- myFICO® Forums

- Types of Credit

- Credit Cards

- TRIGGER???.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

TRIGGER???.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TRIGGER???.

I recently got a not so good experience with an app that I was pre-qualified and then denied.

The Credit Bureau in question was Transunion. So I went to AnnualCreditReport and checked the file.

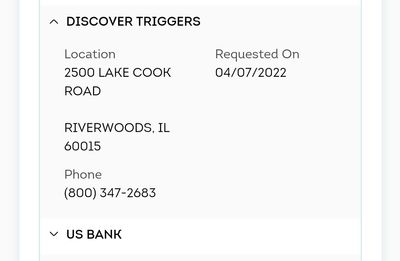

Nothing out of the ordinary, except that next to Discover was the word Trigger. It was a SP.

BTW, my AUs are there, but didn't do squat for me.

Is it possible that that little "stain" could be the reason for the denial?.,

I remember asking for a CLI about that time. With 0 balance. Denied, but that's OK.

What's your opinion?. Thanks in advance.

Cheers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TRIGGER???.

It has nothing to do with your denial.

Read up on Trigger Leads by CRAs, that's what it is

They SPed your report based on it

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TRIGGER???.

Ok, I'll bite.

Does OP already have a Discover card, or the Discover was the denial and now appears on the credit report as a marketing skeleton?

I will admit to major confusion.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TRIGGER???.

@NRB525 wrote:Ok, I'll bite.

Does OP already have a Discover card, or the Discover was the denial and now appears on the credit report as a marketing skeleton?

I will admit to major confusion.

Yes, I have a Discover card.

A few months ago, I asked CLIs in the small limit cards. Discover amonst them.

Fast forward to the Trigger thing.

A few days ago, I prequalified for CreditCare for 9.2k, pressed the "not interested"

key, since the interest rate was too high, and they did prequal me anyway. It was a denial. SP. Transunion.

I went to Transunion to check if something was really wrong in the file.

Nothing was. They have approved me with much less credit and much lower credit score.

The only thing out of the ordinary was a notation next to a Discover SP saying "Trigger."

From when I asked for the CLIs before all this. And @Remedios sent me the info to

read what CRA Trigger is, I know now what it means.

Has nothing to do with the denial, as was pointed out.

Hope this clarify the situation. For I tend to think way more than I convey.

Cheers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TRIGGER???.

I'm still clueless.

Does discussion of CRA Triggers violate MF TOS, so links about it cannot be shared?

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TRIGGER???.

@Creditin i get one of those every time Disco offers me a new product such as savings, PL, etc

This is just the latest one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TRIGGER???.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TRIGGER???.

OP thanks for creating this post, and thanks for the link @Remedios . I haven't checked annual credit report probably in at least three weeks to a month. Same as OP I found "Discover Trigger" on my Transunion report. Learn something new everyday I guess.