- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Quad Apps - too much?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Quad Apps - too much?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

@lg8302ch wrote:

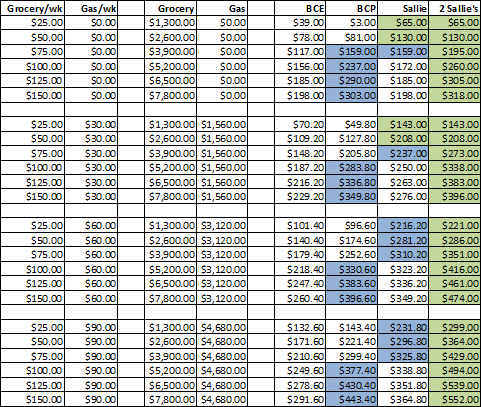

@Themanwhocan wrote:The Sallie Mae gets more rewards than a BCE, under all spending patterns. And if you consistently exceed $250 monthly spend on either Grocery or Gas Station purchases, you can always wait 6 months and apply for a second Sallie Mae card.

wow.... you can have two Sallie Mae cards ?? You really have done an excellent job with your cash back strategy

I do what I can.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

Ok, My new planned App Spree, with app order: (Please make any comments if applicable)

Discover IT

Barclays Sallie Mae (kind of thinking of app'ing for this one now Since I'm at TU 744 and a few more points won't make a difference, and no one looks at TU other than Barclays anyway)

Chase Freedom

Bank Americard Cash Rewards

Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

@nj23 wrote:Ok, My new planned App Spree, with app order: (Please make any comments if applicable)

Discover IT

Barclays Sallie Mae (kind of thinking of app'ing for this one now Since I'm at TU 744 and a few more points won't make a difference, and no one looks at TU other than Barclays anyway)Chase Freedom

Bank Americard Cash Rewards

Thanks

Sure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

@nj23 wrote:Ok, My new planned App Spree, with app order: (Please make any comments if applicable)

Discover IT

Barclays Sallie Mae (kind of thinking of app'ing for this one now Since I'm at TU 744 and a few more points won't make a difference, and no one looks at TU other than Barclays anyway)Chase Freedom

Bank Americard Cash Rewards

Thanks

App-ing for Barclays first is OK. However, Barclay is good about updating the credit bureas quickly. So if there is a delay between the Barclay app and others, then all the others will see the new tradeline on whatever bureau(s) they pull. And that will affect the Fico score from those bureas as well.

Probably best to do them all at once.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

@nj23 wrote:Ok, My new planned App Spree, with app order: (Please make any comments if applicable)

Discover IT

Barclays Sallie Mae (kind of thinking of app'ing for this one now Since I'm at TU 744 and a few more points won't make a difference, and no one looks at TU other than Barclays anyway)Chase Freedom

Bank Americard Cash Rewards

Thanks

I would make Barclay first and Discover has been also known to look at TU depending on the region

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

Thanks for the advice, I will hold off and do all at once and start with Barclay's.

I am going to keep an eye on AMEX BCE in case they have a better offer by the time I app - It kind of seems like the Bank Americard Cash Rewards and BCE aren't all that different. One thing that seems appealing about AMEX is the CL/CLIs. I'm looking to get the largest credit lines I can. My income is about 55k, so I'm not expecting gigantic limits, but I've seen people (a couple around these forums) with less income get pretty large limits.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

Dont think so. I did a Quint

Walmart, Best Buy, - Friday

Amazon - Saturday

Amex - Tuesday

Citi DP - Wedsneday.

approved for all. I have commited to no more for the next two years or until a house. I have all the cards i need now ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

@nj23 wrote:Thanks for the advice, I will hold off and do all at once and start with Barclay's.

I am going to keep an eye on AMEX BCE in case they have a better offer by the time I app - It kind of seems like the Bank Americard Cash Rewards and BCE aren't all that different. One thing that seems appealing about AMEX is the CL/CLIs. I'm looking to get the largest credit lines I can. My income is about 55k, so I'm not expecting gigantic limits, but I've seen people (a couple around these forums) with less income get pretty large limits.

Why? IMO, this focus is wrong. You should go for what maximizes your return. Now if you need to transfer a balance, or are always carrying a balance (and want to reduce util), or need to make a large purchase, then maybe getting a large CL is worthwhile. But in other cases a large CL has no real value, whereas getting good rewards does.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

I dunno...

I like the higher limits to keep the utilization down. You have some pretty serious limits there yourself. I cant imagine a 42k limit in my lifetime. Awesome job!

@Anonymous wrote:

@nj23 wrote:Thanks for the advice, I will hold off and do all at once and start with Barclay's.

I am going to keep an eye on AMEX BCE in case they have a better offer by the time I app - It kind of seems like the Bank Americard Cash Rewards and BCE aren't all that different. One thing that seems appealing about AMEX is the CL/CLIs. I'm looking to get the largest credit lines I can. My income is about 55k, so I'm not expecting gigantic limits, but I've seen people (a couple around these forums) with less income get pretty large limits.

Why? IMO, this focus is wrong. You should go for what maximizes your return. Now if you need to transfer a balance, or are always carrying a balance (and want to reduce util), or need to make a large purchase, then maybe getting a large CL is worthwhile. But in other cases a large CL has no real value, whereas getting good rewards does.

Starting Score: EQ 680 EX 731 TU 697

Starting Score: EQ 680 EX 731 TU 697Current Score: EQ 742 EX 752 TU 743

Goal Score: 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

I say do it! I've apped for multiple cards a few times and has been great, they will all age together and your chances (going off your scores) are excellent.