- myFICO® Forums

- Types of Credit

- Credit Cards

- TD Easy Rewards Becoming TD Cash

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

TD Easy Rewards Becoming TD Cash

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TD Easy Rewards Becoming TD Cash

Hey all,

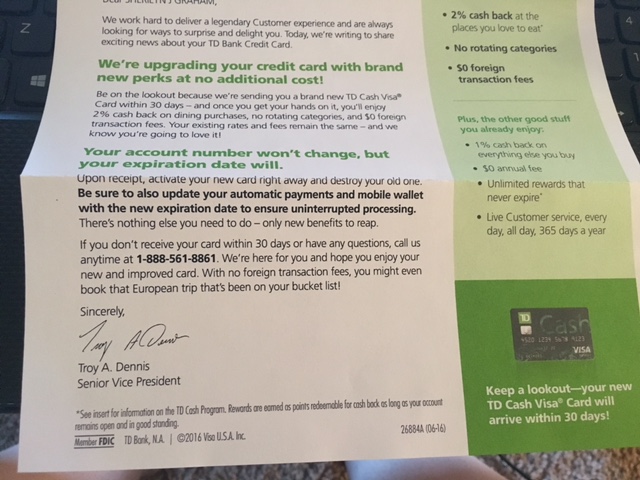

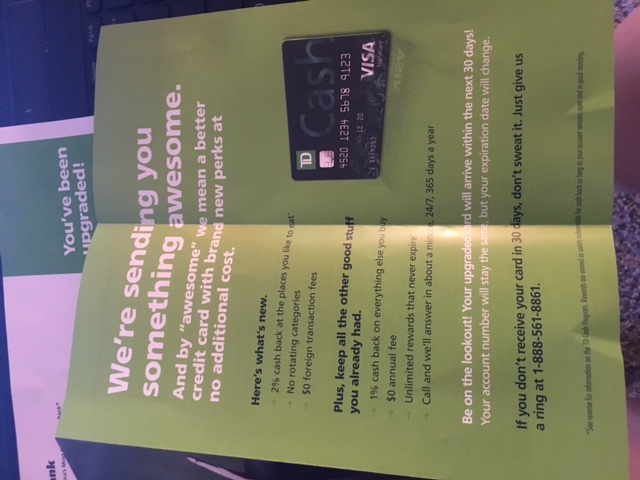

Got this mailer today regarding my TD Easy Rewards credit card. Was a nifty card when I first got with unlimited 5% on restaurants, gas, utilities, and some other category I can't remember..., but it only lasted for 6 months and then reverted to a plain jane 1%.

Anyways, looks like the Cash Rewards and Easy Rewards are being phased out, and turned into this new card. Nothing fantastic to write home about, but will have more use than it previously was after the 5%, with a 2% reward on restaurants (which includes coffee shops and convenience stores) with 1% everywhere else and no foreign transaction fee.

Figured I'd throw it out there for the few members who have a TD card ![]() Sorry that the last two images are flipped, for whatever reason MyFico flipped it from the original orientation that I can view in the Windows Picture Viewer on my computer.

Sorry that the last two images are flipped, for whatever reason MyFico flipped it from the original orientation that I can view in the Windows Picture Viewer on my computer.

Cheers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TD Easy Rewards Becoming TD Cash

I like "We are sending you something awesome:!

While it is better than the post-6month card, will you use this though?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TD Easy Rewards Becoming TD Cash

Probably not very much this year for since my GM card covers the 2% currently. May be nice next year when restaurants aren't going on on Freedom/IT and I'd like to focus the 5% on up to $5k on non-category spend on the GM for a while. It raises an eyebrow though for somebody who doesn't have any of the current 2% on all spend cards and likes to grab their morning cup of joe and breakfast sandwich at a convenience store.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TD Easy Rewards Becoming TD Cash

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TD Easy Rewards Becoming TD Cash

The only thing this has going for it is the no foregin transaction fees. I wish more cards would eliminate FTFs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TD Easy Rewards Becoming TD Cash

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TD Easy Rewards Becoming TD Cash

First post here. I am replying to this to give my take on this card plus other information (helps with people who want to Google/Search in the future about this card).

I got this TD Cash Card when they rolled it out back in January 2016 with an offer for $200 cash back if you spend $1500 within 90 days. I smashed that goal pretty quickly.

However, as stated at the beginning you earn 2% cash back on restaurants/food places) and 1% everywhere else. In order to redeem the Cash Rewards you need to have at least $25/2500 points in your account. You can redeem the points to products on the TD Bank Rewards website or Cash Back by statement credit, direct deposit, or check in the mail.

Pros:

*Can use Direct Deposit for Cash Back above $25.

*No AF

*No FTF

*US-based Customer Service Support 24/7.

*High amount of AUs you can add to the account, which is 24.

*Visa Signature Card above $5k

Cons:

*You need to be located in the TD Bank Retail footprint in order to apply for this card (East Coast with New England states, excludes for Georiga but could be wrong on this).

*Need to earn at $25 Cash Back to Redeem.

*Website is buggy (gave me an error message when trying to update my mailing address for them.

*No Mobile App support, unless you have a TD Bank Banking Product. Which in that case you can review your Credit Card balance/charges thru there, but for full review on your credit card you need to go to the TD Card Services website

Other information:

*Max Credit Limit is $25,000 which you can request an increase every six months with a HP.

*VantageScore is offered with your Credit Card but you must have a TD Bank Banking product to access it via Online Banking. If your only TD Bank Product is a Credit Card you are out of your luck.

My final thoughts: This is my only No FTF card I have so I am putting this away. I don't travel but the limit they gave was $12,500 so I am not closing the account. There are better credit cards out there that have better rewards than this TD Cash Card. From my understanding TD Bank is trying to step up their credit card offerings. Also I feel they are targeting this card for those who have a banking reslationship with TD and those who travel from Canada to US and trans versa back (TD is a Canadian Bank with US presence in East Coast US). The real lack of a Mobile App for those who only have a TD Credit Card is annoying.