- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Percents - All Your Cards In One

https://www.allyourcardsinone.com

Has anyone gotten off the waitlist and have more info on this? It seems to be similar to Curve.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Percents - All Your Cards In One

I would never get it simply becasue it appears the only way you can get on the waitlist is to give them your mobile number! no thanks

13Oct22 Exp F8: 812

13Oct22 Exp F8: 812

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Percents - All Your Cards In One

No information on the home page. As my kids would say, seems "sus".

5% CB rotating:

;

;Everyday 3% CB:

;

;Everyday 5%:

;

;Companion Card:

;

;Everyday 2.2% CB:

;

;Retired to sock drawer after AOD (kept alive w/ 1 purchase every 6 mo):

;

;On my radar:

;

;Still Waiting for an Invite:

;

;No hope:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Percents - All Your Cards In One

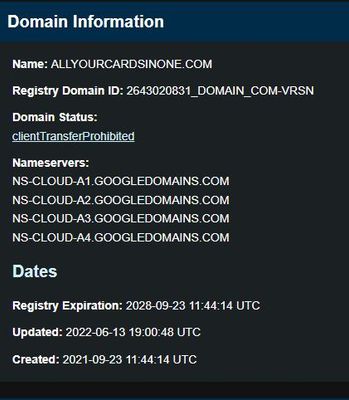

I wouldnt go near it. The domain name was created on 9/23/21 with Google Domains. Over a year for a waitlist website? No talk at all yet online about this company. Think of it this way. Been created over a year ago and no talk on here that I can remember about it? Then it doesnt pass the smell test. ![]()

Google Whois sites and type in the domain name.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Percents - All Your Cards In One

Even the name just sounds like a mouthful.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Percents - All Your Cards In One

I just got off their waitlist, an invite to be a beta tester. I'll give it a test drive and report back.

@ZAWARUDO wrote:https://www.allyourcardsinone.com

Has anyone gotten off the waitlist and have more info on this? It seems to be similar to Curve.

TCL: $401.4k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Percents - All Your Cards In One

@ZAWARUDO wrote:https://www.allyourcardsinone.com

Has anyone gotten off the waitlist and have more info on this? It seems to be similar to Curve.

What is it? I can't find anything about what this card actually offers?

"When prosperity comes, do not use all of it"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Percents - All Your Cards In One

@SDMarik It's an alternative to the Curve Card, which has been available in the UK for some time now and is now rolling out to the US.

Unfortunately, the US Curve Card doesn't yet support Visa credit cards. The Percents Card appears to support Visa credit cards right away (as well as Mastercards and Discover). Also, while the US Curve Card appears to require a HP and new account reported to the CRAs, so far the Percents Card does not.

TCL: $401.4k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Percents card

So this Percents card that is starting to pop up, what's the point of this thing? I just clicked through the FAQ and it seems to just be a card/app that you can use and it automatically re-routes the spend to the card in your wallet that has the best rewards earning potential for the transaction. I guess it seems cool at surface level, but I'm also not sure if it's something really needed unless you have your spend split over a ton of cards and cant keep track of what to use when.

I guess it reports the payments and you're expected to make the card payments through Percents?

They sent me the link to download the app and congratulated me for being off the waitlist (lol), but I'm not about to plug all of my card info, for all of my cards into some Fintech app in Beta. Also, they don't support Amex so I don't really have much of an interest.

Wondering if anyone else has any more insight on this? TIA

"When prosperity comes, do not use all of it"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Percents card

I'm pretty dubious of these services ever since a major once suggested I use my Sallie Mae MC to buy gas at Costco.

I know that was years ago, but does it know about available statement credits? Special offers? Minimum spend requirements? Purchase protections?

(And I will suggest a thread merge to mods.)

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select