- myFICO® Forums

- Types of Credit

- Credit Cards

- New AMEX Hilton card SUB Offers

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New AMEX Hilton card SUB Offers

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New AMEX Hilton card SUB Offers

I got an email yestereday with updated American Express Hilton card SUB updates. They had an enhanced SUB on the Marriott Bonvoy Brilliant which expired mid-January, so looks like they are rotating the special SUBs to the Hilton cards.

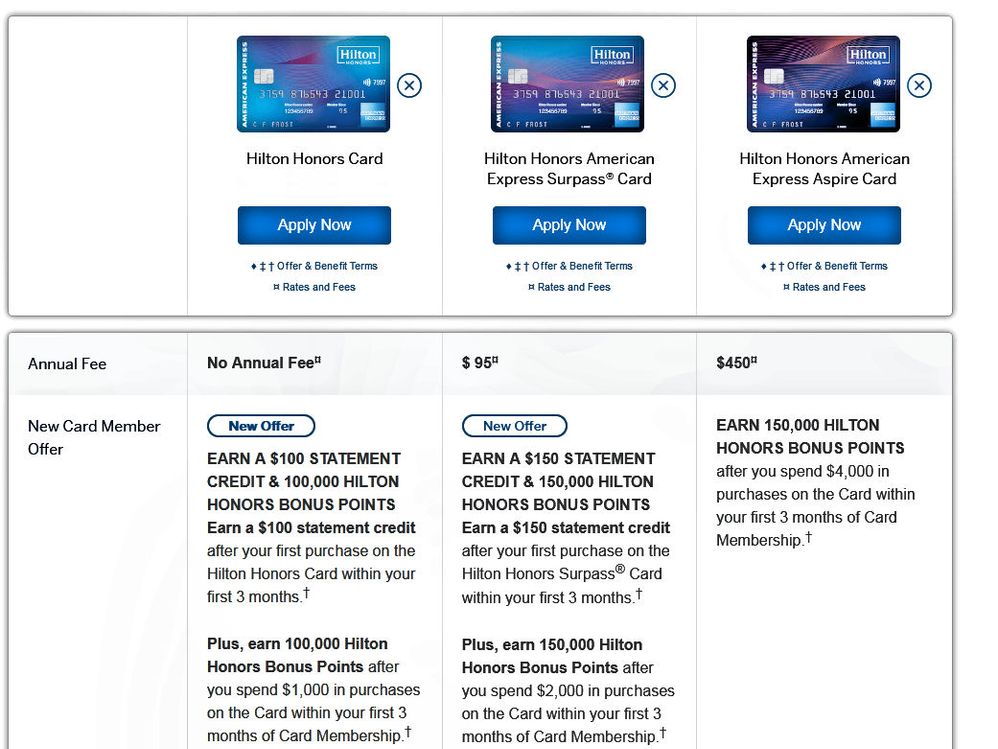

There are three Hilton cards: Basic No-AF version, $95 AF Surpass, and $450 AF Aspire. For the past several months of watching, the standard SUBs were 80K points, 100K points, and 150K points, although I regularly saw offers incognito browser or targeted for 100K, 150K and 150K points respectively. It looks like they made those special point SUBs the standard ... PLUS ... on the no-AF and $95 AF Surpass versions, you can claim either a $100 or $150 SUB! So on the Surpass version, that pays the AF for the first year and a half plus you get the higher 150K point SUB. If Hilton Honors points are worth about 6/10 ccp, that makes the SUB worth $900. (estimate from thepointsguy.)

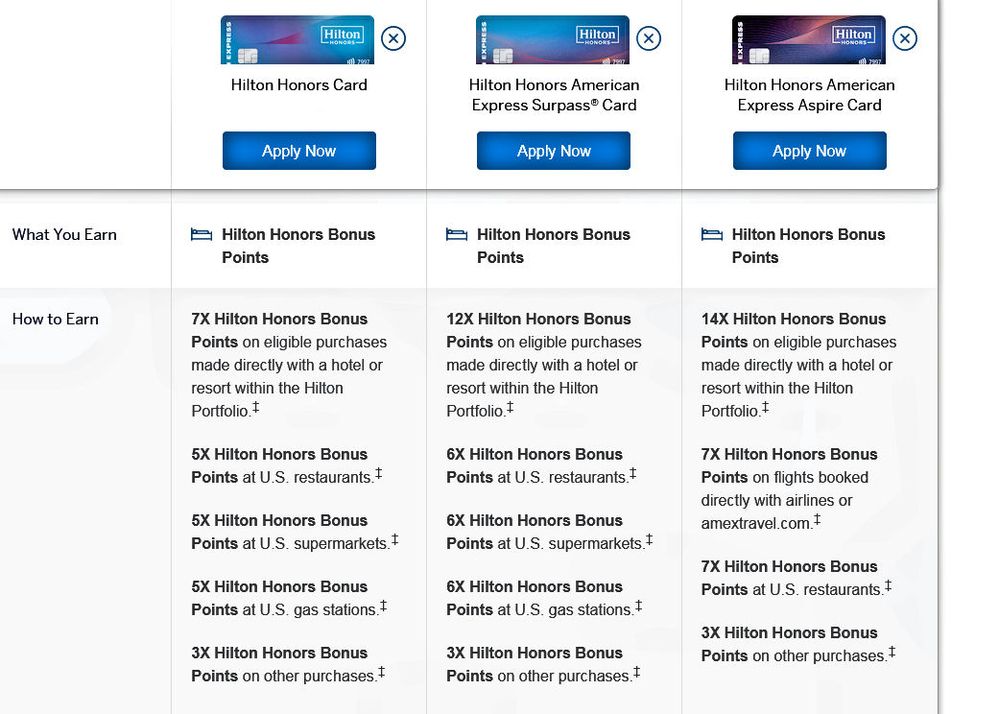

To me, as an infrequent Hilton guest, the sweet spot on these three cards is the Surpass. Although it doesn't offer a free annual night for the $95 AF like some cards such as my Chase Marriott Bonvoy Boundless or Chase World of Hyatt, the card is worthwhile based on the $150 and 150K point SUBs combined with the high earnings rate possible. Surpass pays 12 pts in-hotel at Hilton (about 7.2% return) which is a nice compromise between the 7x and 14x on the other cards. Plus if you want to accumulate Hilton points, it gets 6x points (about 3.6% return) on restaurants (in USA), supermarkets, and gas as well as 3x points (about 1.8% return) on everything else. For someone who appreciates hotel points and wants a simple and versatile rewards card, it could be a great pick. Unlike some of the other AMEX cards that have higher payouts on groceries, this one is uncapped on any categories.

The Aspire can be a great card too, but for my level of Hilton loyalty, I don't think it's worth the high AF for me. The Aspire also doesn't offer any enhanced SUB above what has been recently offered.

I have considered adding a Hilton card and this SUB might make it a good time to apply, if it sticks around until I leave the garden in a few weeks.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New AMEX Hilton card SUB Offers

The Surpass deal really stands out. If I was in the position to apply for an AMEX right now, I would be all over it. $95 fee offset by $150 statement credit and 150,000 points is one of the better SUBs around. SUB requires 2k spending, should be easy for most.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New AMEX Hilton card SUB Offers

I agree with you on the surpass. I just received the same offer and picked it up on my way to garden. I'll sit in the garden for awhile until I see an offer for the platnium that will claw me out. Thanks for explaining the difference in detail. I'm not tied to a certail hotel chain so this will be a good one to have in the wallet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New AMEX Hilton card SUB Offers

I think you are overvaluing Hilton Honors points; I'd estimate they are worth about 0.4 cents per points rather than 0.6 points per point. (Mind you, I did my evaluation on Hilton Honors points in about July 2020.)

Current credit cards:

American Express: Hilton Honors

Bank of America: Customized Cash Rewards Visa

Capital One: SavorOne MC

Chase: Amazon Visa, Freedom Unlimited Visa, Freedom Flex MC

Citi: Sears/ThankYou Rewards MC, My Best Buy Visa, Custom Cash MC

Comenity: AAA Travel Advantage Visa

Discover: Cash It

Elan: S&T Bank Max Cash Preferred Visa

FNBO: Amtrak Guest Rewards MC

PSECU: Founder's Visa

U.S. Bank: Cash+ Visa

Wells Fargo: Autograph Visa

Store cards: Kohl's

Next target credit cards: Wells Fargo Bilt Mastercard (probably), Truist Enjoy Travel Visa (maybe)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New AMEX Hilton card SUB Offers

I'm hoping they'll bring some of this goodness to upgrade offers. I hit a year back in August with my no AF version, and I am waiting for an offer on the Surpass before climbing the ranks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New AMEX Hilton card SUB Offers

@FormerCollegeDJ wrote:I think you are overvaluing Hilton Honors points; I'd estimate they are worth about 0.4 cents per points rather than 0.6 points per point. (Mind you, I did my evaluation on Hilton Honors points in about July 2020.)

Valid argument, @FormerCollegeDJ. With points, one problem is always "YMMV." So in your case, that may be a more correct estimate. I personally haven't played in redeeming Hilton Honors points so I don't have personal experience. I usually choose to reference the monthly points valuation update on thepointsguy website, as much as some on the forums dismiss their calculations. It's true that they market credit cards and their valuations may be a little optimistic based on some redemptions. I did another search and other websites do mention HH points values in the general range of 0.4 ccp to 0.5 ccp to 0.6 ccp. I think it also depends how diligent and flexible someone is in looking for (and waiting for) the best values.

Regardless, even at 0.4 ccp or 0.5 ccp, I think the offer above is a good one! On the Surpass, that $150 still pays for 1.5 years of AF. And 150K points would be worth at least $600 in stays, or $750 in stays at 0.5 ccp or $900 at 0.6 ccp. Those are all high SUBs for a $95 AF card, with the AF essentially waived for 18 months. ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New AMEX Hilton card SUB Offers

Points especially hotel (Hilton) are what you make of them. I mean there is a major gap in the value based on where you stay. Just take a look at the Maldives and Bora Bora yes those are the outliers but I personally have been saving (enough) of my points specifically for a 10 night stay at the Maldives over water villas. Now points are also valuable at regular hotels too if booking say for NYE or something special.

I for one do love the Hilton points and they are more valuable to me than a 2% cash back card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New AMEX Hilton card SUB Offers

@Aim_High wrote:

@FormerCollegeDJ wrote:I think you are overvaluing Hilton Honors points; I'd estimate they are worth about 0.4 cents per points rather than 0.6 points per point. (Mind you, I did my evaluation on Hilton Honors points in about July 2020.)

Valid argument, @FormerCollegeDJ. With points, one problem is always "YMMV." So in your case, that may be a more correct estimate. I personally haven't played in redeeming Hilton Honors points so I don't have personal experience. I usually choose to reference the monthly points valuation update on thepointsguy website, as much as some on the forums dismiss their calculations. It's true that they market credit cards and their valuations may be a little optimistic based on some redemptions. I did another search and other websites do mention HH points values in the general range of 0.4 ccp to 0.5 ccp to 0.6 ccp. I think it also depends how diligent and flexible someone is in looking for (and waiting for) the best values.

Regardless, even at 0.4 ccp or 0.5 ccp, I think the offer above is a good one! On the Surpass, that $150 still pays for 1.5 years of AF. And 150K points would be worth at least $600 in stays, or $750 in stays at 0.5 ccp or $900 at 0.6 ccp. Those are all high SUBs for a $95 AF card, with the AF essentially waived for 18 months.

Yeah, I tend to think The Points Guy website overvalues hotel reward program point values (along with Chase Ultimate Rewards points and probably most other points systems, but that's another story). I use the Upgraded Points website when examining rewards program valuations; I think that site tends to be a little more conservative (and therefore IMO realistic).

https://upgradedpoints.com/points-and-miles-valuations/

As I inferred in my earlier post in this thread, back in late July 2020 I did a thorough examination of the various hotel branded credit cards for the major hotel chains (Best Western, Choice, Hilton, Hyatt, IHG, Marriott, Radisson, and Wyndham) that looked at their program point valuations, status provided by holding a card, points earned per stay (including the base points per stay, the credit card "bonus" points per stay, and the status earned through holding the credit card "bonus" points per stay), and points sign-up bonus value based on points valuations. Some other factors, such as rewards rates for non-hotel spending and points expiration dates, were also included. A few important findings:

*Best Western is the only hotel chain that offers rewards points that do not expire. (Some of that is likely due to BW's different setup relative to other chains; BW is more like an association of hotels rather than a hotel brand operated by a common parent company. The BW setup is sort of similar to AAA member offices, which vary around the country, or for people who are familiar with intercity bus travel, similar to the difference between Trailways and Greyhound, where BW is analogous to Trailways while the other chains are analogous to Greyhound.)

*Wyndham is the only hotel chain that has points that expire even if you hold their co-branded credit card and are an active user. (The points expiration period does extend from 18 months to 48 months if you hold their card and periodically use it however.)

Regarding the co-branded credit cards themselves:

*All chains excluding Hyatt offer no annual fee credit cards.

*All chains excluding Choice offer low annual fee (<$100) credit cards

*Only Hilton and Marriott offer high annual fee (>$100) credit cards.

*Among the no annual fee credit cards, I'd personally rank the American Express Hilton Honors card as the best card, due to its high sign-up bonus (at 80,000 points with $1000 spend in first 90 days, it is worth $320 if points are valued at 0.4 cents per point) and very strong earning percentages on non-hotel spending (2% at restaurants, grocery stores, and gas stations; 1.2% on other spending - this assumes 0.4 cents per point valuation).

*I'd rank the Barclays Wyndham Rewards Earner Visa card as the second-best no annual fee hotel branded card, due to its high hotel stay rewards rate (11.2% with 11 points/stay as Gold member and 5 points/stay as credit card holder), good sign up bonus (at 30,000 points with $1000 spend in first 90 days, it is worth $210 if points are valued at 0.7 cents per point), and good non-hotel spending earnings, particularly for gas stations (3.5% at gas stations, 1.4% at restaurants and grocery stores, 0.7% on other spending - this assumes 0.7 cents per point valuation).

*Among the low annual fee credit cards, by far the best is the Chase World of Hyatt Visa card ($95 annual fee). It ranks at the top or near the top among low annual fee credit cards in total rewards rate for hotel stays (14.25% with 5.5 points/stay as Discoverist member and 4 points/stay as credit card holder), free annual night reward for Category 1-4 hotels, huge sign up bonus (potentially up to $750 if you spend $3000 in first 90 days and $3000 in second 90 days; can earn 50,000 points with points valued at 1.5 cents/point), and good earnings potential on non-hotel spend (3.0% for restaurants, flights, transit, and gym memberships, 1.5% on other spending - this assumes 1.5 cents per point valuation).

*The Chase IHG Rewards Club Premier Mastercard would probably be my second choice among the low annual fee credit cards, due to its high value sign up bonus (140,000 points if spend $3000 in first 90 days; this is equal to $700 with points valued at 0.5 cents per point), and better than average rewards rate for hotel stays (12.5% rewards rate based on 15 points per stay as Platinum member and 10 points per stay as credit card holder). This card also includes TSA Precheck/Global Entry reimbursement every four years ($25/year value).

*Between the two high annual fee cards, I'd probably rank the American Express Hilton Honors Aspire card slightly ahead of the American Express Marriott Bonvoy Brilliant card, though the comparison is close and each has different strengths.

*With Wyndham, the no annual fee card is a better value than the annual fee card; the latter doesn't provide enough additional benefits to make it worthwhile to get IMO.

*With IHG, the annual fee card ($89/year) is a better value than the no annual fee card; the latter card provides dramatically better benefits that more than offset the cost of the annual fee.

*Radisson branded credit cards (both the no annual fee and the $75 annual fee cards) provide the weakest level of benefits relative to the hotel's rewards program and IMO are not worth getting unless you stay at Radisson hotels a lot.

Current credit cards:

American Express: Hilton Honors

Bank of America: Customized Cash Rewards Visa

Capital One: SavorOne MC

Chase: Amazon Visa, Freedom Unlimited Visa, Freedom Flex MC

Citi: Sears/ThankYou Rewards MC, My Best Buy Visa, Custom Cash MC

Comenity: AAA Travel Advantage Visa

Discover: Cash It

Elan: S&T Bank Max Cash Preferred Visa

FNBO: Amtrak Guest Rewards MC

PSECU: Founder's Visa

U.S. Bank: Cash+ Visa

Wells Fargo: Autograph Visa

Store cards: Kohl's

Next target credit cards: Wells Fargo Bilt Mastercard (probably), Truist Enjoy Travel Visa (maybe)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New AMEX Hilton card SUB Offers

Great read @Aim_High thanks! I went for the AF Surpass in November 2020 w/130k points after $2k/3 months and I travel for business 8 out of 12 months so that made the most sense. As @randomguy1 stated that is the deal that stood out for me as well.

The brands that are under the Hilton family, Waldorf, LXR, Double Tree, Hilton Garden, Embassy Suites, Hampton Inn, Homewood Suites, etc... made the choice easier for me and my travels. But I now wish I would have waited till December…oh well, time for me to start gardening.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New AMEX Hilton card SUB Offers

@Demented1 wrote:Great read @Aim_High thanks! I went for the AF Surpass in November 2020 w/130k points after $2k/3 months and I travel for business 8 out of 12 months so that made the most sense. As @randomguy1 stated that is the deal that stood out for me as well.

The brands that are under the Hilton family, Waldorf, LXR, Double Tree, Hilton Garden, Embassy Suites, Hampton Inn, Homewood Suites, etc... made the choice easier for me and my travels. But I now wish I would have waited till December…oh well, time for me to start gardening.

@Demented1 Nice choice in cards, I have my eye on this one.

Welcome to the forums!