- myFICO® Forums

- Types of Credit

- Credit Cards

- My Chase Loan

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

My Chase Loan

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Chase Loan

@Anonymous wrote:

@Remedios wrote:

I've only seen this when Chase sent emails quite a while ago.

My APR was very close to payday loan

That's my love-hate relationship with them. They will give me all the money, but stick me with 21%.

I'm fairly certain that's because I keep trashing my AAoA, new accounts etc.

In a way, it's an accurate risk assessment because there are times when it looks like I'm ready to rob the world.Yeah, in that case it wouldn't be any better than swiping for a large purchase and carrying a balance. If I wanted to use it for a 10K purchase, I'd be better off using another card, getting the points, and getting a direct deposit from Chase before payment is due and PIF, then carry the balance at 7-9% on Chase. It kind of discourages use of the card for a large purchase.

Yeah but the Freedom by definition is not a large purchase card.

Well I suppose it depends what one considers a large purchase but my purchases are either in the <$300 category or >$1500 and as a general rule the Freedom calendar doesn't line up on the large ones as a general rule.

Pretty sure I'm not going to get said offer from Chase though, they know me too well haha.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Chase Loan

@Revelate wrote:

@Nomad3 wrote:It's interesting they do this, would the payments for it be separate or will it fall under normal CC pay method which is any money to you pay towards the card hits the lowest interest segments first? (Ie normal card spend that isn't accruing yet)

Citi has recently been doing it (received the second letter yesterday, got one last month/year/decade however you want to look at it) on their DC.

10K of 10K limit, similar aggressive fixed APR, nearly identical terms.

Pretty sure this is a new shift to Remedios's point, the prior ones were just the usual cash advance rates and this is something different and recent in the market... but when a major moves in a new and interesting direction, it's not going to be lost on the other majors as well.

What's interesting to me is that they're doing this at all but I guess we'll see how it plays out and if this is just a friendly holiday refinance your CC debt offer or if it's really a change in the wider credit market. Citi / Chase may be after the Goldman Sach's play into personal loans that they made previously without the overhead of fully underwriting a new loan. It's pretty ingenious I just don't know how long it's going to go around.

I just got an email from Citi about 30 minutes ago, 7.99% on a FlexLoan.

I actually got a pre-announcement from Citi around Sept 2018 about a new loan feature on my card coming in December (2018, I don't think it rolled out until Feb 2019). I thought it was a great idea to be able to use part of the CL for a loan, and the rest like a rewards card, keeping things separate so that a cardholder can still PIF and not owe interest on purchases.

I think its a trend. I bet we see it on other cards as well, and will stick around for quite a while. These are hard to implement.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Chase Loan

@Revelate wrote:

@Anonymous wrote:

@Remedios wrote:

I've only seen this when Chase sent emails quite a while ago.

My APR was very close to payday loan

That's my love-hate relationship with them. They will give me all the money, but stick me with 21%.

I'm fairly certain that's because I keep trashing my AAoA, new accounts etc.

In a way, it's an accurate risk assessment because there are times when it looks like I'm ready to rob the world.Yeah, in that case it wouldn't be any better than swiping for a large purchase and carrying a balance. If I wanted to use it for a 10K purchase, I'd be better off using another card, getting the points, and getting a direct deposit from Chase before payment is due and PIF, then carry the balance at 7-9% on Chase. It kind of discourages use of the card for a large purchase.

Yeah but the Freedom by definition is not a large purchase card.

Well I suppose it depends what one considers a large purchase but my purchases are either in the <$300 category or >$1500 and as a general rule the Freedom calendar doesn't line up on the large ones as a general rule.

Pretty sure I'm not going to get said offer from Chase though, they know me too well haha.

They still have extended warranty (for now). I would use my Freedom for a $1,500 purchase at 1% over the DC at 2% if the extended warranty applied. I would basically be giving up $15 in rewards for an extended warranty I can no longer get with my DC. $15 isn't bad for an extended warranty on a $1500 item.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Chase Loan

@Anonymous wrote:

@Anonymous wrote:The details say the payments become fixed but the money you pay will go towards which ever money you owe which has the highest APR. In every case it would seem this is money you owe before you get the loan. My offer is 7.99%. My regular APR is 17.24%.

That might be the case.

Here is some answers to FAQ:

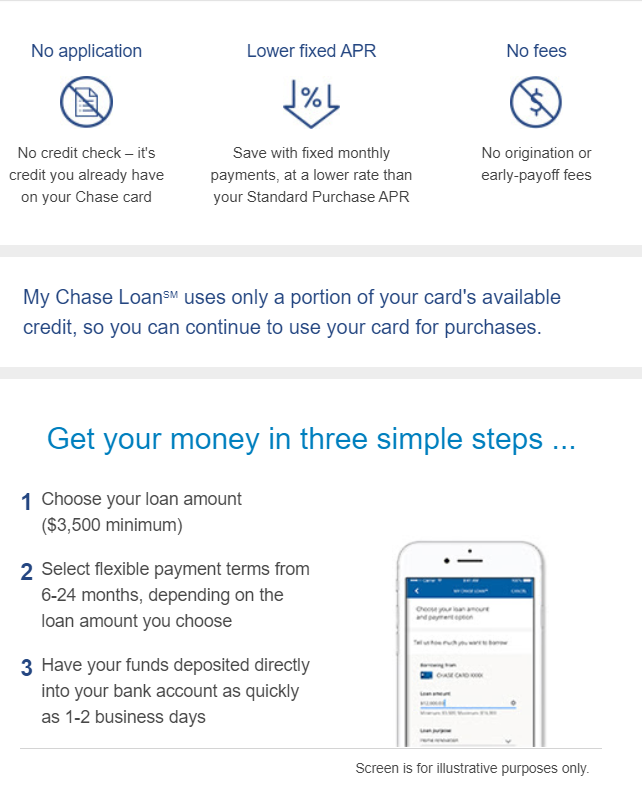

Unlike traditional loans, with My Chase LoanSM there’s no need for an application, credit check or a separate account to manage it. My Chase LoanSM allows you to borrow money from your existing card’s available credit. We’ll show you a single statement, and you’ll have one monthly payment due on your credit card account.

We’ll add the full amount of the loan to your credit card’s current balance. Your minimum payment due each billing cycle will automatically include the monthly payment amount for your loan.

There’s no need to make any separate, additional payments for your active My Chase LoanSM. You can make your payments by paying your credit card bill each month as usual. We’ll add your monthly My Chase LoanSM payment to your minimum payment due each billing cycle.

You can avoid owing interest on new purchases by paying the “interest saving balance” payment option each month by your due date. Keep in mind: your monthly interest saving balance won’t pay off the full amount of your My Chase LoanSM or any other flexible financing offer balances early.

Pay the interest saving balance every month by your due date to avoid interest on new purchases and avoid prematurely paying off your flexible financing offer balances, such as My Chase LoanSM. This amount includes your statement balance, minus your total balance for flexible financing offers, plus your monthly payment due for all active flexible financing offers. It doesn’t include unpaid amounts you’ve disputed.

Here’s how interest saving balance is calculated (the numbers shown here are for illustration purposes, and don’t reflect your actual account):

Statement balance

Your current statement’s new balance, which is the total amount outstanding on your account, including all flexible financing offers, such as My Chase LoanSM

$2,400 Total balance for flexible financing offers

Total amount outstanding for all flexible financing offers, including My Chase LoanSM

- $1,000 Monthly payment due for flexible financing offers

Total amount due each month for your active flexible financing offers, including My Chase LoanSM

+ $10 Interest saving balance

Amount to pay by your due date in a given month to avoid interest on next statement’s purchases

= $1,410

You can set up automatic payments through your online credit card account. Keep in mind: you might want to avoid choosing the “statement balance” payment option while you have an active My Chase LoanSM on your account, since this would pay off your entire loan at once. If you choose the "fixed amount" payment option, make sure the amount you set up is enough to cover your minimum payment due, which now includes your My Chase LoanSM monthly payment, to avoid any late fees or additional interest on your loan. Choose the “interest saving balance” payment option to avoid interest on new purchases and avoid prematurely paying off your flexible financing offer balances, such as My Chase LoanSM.

Thanks for sharing that, it explains it nicely. Guess it's a good way to get a decent personal loan without the HP/origination/etc