- myFICO® Forums

- Types of Credit

- Credit Cards

- New Fifth-Third 1.67% & 2% Cashback Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New Fifth-Third 1.67% & 2% Cashback Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Fifth-Third 1.67% & 2% Cashback Cards

Hello Friends!

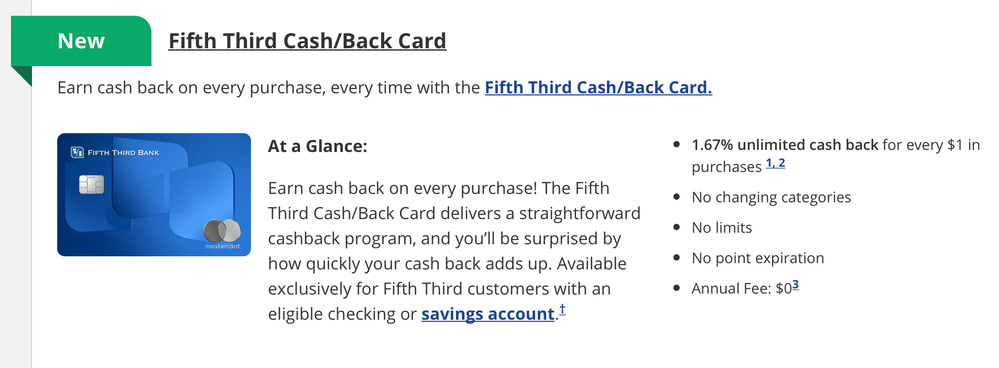

Not sure if this was already posted somewhere, didn't see it, but looks like 5/3 has removed the Trio Rewards card from their website and replaced it with a new 1.67% catch-all cashback card. That is such a specific number, but i guess when your name is a fraction, it sounds about right.

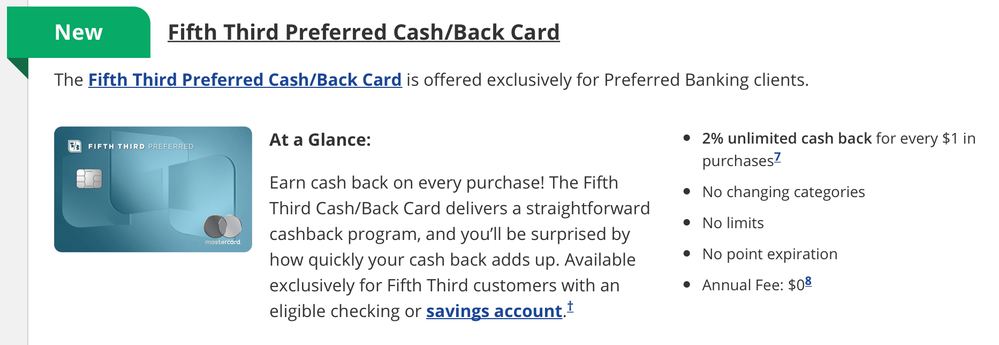

I wonder if they are grandfathering our legacy Trio cards (3% dining, 2% gas and groceries), although I never use the thing. I just dont want to be converted to a 1.67% card, my OCD will have an aneurysm ![]() I do like the sleeker new look though. Their new 2% card is for preferred clients only...

I do like the sleeker new look though. Their new 2% card is for preferred clients only...

In addition to that, all the credit card pages say "Available exclusively for Fifth Third customers with an eligible checking or savings account." Looks like no more credit card only applicants are welcome at this time

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fifth-Third 1.67% & 2% Cashback Cards

Well, I do find it interesting that 5 divided by 3 yields 1.67! Good thing they aren't Third-Fifth bank.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fifth-Third 1.67% & 2% Cashback Cards

Let me put that on my 1.67% card!!! That's some genius boardroom flop ahead. Yeah, I know there's a boatload of 1.5% cards... Just don't see people running for that ummm unique card!!! 😂 😂

Thanks for sharing that info!!

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fifth-Third 1.67% & 2% Cashback Cards

@Anonymous wrote:Well, I do find it interesting that 5 divided by 3 yields 1.67! Good thing they aren't Third-Fifth bank.

Hahaha good catch on that!

That didn't even cross my mind!

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fifth-Third 1.67% & 2% Cashback Cards

@credit_is_crack wrote:Hello Friends!

Not sure if this was already posted somewhere, didn't see it, but looks like 5/3 has removed the Trio Rewards card from their website and replaced it with a new 1.67% catch-all cashback card. That is such a specific number, but i guess when your name is a fraction, it sounds about right.

I wonder if they are grandfathering our legacy Trio cards (3% dining, 2% gas and groceries), although I never use the thing. I just dont want to be converted to a 1.67% card, my OCD will have an aneurysm

I do like the sleeker new look though. Their new 2% card is for preferred clients only...

Anything is possible if they are moving toward unifying their product family. I suppose we'll have to see.

FWIW, only one of my CCs was converted to TRIO (merged into another CC since I already had an active TRIO CC). Then again, some of their legacy CCs haven't been converted. I still have their legacy Cash Rewards and SU2C cards 🤷♂️ in addition to TRIO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fifth-Third 1.67% & 2% Cashback Cards

@Mr_Mojo_Risin wrote:

@Anonymous wrote:Well, I do find it interesting that 5 divided by 3 yields 1.67! Good thing they aren't Third-Fifth bank.

Hahaha good catch on that!

That didn't even cross my mind!

Same here - never would have noticed that @Anonymous lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fifth-Third 1.67% & 2% Cashback Cards

@blindambition wrote:Let me put that on my 1.67% card!!! That's some genius boardroom flop ahead. Yeah, I know there's a boatload of 1.5% cards... Just don't see people running for that ummm unique card!!! 😂 😂

Thanks for sharing that info!!

Can you imagine the calls they'll get from people saying "my points aren't adding up!" and them having to explain that ![]() I wonder if they'll take the round-up or round-down approach. It just sounds messy lol

I wonder if they'll take the round-up or round-down approach. It just sounds messy lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fifth-Third 1.67% & 2% Cashback Cards

I just noticed that all their cards say have this disclosure -- "Available exclusively for Fifth Third customers with an eligible checking or savings account"

I don't have anything with them but the Trio card. I guess they changed their policy where you must have a banking product first even to be eligible for any of their credit cards. Hopefully this only applies to new applicants, but they could always circle back to existing credit card only customers and force a banking product on them, which would be pretty aggressive for a 1.67% return rate

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fifth-Third 1.67% & 2% Cashback Cards

@credit_is_crack wrote:I just noticed that all their cards say have this disclosure -- "Available exclusively for Fifth Third customers with an eligible checking or savings account"

I don't have anything with them but the Trio card. I guess they changed their policy where you must have a banking product first even to be eligible for any of their credit cards. Hopefully this only applies to new applicants, but they could always circle back to existing credit card only customers and force a banking product on them, which would be pretty aggressive for a 1.67% return rate

The policy changed and it now applies to all applicants, even if you're an existing 5/3 CC customer. IIRC, checking or savings account needs to be open for 90 days.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fifth-Third 1.67% & 2% Cashback Cards

Well i guess it beats the Quint![]() 😁

😁