- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Real funny Cap One

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Real funny Cap One

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real funny Cap One

--------$32,000-------------$30,000-----------$30,000-----------$30,000-----$13,000---------$18,200----------$15,000---------$6,500----

FICO - TU: 780 EX: 784 EQ: 781

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real funny Cap One

Credit Steps? What does that mean exactly? I need to make a post for advice on what cards to apply for etc, i opened two secured cards about 18 months ago now, Capital One automatically incresed it to 500$ limit without bein further secured, it was like 200$. I have also gotten rid of a bunch of collections and innacurate medical debts on my report so between starting to build my credit with secured cards and getting rid of all blemishes i went from terrible to great credit pretty quick, my Equifax FICO is 777, my Experian is 730, and my Transunion FIco is about 690, which should shoot up any day now that the final collection was removed from it yesterday. So anyway i need some advice on what cards to apply for and all, i will make a seperate post on it as i dont want to hijack this thread, just wondering if the "steps" thing is relevant ? Thanks

2020: FICO Score 9 850/850 (Equifax) (I still only have ~4 cards)

2018 FICO: EQ: 820 TU: 807 EX: 806

First Credit Card in 2016 (2 secured cards)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real funny Cap One

@FiveOhFour wrote:Credit Steps? What does that mean exactly? I need to make a post for advice on what cards to apply for etc, i opened two secured cards about 18 months ago now, Capital One automatically incresed it to 500$ limit without bein further secured, it was like 200$. I have also gotten rid of a bunch of collections and innacurate medical debts on my report so between starting to build my credit with secured cards and getting rid of all blemishes i went from terrible to great credit pretty quick, my Equifax FICO is 777, my Experian is 730, and my Transunion FIco is about 690, which should shoot up any day now that the final collection was removed from it yesterday. So anyway i need some advice on what cards to apply for and all, i will make a seperate post on it as i dont want to hijack this thread, just wondering if the "steps" thing is relevant ? Thanks

I'm not sure about the other cards being that I only have 2 but the platinum and quicksilver one goes through the credit steps which mean you start off with a low credit limit and after the sixth statement cut you'll either get a generous limit or a small one up to like 250. I've seen ppl go from 300 to 3000. Sure someone can probably explain this better

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real funny Cap One

@Anonymous wrote:Good one Captial One

I'll pass on that!!

I don't know whether to laugh or cry...or to be shocked that someone actually got a CLI by pushing the "Luv" button.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real funny Cap One

@FiveOhFour wrote:Credit Steps? What does that mean exactly? I need to make a post for advice on what cards to apply for etc, i opened two secured cards about 18 months ago now, Capital One automatically incresed it to 500$ limit without bein further secured, it was like 200$. I have also gotten rid of a bunch of collections and innacurate medical debts on my report so between starting to build my credit with secured cards and getting rid of all blemishes i went from terrible to great credit pretty quick, my Equifax FICO is 777, my Experian is 730, and my Transunion FIco is about 690, which should shoot up any day now that the final collection was removed from it yesterday. So anyway i need some advice on what cards to apply for and all, i will make a seperate post on it as i dont want to hijack this thread, just wondering if the "steps" thing is relevant ? Thanks

Credit Steps is revelant, it is a program to help members reestablish a CC without having to go the Secured Card route. Once accepted the member gets a low CL and if after 6 mths of successful account management it graduates and the member is eligilble for a standard CL.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real funny Cap One

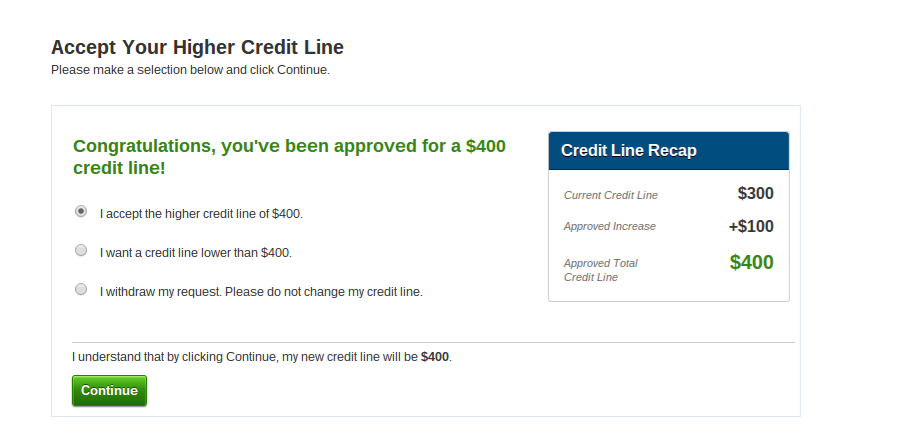

$100? ![]() I guess its better than nothing....but not really. Hopefully the credit steps increase is much better

I guess its better than nothing....but not really. Hopefully the credit steps increase is much better ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real funny Cap One

If you have that account for only 2 months and get a CLI of like 33% - take it and repeat after 6 months... do not close it so early. Keep it and see where it is in a year from now. Then decide if you want to close it if it does not grow. Remember credit takes time to build and it is not an overnight action ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real funny Cap One

@Anonymous wrote:

@FiveOhFour wrote:Credit Steps? What does that mean exactly? I need to make a post for advice on what cards to apply for etc, i opened two secured cards about 18 months ago now, Capital One automatically incresed it to 500$ limit without bein further secured, it was like 200$. I have also gotten rid of a bunch of collections and innacurate medical debts on my report so between starting to build my credit with secured cards and getting rid of all blemishes i went from terrible to great credit pretty quick, my Equifax FICO is 777, my Experian is 730, and my Transunion FIco is about 690, which should shoot up any day now that the final collection was removed from it yesterday. So anyway i need some advice on what cards to apply for and all, i will make a seperate post on it as i dont want to hijack this thread, just wondering if the "steps" thing is relevant ? Thanks

I'm not sure about the other cards being that I only have 2 but the platinum and quicksilver one goes through the credit steps which mean you start off with a low credit limit and after the sixth statement cut you'll either get a generous limit or a small one up to like 250. I've seen ppl go from 300 to 3000. Sure someone can probably explain this better

You'll be fine despite what many have said very few people get a CLI of signifigance while enrolled in Credit Steps, just make sure those payments are on time, and make sure you are getting good usage out of it Capitol One will factor your CL off of usage once it graduates.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real funny Cap One

Don't close it.

you have to start somewhere.

my very first credit card back in 2006 was a $300 Crapital One Platinum. took me several years to get rid of the pos, but did. Check my Siggy to see where I am now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real funny Cap One

@joedtx wrote:

@Anonymous wrote:

@FiveOhFour wrote:Credit Steps? What does that mean exactly? I need to make a post for advice on what cards to apply for etc, i opened two secured cards about 18 months ago now, Capital One automatically incresed it to 500$ limit without bein further secured, it was like 200$. I have also gotten rid of a bunch of collections and innacurate medical debts on my report so between starting to build my credit with secured cards and getting rid of all blemishes i went from terrible to great credit pretty quick, my Equifax FICO is 777, my Experian is 730, and my Transunion FIco is about 690, which should shoot up any day now that the final collection was removed from it yesterday. So anyway i need some advice on what cards to apply for and all, i will make a seperate post on it as i dont want to hijack this thread, just wondering if the "steps" thing is relevant ? Thanks

I'm not sure about the other cards being that I only have 2 but the platinum and quicksilver one goes through the credit steps which mean you start off with a low credit limit and after the sixth statement cut you'll either get a generous limit or a small one up to like 250. I've seen ppl go from 300 to 3000. Sure someone can probably explain this better

You'll be fine despite what many have said very few people get a CLI of signifigance while enrolled in Credit Steps, just make sure those payments are on time, and make sure you are getting good usage out of it Capitol One will factor your CL off of usage once it graduates.

When you Say "enrolled in credit steps" is that card based or any card can be it just depends on the customer? For instance i know My Capitol One Pre Approved QuickSilver offers say i will get a CLI after 6 months, so thats the Credit Steps thing, but is that just how that card works for everyone or is that more because of my Credit? I'm about to post a threat looking for input on getting a new card, right now i only have 2 secured cards for about 16 months or so as thats all i could get then, but since then my credit has gone up substantially, now all 3 of my FICO scored are "Very Good", in the 700's, 2 in the high 700's, so i'm looking for input on the best cards to apply for while still being a relatively safe bet/sure thing, anyway point being I'd appreciate if you come over to the thread i start and share any input you have. thanks

2020: FICO Score 9 850/850 (Equifax) (I still only have ~4 cards)

2018 FICO: EQ: 820 TU: 807 EX: 806

First Credit Card in 2016 (2 secured cards)