- myFICO® Forums

- Types of Credit

- Credit Cards

- Multiples of Multi-Category Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Multiples of Multi-Category Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@JNA1 wrote:

I’m not sure what you mean statement credit reducing value, but the way I do it, it definitely doesn’t. I let the cash back build up for a few months at time and then redeem it all at once. I approach it that I PIF, so I have to pay whatever I spend monthly anyway. That’s a finite number that I am going to spend no matter what. When I do redeem Cashback as statement credit, I transfer that amount from bank to my dedicated Cashback savings account and then I pay the rest of the card payment to PIF. It’s an extra step (sorta but not really), and requires discipline, but doing it that puts my Cashback all in one place. I redeem my Discover and PayPal Cashback into the same account, so for me it’s really no different. Redeeming cashback from a card into my savings account is an extra step too, so it’s really no different if you think about. It’s just moving money around. The only cards I don’t like the structure is like DW’s Credit One card. It puts the cash back against the balance with each purchase and you cannot let it build up. It’s more of a PITA to track that way, but we rarely use that card anyway, and when we do, it’s just purchases big enough to keep it open.

The reason you lose money is because you don't actually have that extra cash to cycle for rewards. It's a small amount of loss but it's still a loss and that bothers some people. I personally don't care as long as I get my reward and in many cases it's just easier to use statement credits anyway instead of redeeming to my bank account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@JNA1 wrote:

I’m not sure what you mean statement credit reducing value, but the way I do it, it definitely doesn’t.

When people refer to this, they are generally talking about one of two things:

1) Statement credit as a low-value option. This is true for things like MR (and I think Venture) where redeeming for statement credit is clearly lower value than some alternatives

2) Special cases such as the Double Cash. With DC, you get 1% on payment (as well as 1% on spend). If you redeem for statement credit, you end up having to pay less, and so get the 1% on a smaller amount. The impact is very small (making it a 1.99% card) but worth avoiding by depositing to a bank account, whereas in case 1 you may not be able to use a better redemption.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@Taurus22 wrote:

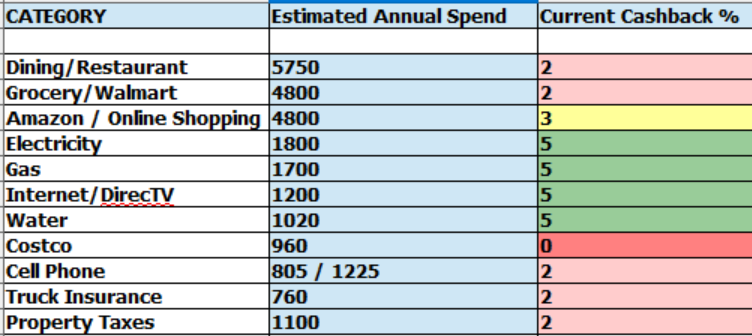

Thanks for the chart, I was perfectly fine being oblivious to what I actually spent yearly on this stuff!

Now I have to be actively more conscious about what spend goes where. Problem it that "utilities" category is very rare, so i've yet to aquire the right card for that. if it were a perfect world, i could cover all categories in only 3 cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@Taurus22 wrote:@wasCB14

I understand your point regarding the DC 2% catch-all, but Citi never offers bonuses. And the card categories are subject to change, but as in USBank's case, they replaced restaurants with utilities which was equally useful. So they can be beneficial as well. (I'm also considering replacing my DC 2% MC with FNBO 2% Visa so I can use it at Costco without having to bind myself to the Costco Anywhere.)

Fortunately, my expenses are somewhat modest, but this doesn't include misc. purchases either. Things like Healthcare, Home Improve, Vacations, etc all fall under the 2% catch-all for me. But when they do hit, they can be just as expensive (if not more) than my highest spend category. And then there's the toys and impulse buys.

Dining is my largest spend, including lunch @ work. 5% is an obvious goal for me here, minimum 3%.

(Barclay Uber really scorched me on this one, that 4% dining was huge)

Grocery usually falls primarily under Walmart for me. 5% is again my goal here, minimum 3%.

The difference between 2%/3% doesn't seem like much, but it essentially equates to $160 in lost return annually for me. The difference between my current cashback and having 5% across all categories is $540 annually. So the 3% stretch is the progression for now until I can find a way to fill those 5% holes. And cards like BBVA which offer bonuses can be a boost.

As noted in the other threads by many, you ( none of us ) will find 5% cash back across all categories. The closest you can get is with travel rewards cards, but those generally come with AF and do not redeem for straight cash.

And there is the basic reason that the swipe fees are the main source of the rewards. When merchant swipe fees approach 5% then we will see higher CC rewards. Prices merchants charge will also be 5% or more higher, and pigs will fly.

I am a little shocked at the amount of "online shopping" you have listed, given the spend in other categories. Maybe I am just old.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@NRB525 wrote:As noted in the other threads by many, you ( none of us ) will find 5% cash back across all categories. The closest you can get is with travel rewards cards, but those generally come with AF and do not redeem for straight cash.

Probably not, but for that last few months I've been using the 5% everything uncapped Citizen's Bank card. This ends March 31 but made me wonder if there are other similar cards around from time to time!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@Anonymous wrote:

@NRB525 wrote:As noted in the other threads by many, you ( none of us ) will find 5% cash back across all categories. The closest you can get is with travel rewards cards, but those generally come with AF and do not redeem for straight cash.

Probably not, but for that last few months I've been using the 5% everything uncapped Citizen's Bank card. This ends March 31 but made me wonder if there are other similar cards around from time to time!

And the value of the extra earnings, over what you would have gotten in-category on your other cards, whether rotating or selected, is.... how much money?

As we all know, the intent of the categories bonus is to get cardholders to use their cards more, in the non-category spend. The interesting data point will be if Citizen's ever comes back with the 5% Everything offering.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@kdm31091 wrote:

@Taurus22 wrote:@wasCB14

I understand your point regarding the DC 2% catch-all, but Citi never offers bonuses. And the card categories are subject to change, but as in USBank's case, they replaced restaurants with utilities which was equally useful. So they can be beneficial as well. (I'm also considering replacing my DC 2% MC with FNBO 2% Visa so I can use it at Costco without having to bind myself to the Costco Anywhere.)

Fortunately, my expenses are somewhat modest, but this doesn't include misc. purchases either. Things like Healthcare, Home Improve, Vacations, etc all fall under the 2% catch-all for me. But when they do hit, they can be just as expensive (if not more) than my highest spend category. And then there's the toys and impulse buys.

Dining is my largest spend, including lunch @ work. 5% is an obvious goal for me here, minimum 3%.

(Barclay Uber really scorched me on this one, that 4% dining was huge)

Grocery usually falls primarily under Walmart for me. 5% is again my goal here, minimum 3%.

The difference between 2%/3% doesn't seem like much, but it essentially equates to $160 in lost return annually for me. The difference between my current cashback and having 5% across all categories is $540 annually. So the 3% stretch is the progression for now until I can find a way to fill those 5% holes. And cards like BBVA which offer bonuses can be a boost.

Obviously it does make sense to get rewards on spend you're doing anyway, but consider also that maximizing dining spend rewards is never going to save you more money vs packing a lunch for work even once or twice a week. Those savings will far eclipse an extra 1 or 2% on overpriced dining out lunches.

Not to say you cannot do both -- maximize rewards and still try to save sometimes -- but something to note. Just because you get more rewards on dining out doesn't mean you may not save more by changing your habits, too.

Agreed on saving money where possible. Not exactly sure what "toys and impulse buys" cost per year, but that could be worth examining.

At $160/year, even if you find a 3% card for everything, don't get any nerfs, don't hit any caps, get the merchant categories exactly right, and always always end up using the right card...you still end up with about as much in additional rewards as you would from a $500 SUB every three years.

The latter approach just seems so much simpler to me!

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@Anonymous wrote:BOA CR can be had in multiple varieties, such as regular, MLB, Komen, etc. Each can be set to a different rewards category. Each is eligible for 3% up to 5.25% cash back per chosen category depending on how much money you have with BOA/Merrill, including IRAs. Each card comes with its own SUB.

BOA has rules that limit you to 2 cards over 2 months, 3 cards over 12 months, and 4 cards over 24 months. So it's possible to get 2 BOA CR on the same day, and then get a 3rd 62 days later. And a 4th 367 days later. Since there are 6 categories and you can switch monthly, in 62 days you can essentially have all the bases covered with 3 cards.

They also now have 3/12 and 7/12 rules; their default (it's not absolute, I'm an example) is to deny new applications from current accountholders who have obtained 7 or more cards across all issuers over the last 12 months, 3 or more cards for applicants who are not current customers.

FICO 8 (EX) 850 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiples of Multi-Category Cards

@NRB525 wrote:

@Anonymous wrote:

@NRB525 wrote:As noted in the other threads by many, you ( none of us ) will find 5% cash back across all categories. The closest you can get is with travel rewards cards, but those generally come with AF and do not redeem for straight cash.

Probably not, but for that last few months I've been using the 5% everything uncapped Citizen's Bank card. This ends March 31 but made me wonder if there are other similar cards around from time to time!

And the value of the extra earnings, over what you would have gotten in-category on your other cards, whether rotating or selected, is.... how much money?

As we all know, the intent of the categories bonus is to get cardholders to use their cards more, in the non-category spend. The interesting data point will be if Citizen's ever comes back with the 5% Everything offering.

Because I've been good and avoided MS (but some big spend on estimated taxes) it's not going to be huge, but several hundred extra for the 4.5 months. I've also used other 5% cards where possible, as the Citizen's 5% is delayed. Before the period ends I will buy gift cards for some repeated spending that I don't have good cards for (Amazon UK being a good example!)

I have moved some subscription-type stuff to this card. If only the non-promo rate was 2% rather than 1.8% I would keep them there, seems like Citizen's missed an opportunity there....

Searching I found an earlier offer from a different place:

The author seems to be stressing the potential strings, but looked normal verbiage to me!