesn't have. The VentureOne doesn't earn as much per dollar as the QS. And the Venture's annual fee necessitates spending 19k before breaking even with the QS.

All done. He is now the proud owner of a QuickSilver card (or will be in 7-10 business days). :-) Thanks for the help! Totally painless. Clicked the link and checked the box accepting the conditions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

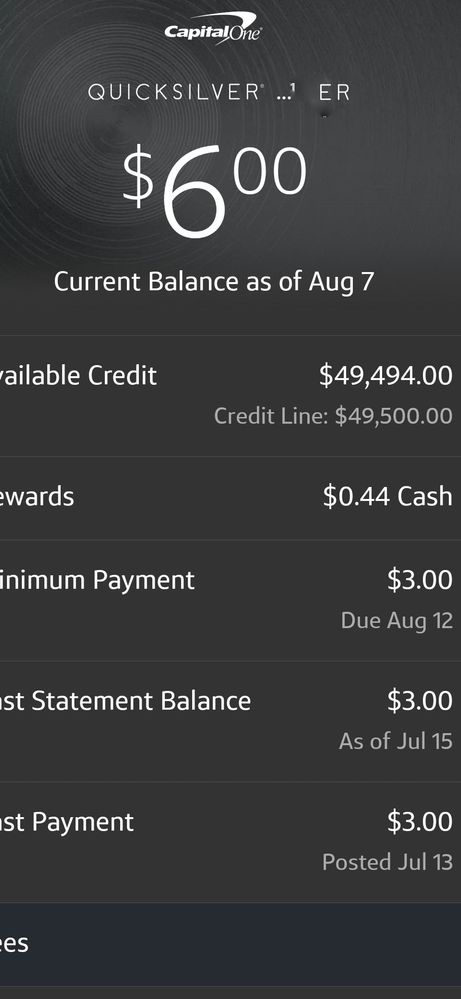

My heavy usage (14 charges over the last four years averaging $3.01 per charge) is keeping my Cap One Quicksilver alive, but did not prevent a totally undeserved CLD from $16000 to $5000. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Anonymous wrote:My heavy usage (14 charges over the last four years averaging $3.01 per charge) is keeping my Cap One Quicksilver alive, but did not prevent a totally undeserved CLD from $16000 to $5000.

Apparently my 6K per year spend on the card isn't enough to keep my 27.5K line intact. Got reduced to 10K. I opened the card with 17.5K SL.

It's going around. Cap 1 CLDs are extremely contagious.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Anonymous wrote:My heavy usage (14 charges over the last four years averaging $3.01 per charge) is keeping my Cap One Quicksilver alive, but did not prevent a totally undeserved CLD from $16000 to $5000.

This is just boasting about your disposable income "I can spend OVER $10 a year every year for 4 years!" Please be aware that not everyone has those resources.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Anonymous wrote:

@Anonymous wrote:My heavy usage (14 charges over the last four years averaging $3.01 per charge) is keeping my Cap One Quicksilver alive, but did not prevent a totally undeserved CLD from $16000 to $5000.

This is just boasting about your disposable income "I can spend OVER $10 a year every year for 4 years!" Please be aware that not everyone has those resources.

No, I am not. Otherwise, I would have mention that I also had 12 charges on my Barclay Arrival over the last three years averaging $2.53 per charge.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Anonymous wrote:My heavy usage (14 charges over the last four years averaging $3.01 per charge) is keeping my Cap One Quicksilver alive, but did not prevent a totally undeserved CLD from $16000 to $5000.

@Anonymous wrote:No, I am not. Otherwise, I would have mention that I also had 12 charges on my Barclay Arrival over the last three years averaging $2.53 per charge.

I cannot imagine such opulence... When I grow up, I want to be just like you!

Business Cards

Debit Cards

FICO 8 Scores (as of Dec 14, 2022)