- myFICO® Forums

- Types of Credit

- Credit Cards

- Time Table for Requesting CLIs on my Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Time Table for Requesting CLIs on my Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Time Table for Requesting CLIs on my Cards

Hello!

So on my journey to build lots of credit over time, I'm trying to best figure out around when I should request CLIs for my current cards.

I'm done applying until at least next June, but most likely none until July 2020.

I currently have a TD Card, 500 SL from June 2016, auto increase to 1000 last year and a hard inq to increase to 1250 this past june.

I have a discover it card, SL was 1000 and after 1 year I pressed button and increased it to 2000 last month.

Opened Citi DC in June, $2,300 SL

Opened BOA Travel Rewards, $900 SL

Opened AMEX Gold Delta $6,000 SL

Opened Amazon Prime Visa $1,000 SL

I was thinking not touch TD for at least a year, press discover in 3 months, try something with AMEX in 90 days.

No clue how to approach the rest.

I always pay off in full every month and use each card for at least something.

Ex - 734 TU - 742 EQ - 730

Utilization is always between 0-1%

Income at 25k, will be 30k in 6 months

Never Missed a payment, 6inqs on EX, 2 TU, 1 EQ

Getting the "Bonus" on all the new cards with higher spending early on those cards, less on my previous primary cards.

The goal is to build stronger CLs early so when I'm out of Law School I can go after PRG/Plat, CSP.

Thanks for all advice!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time Table for Requesting CLIs on my Cards

Amazon I would wait at least 90 days.

Amex do a search on the forum for AMEXx3 CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time Table for Requesting CLIs on my Cards

For new Citi cards often people will get a CL increase early from a customer request.(First few days or a couple of months). After your 1st CL increase either by request or from Citi automatically they use a 6 month lock out for another increase. When you get an increase note the date to try again in 6 months. You "Can Not" go by the web page showing a SP CL increase option. It can be shown every month for many users who are locked out from another increase. Need a calendar or reminder program for Citi

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time Table for Requesting CLIs on my Cards

@Kforce wrote:For new Citi cards often people will get a CL increase early.(First few days or a couple of months)

However after your 1st CL increase either by request or from Citi automatically they use a 6 month lock out from another increase.

When you get an increase note the date to try again in 6 months. You can not go by the web page showing a SP CL increase option. It can be shown every month for many users who are locked out from another increase. Need a calendar or reminder program for Citi

Is that first CL increase done by Citi or is it usually requested?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time Table for Requesting CLIs on my Cards

Bank of America allows CLIs every 3 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time Table for Requesting CLIs on my Cards

@Anonymous wrote:

Is that first CL increase done by Citi or is it usually requested?

Requested, most auto are grater than 6 months

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time Table for Requesting CLIs on my Cards

@Anonymous wrote:Bank of America allows CLIs every 3 months.

Soft or Hard pulls? I think I remember reading soft somewhere

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time Table for Requesting CLIs on my Cards

@Anonymous wrote:

@Anonymous wrote:Bank of America allows CLIs every 3 months.

Soft or Hard pulls? I think I remember reading soft somewhere

They are now SPs.

Last HP 08-07-2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time Table for Requesting CLIs on my Cards

Bank of America CLIs are now soft pulls.

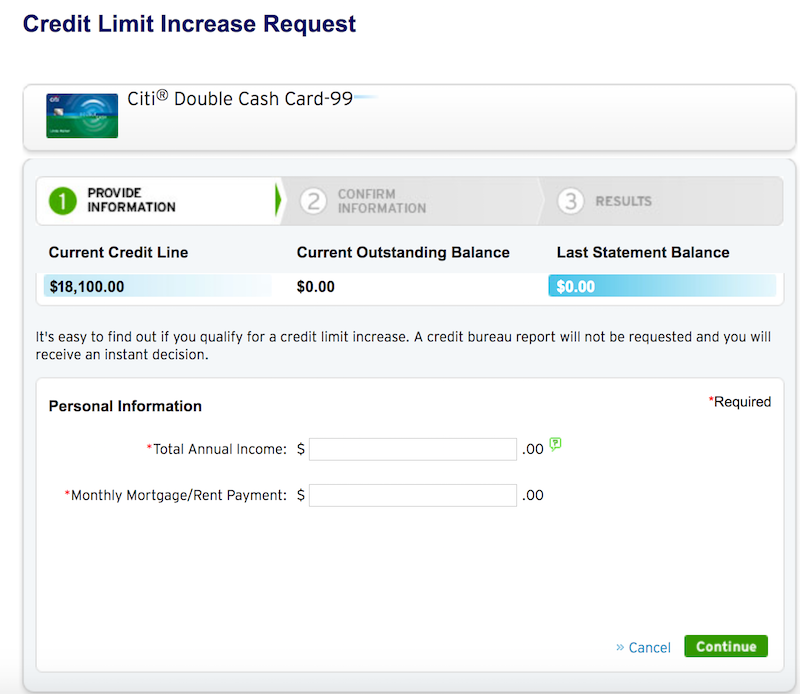

For Citi you need to check your account by clicking on Services > Credit Card Services > Request Credit Line Increase to see if you're eligible for a soft pull CLI; I was able to get one after just 2 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time Table for Requesting CLIs on my Cards

If you are attempting to minimize the number of HPs, then I'd suggest trying the SP options mentioned above for BoA, AMEX and Citi.