- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Setting Your >2024< Card Strategy

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Setting Your >2024< Card Strategy

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Setting Your >2024< Card Strategy

My expectation is that 2024 won't be as active as 2023 ended up being ![]()

only 2 planned apps, but that can always change

January - Apply for CIC, hopefully the 90k will still be around at that point

August - Close AMEX Delta Business gold, opened it mainly for the sub, did not find any use for it so planning on closing after AF hits

October - Apply for the IHG Premier, this would put my at 5/24 until March 2025

Cheers!

Business Cards:

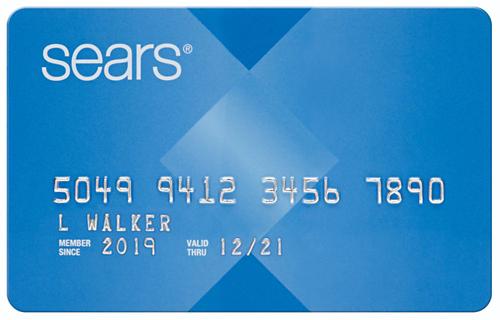

Store Cards:

Credit Health:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Setting Your >2024< Card Strategy

Gardning and working on begging US Bank to increase my lines...

Probably will cancel Apple Card (no sim free financing anymore) and Discover (no use).

EQ - 841 / TU - 813/ EX - 823

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Setting Your >2024< Card Strategy

I went below 5/24 a few months ago while no activities yet ![]() . I was hoping to get SUB by PCing one of my Cash+ to AR, while I had no luck to receive the SUB after completing all spends (receiving SUB in this way looks to be hit or miss). I received a few large spend offers on Citi SYW and hope to cover them soon.

. I was hoping to get SUB by PCing one of my Cash+ to AR, while I had no luck to receive the SUB after completing all spends (receiving SUB in this way looks to be hit or miss). I received a few large spend offers on Citi SYW and hope to cover them soon.

I plan to start my own biz soon and I will go for a few Chase/Amex Biz cards (no AF).

For personal cards, I see whether there are any new CB cards that can optimize better CB coverage of ~5% on every day purchases and bills. I may apply for a Citi CCC (prior planning to PC my Premier to CCC was not successful). Citi is a bit picky and they seem to prefer a clean sheet in the past 6 months. So, it might not worth to risk a HP.

Fico8: EX~EQ~TU~840 (12 month goal~850).

Fico8: EX~EQ~TU~840 (12 month goal~850).BOA (CCR, UCR), Chase (CFF, CSP, Amazon, CIC, CIU), US Bank (Cash+, AR, Go, Ralphs), Discover, Citi (CCC, DC, SYW), Amex (BCP, HH, Biz Gold, BBC, BBP), Affinity CR, Cap1(Walmart), Barclays View.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Setting Your >2024< Card Strategy

@Aim_High wrote:It's that time again for what has become a standing My FICO tradition. We're rapidly approaching the last month and a half of 2023, so it's time to consider our credit and financial plans for 2024!

As we approach the new year, and with the goal of making credit changes a premeditated and mindful decision, what are the planned changes for your card lineup in 2024?

I have a robust wallet and only two cards remain on my wishlist: the BofA UCR and the US Bank Altitude (or the WF Bilt). With most of 2024 covered with existing 0% purchase APR card and low-rate BTs, there isn't a pressing need to get another card. I'm not committing to no apps, but I'm not planning to app. As such, my card strategy for 2024 will be similar to 2023, except adjusting spend allocation to leverage better rate cards and promotions.

2023-2024 Card Strategy

- Spend Allocation / What's in my wallet

- 2023: Most of my spend was on 0% between Disco, BofA CCR, and AMEX BCE. Incidental PIF spend was on AppleCard (3% ApplePay), CU Visa (2% CB) and the RedCard & Amazon cards (5% credit).

- 2024: Most spend will be on BCE and incidental purchases spread between category and 2% cards.

- Account Management

- 2023: AMEX BCE App ✅ |Disco CLI ✅ | Closed PF 2% Visa ✅ | Downgrade AMEX Gold to Green (pending)

- 2024: Request Disco 0% APR and CLI | Request Amazon CLI | Downgrade AMEX Gold to Green (if I don't complete in '23)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Setting Your >2024< Card Strategy

First time participating in this thread, so here goes.

As we close out '23, I'll be going for a 3rd INK, the CIU, before 90k SUB goes away.

Currently at 4/24 and won't have room for more than 1 personal non Chase app till 6/24 unless I want to be over 5/24 for a while. CFU double points SUB is tempting tho so may go for it after CIU.

Will drop to 3/24 in Aug '24 IIRC, so next apps will probably be to expand CU memberships and pick up expanded 5% category spend via BoA (Platinum Honors Member) CCR for online, AAA Comenity for grocery, SAFE and Langley for rotators, and a SYW. Oh, and the new Bread Amex possibly if it ever goes off invite only.

Other than that, increase TCL to 400K (?) via SP CLI and new apps and combine some accounts where possible. Also some PC's to boost earn rates wherever I can and continue with the BT shuffle between DW and I.

Hmm, looks like this will keep me busy into 2025 if I want to stay under 5/24...

BECU CLOC 15K

~BIZ Credit~ Amex BBP 9.6K BBC 10.2K Biz Plat NPSL x2 Biz Gold NPSL x2 | USBank Biz Cash 10K | Citizen's ED Points Biz 7K | FNBO Biz Evergreen 13.7K | BoA Biz Unlimited #1 7.5K |BoA Biz Unlimited #2 50K | BoA Biz CCR #1 7K | BoA Biz CCR #2 22K | CIC 9K | INK Premier 80K/16K Flex | CIU#1 11K CIU #2 5K |

~formerly known as Xatos~

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Setting Your >2024< Card Strategy

I opened 5 cards in the past year...so...I will mostly be gardening in 2024. I still need a dedicated 5% card for grocery and a 2% catch-all card. For grocery, the current plan is to app for a Double Cash not sooner than June, then wait a year and hope they let me PC it to a second Custom Cash. I'd then app for a different 2% card while waiting, maybe the Paypal Mastercard. The other option would be AAA then Paypal. I need to be cautious rebuilding this quickly on a derog profile, though.

With either set, that would give me:

5% - Grocery

5% - Gas

5% - Electronics Stores

5% - Ground Transport

3% - Online Shopping

3% - Dining

3% - Entertainment

3% - Anything that takes Paypal

2% - Whatever else

And that would be a pretty good lineup for a while. I consider this plan the core lineup for my spending patterns and anything else like an Amazon card or Max Cash would just be a bonus for diminishing returns and wouldn't be happening in 2024. My only other goal for next year is getting CLIs on the Custom Cash and Cash+. I don't need any more user-initiated CLIs on the Savor One or BCE as I don't use them as heavily as earlier in the year.

__

Rebuilding, FICO 8s as of March 2025:

VS4: 709

VS4: 709

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Setting Your >2024< Card Strategy

I got a bunch of cards in 2023, so 2024 will be spent continuing to garden and pay down my 0% balances. Considering what seems to be goals of ppl much higher up than me, gonna stay financially safe

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Setting Your >2024< Card Strategy

I just got approved for the Chase Sapphire Reserve, and the card should be arriving in the next few days! Therefore, my 2024 strategy looks pretty much set in stone:

In wallet already/approved:

1. Chase Freedom Unlimited (July 2023) (Chase 1/24)

2. Capital One Venture X (September 2023) Chase 2/24)

3. Chase Sapphire Reserve (early December 2023) (Chase 3/24)

Planned for next year:

1. IHG Premier - late January 2024 (Chase 4/24)

2. Chase Freedom Flex - late March 2024 (Chase 5/24)

3. Capital One Savor One - late May 2024 (Capital One 2/2 - Venture X applied September 2023)

I should have all of the cards in my current setup by the time I go on my 2-2.5 week trip to the Netherlands in June - July 2024, and be satisfied. No interest in Amex, as their MR cards are too much of a "coupon book" to be worthwhile. The only wild card (no pun intended) is the potential addition of travel partners to Wells Fargo - it might be worth looking into, but I probably take a break from applications until around November 2024, when I will be planning travel for summer 2025.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Setting Your >2024< Card Strategy

We need a 2024 strategy already? Uh-oh. I've barely figured out my 2023 strategy ![]()

4 new cards this year, 2 from Chase and 2 from US Bank, both of which are notoriously sensitive about new accounts.

So, I need to tend to my garden.

I don't need more cards, but there are some I'd like to have.

I would like to have a 2nd Discover Cash Back. I was preapproved for it when I checked the other day. Maybe not when my newest card hits the reports. I didn't care for the bonus categories this quarter and decided to wait.

I've never been an Amex guy, but I would like to have the Blue Cash Everyday for the 3% online purchases. I applied for it and got rejected a week or so ago. I might try again in 2024.

I'm not sure I need that Redstone Visa that all the cool kids are getting these days, but . . . I probably would have applied for that instead of the USB Shopper Cash Rewards the other day, I just wasn't in the mood to jump through the hoops for some out-of-state credit union. It could happen in the near future. We'll see.

Did I tell you my garden needs attention?

I could get a CFU just for the intro bonuses, or something else that offers a nice SUB. No particular order or timing plan for any of this. Just whatever looks good when the time seems right.

EDIT: I forgot to mention the card that has gotten my interest the past couple days. The Kroger card, and similar card from Kroger subsidiaries, gets 5% back on mobile wallet purchases. This is a card I've seen in people's sigs, but didn't pay much attention to before. It is now up at the top of the list of credit cards I need. It's another US Bank card so I probably need to chill for a while before I hit them again.

EQ8 772, TU8 762, EX8 776 as of October 14

EQ8 772, TU8 762, EX8 776 as of October 14- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Setting Your >2024< Card Strategy

@mgood wrote:We need a 2024 strategy already? Uh-oh. I've barely figured out my 2023 strategy

4 new cards this year, 2 from Chase and 2 from US Bank, both of which are notoriously sensitive about new accounts.

So, I need to tend to my garden.

I don't need more cards, but there are some I'd like to have.

I would like to have a 2nd Discover Cash Back. I was preapproved for it when I checked the other day. Maybe not when my newest card hits the reports. I didn't care for the bonus categories this quarter and decided to wait.

I've never been an Amex guy, but I would like to have the Blue Cash Everyday for the 3% online purchases. I applied for it and got rejected a week or so ago. I might try again in 2024.

I'm not sure I need that Redstone Visa that all the cool kids are getting these days, but . . . I probably would have applied for that instead of the USB Shopper Cash Rewards the other day, I just wasn't in the mood to jump through the hoops for some out-of-state credit union. It could happen in the near future. We'll see.

Did I tell you my garden needs attention?

I could get a CFU just for the intro bonuses, or something else that offers a nice SUB. No particular order or timing plan for any of this. Just whatever looks good when the time seems right.

Your credit scores are excellent and Amex BCE is an entry level card with them right? So I'm confused how were you denied that card last week? Makes no sense.