- myFICO® Forums

- Types of Credit

- Credit Cards

- Multiples of Multi-Category Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Multiples of Multi-Category Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiples of Multi-Category Cards

So I've been re-evaluating my future needs for my cashback lineup and I need some clarification on obtaining multiples of the same card. I know some people have multiples due to PC and some are actually achieved by cold apps. However, I'm unsure which lenders allow for multiple cards without PC's and what criteria must be met in order to do this. (Time lapse between apps, other factors, etc)

Interest #1) BoA Cash Rewards : I currently have the MC version of this card (March 2019) that I keep for Perma- 3% Online Shopping. But this card is very flexible, allowing for category change each month. I think a 2nd would be beneficial to me to rotate between dining, home improvement so I can keep my 1st one on Online Shopping. I am fond of the no-FTF, straight cashback redemption, and I would like the US Pride Visa version. (Would apping for the Visa version hold any weight for approval of the 2nd card?) I have no other BoA's to PC. As an added thought....if it is possible to app for a 2nd, would I be eligible for the $200 spend bonus again?

Interest #2) BBVA Clearpoints Visa : I don't have this card yet (not sure if it's geo-restricted or if I even qualify for it). But the versatility of the card is fantastic due to the categories it covers. (Has useful categories the BoA doesn't cover) People also mention special bonuses that are frequently offered.

3% Dining , Travel , Healthcare , Maintenance (both auto and home), Retail , Grocery , Gas , Utilities

Having 2x this card, and being able to rotate quarterly, would be very beneficial. There are caveats to this card however: 3% FTF, No 0% purchase promo, and (from what I have seen, correct me if I'm wrong) you can only get statement credit. Doesn't statement credit reduce the actual return?

Interest 3) Huntington Voice : This one has been on my maybe-list for a long time and I keep passing it up. Like BoA and BBVA, there's a nice spread of categories to rotate between. The reason I keep passing it up is: No spend bonus, no 0% promos, unclear on FTF, and appears to be statement credit only. Again, does this reduce the actual return?

3% Dining, Travel, Discount Stores, Grocery, Home Improvement Stores, Gas

The thing that keeps me coming back.....Discount Stores & Grocery (on the same card). I need a Walmart spender above 2% and this would be covered by one or the other, depending on how my local stores code I can figure that out. This would be a Perma-Walmart spender, but with the option to rotate if needed. Again, versatility.

Multi-category cards are so versatile. Big fan here. If anyone has any data points on these I would appreciate it. Are multiples possible? What criteria must be met? Answers to any of the above questions? Other suggestions? Warnings?

Sock Drawered

On Deck: Possibly Aven 3% Visa

On Deck: Possibly Aven 3% Visa

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

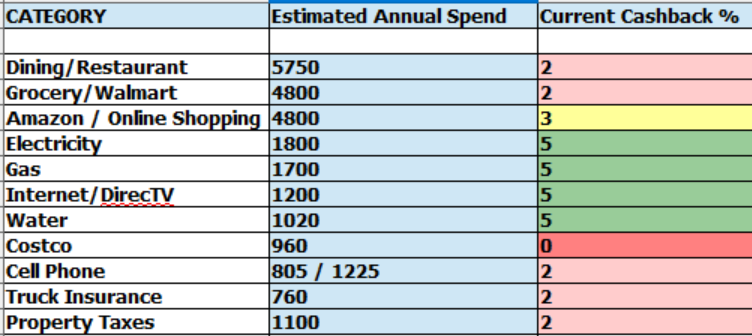

Maybe list your estimated annual spend per category? That might help find an ideal order for applications.

As I mentioned in your other thread, when you already have a 2% DC, big bonuses can be more useful than a bunch of 3% cards.

One general warning is to keep an eye out for category definitions that vary between cards, especially as far as travel/dining/grocery.

Also, keep in mind that categories can change over time, and generally not for the better. Sit-down restaurants and (so I've heard) bill pay used to be Cash+ category options.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

BOA - does have rules in place for apping for new cards so you should check and plan accordingly. Otherwise you should be able to get a 2nd card and possible SUB; the CR does have FTFs useless you have an affinity version I'm not aware of.

BBVA - if your state has branches you should be in their footprint just call them to be sure. This can be your Walmart card as my supercenter codes as groceries YMMV though. They do have 0% APR on purchases and SUB.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@wasCB14 wrote:Maybe list your estimated annual spend per category? That might help find an ideal order for applications.

As I mentioned in your other thread, when you already have a 2% DC, big bonuses can be more useful than a bunch of 3% cards.

This. I understand optimizing but you may find the benefit becomes fairly minimal when you open a bunch of cards for 3% on this or that. Better to cover your major spending categories IMO instead of every single possible spend area.

I know BoA has tightened up somewhat and IIRC there is some sort of rule with the Cash Rewards where you cannot get a 2nd until the first is 24 months old. Copied from their terms: "This Cash Rewards card will not be available to you if you currently have a Cash Rewards card unless you have had that Cash Rewards card for at least 24 months."

Unsure if getting a cobranded Cash Rewards is a way around the rule. In any event, I wouldn't really make a huge priority of opening another account for 3% on one category unless the spend is really large.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

BOA CR can be had in multiple varieties, such as regular, MLB, Komen, etc. Each can be set to a different rewards category. Each is eligible for 3% up to 5.25% cash back per chosen category depending on how much money you have with BOA/Merrill, including IRAs. Each card comes with its own SUB.

BOA has rules that limit you to 2 cards over 2 months, 3 cards over 12 months, and 4 cards over 24 months. So it's possible to get 2 BOA CR on the same day, and then get a 3rd 62 days later. And a 4th 367 days later. Since there are 6 categories and you can switch monthly, in 62 days you can essentially have all the bases covered with 3 cards.

Most of the categories are defined by the MCC codes that qualify. The online shopping category is defined by excluded MCC codes, and therefore crosses over into the other categories if purchased online, like food or travel.

*************

I would recommend US Bank Cash+ over BBVA and Huntington Voice. The US Bank categories are 5%, and they have categories not usually covered elsewhere, like utilities, streaming, department stores, gym memberships, etc. Multiple Cash+ cards can be held simulaneously.

************

Don't overlook opening a second (first?) Discover card, which essentially offers 10% on quarterly categories during the first year with cash back match. At $1500 spend cap per quarter, this is worth up to $150 per quarter or $750 over a 12-month period if you double dip the quarterly category in which you open the card, spending $1500 in the category now and another $1500 ~11 months from now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@wasCB14

I understand your point regarding the DC 2% catch-all, but Citi never offers bonuses. And the card categories are subject to change, but as in USBank's case, they replaced restaurants with utilities which was equally useful. So they can be beneficial as well. (I'm also considering replacing my DC 2% MC with FNBO 2% Visa so I can use it at Costco without having to bind myself to the Costco Anywhere.)

Fortunately, my expenses are somewhat modest, but this doesn't include misc. purchases either. Things like Healthcare, Home Improve, Vacations, etc all fall under the 2% catch-all for me. But when they do hit, they can be just as expensive (if not more) than my highest spend category. And then there's the toys and impulse buys.

Dining is my largest spend, including lunch @ work. 5% is an obvious goal for me here, minimum 3%.

(Barclay Uber really scorched me on this one, that 4% dining was huge)

Grocery usually falls primarily under Walmart for me. 5% is again my goal here, minimum 3%.

The difference between 2%/3% doesn't seem like much, but it essentially equates to $160 in lost return annually for me. The difference between my current cashback and having 5% across all categories is $540 annually. So the 3% stretch is the progression for now until I can find a way to fill those 5% holes. And cards like BBVA which offer bonuses can be a boost.

Sock Drawered

On Deck: Possibly Aven 3% Visa

On Deck: Possibly Aven 3% Visa

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@Chiclets

That is very good info on BoA, thank you. And I do have the USBank Cash+ which I use to cover 5% Utilities and Internet. Also considering replacing this down the road with the Chase Ink Business Cash (5% Utilities, Internet, Phone, Office Supplies) to free up the USBank for other categories, like Dept Stores, Furniture Stores etc. And the $500 SUB on the Ink is very nice.

Sock Drawered

On Deck: Possibly Aven 3% Visa

On Deck: Possibly Aven 3% Visa

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

Hover over cards to see limits and usage. Total CL - $608,600. Cash Back and SUBs earned as of 5/31/24- $21,590.43

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@JNA1

That's pretty much exactly what I do. I build up the cashback on all my cards until Oct/Nov each year, then cash it all out, which covers a chunk of my Christmas spend. This is mainly why I prefer true cashback return rather than statement credit, just old-fashioned that way I guess. I always PIF, as I use CC's siimply as a vehicle to filter my spend in order to get cashback return.

I know with some cards (mainly points cards like Amex) there is a cut in the redemption value when getting a statement credit. Maybe I'm just not clear on the specifics. I know this is true with the ABoC MC, which is a 5% rotater that is only statement credit and converts to 3.75%.

Sock Drawered

On Deck: Possibly Aven 3% Visa

On Deck: Possibly Aven 3% Visa

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@Taurus22 wrote:@wasCB14

I understand your point regarding the DC 2% catch-all, but Citi never offers bonuses. And the card categories are subject to change, but as in USBank's case, they replaced restaurants with utilities which was equally useful. So they can be beneficial as well. (I'm also considering replacing my DC 2% MC with FNBO 2% Visa so I can use it at Costco without having to bind myself to the Costco Anywhere.)

Fortunately, my expenses are somewhat modest, but this doesn't include misc. purchases either. Things like Healthcare, Home Improve, Vacations, etc all fall under the 2% catch-all for me. But when they do hit, they can be just as expensive (if not more) than my highest spend category. And then there's the toys and impulse buys.

Dining is my largest spend, including lunch @ work. 5% is an obvious goal for me here, minimum 3%.

(Barclay Uber really scorched me on this one, that 4% dining was huge)

Grocery usually falls primarily under Walmart for me. 5% is again my goal here, minimum 3%.

The difference between 2%/3% doesn't seem like much, but it essentially equates to $160 in lost return annually for me. The difference between my current cashback and having 5% across all categories is $540 annually. So the 3% stretch is the progression for now until I can find a way to fill those 5% holes. And cards like BBVA which offer bonuses can be a boost.

Obviously it does make sense to get rewards on spend you're doing anyway, but consider also that maximizing dining spend rewards is never going to save you more money vs packing a lunch for work even once or twice a week. Those savings will far eclipse an extra 1 or 2% on overpriced dining out lunches.

Not to say you cannot do both -- maximize rewards and still try to save sometimes -- but something to note. Just because you get more rewards on dining out doesn't mean you may not save more by changing your habits, too.