- myFICO® Forums

- Types of Credit

- Credit Cards

- Upgrade Card?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Upgrade Card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Card?

@FinStar wrote:Thanks for sharing @Creditaddict. Very peculiar concept for a consumer type of card. I found this footnote interesting. I wonder if this is a standard APR for all Upgrade products or just an example of someone being approved at that rate:

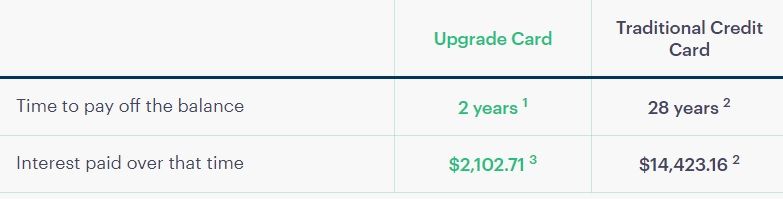

3. Interest of $2,102.71 assumes $10,000 first draw and installment payments of $504.29 for 24 months. Installment payments calculated with 18% APR and 24-month term and is based on amortizing the draw amount and accounting for interest accrued between the draw date and the due date set at 51 days after the draw date.

I think they were making a comparison between the two at the same rate to make it easier to understand how you pay less interest

And unless I'm wrong they're basically treating the purchases as a "loan" you take out and pay a set amount each month at the presumed rate you got your card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Card?

@simplynoir wrote:

@FinStar wrote:Thanks for sharing @Creditaddict. Very peculiar concept for a consumer type of card. I found this footnote interesting. I wonder if this is a standard APR for all Upgrade products or just an example of someone being approved at that rate:

3. Interest of $2,102.71 assumes $10,000 first draw and installment payments of $504.29 for 24 months. Installment payments calculated with 18% APR and 24-month term and is based on amortizing the draw amount and accounting for interest accrued between the draw date and the due date set at 51 days after the draw date.

I think they were making a comparison between the two at the same rate to make it easier to understand how you pay less interest

And unless I'm wrong they're basically treating the purchases as a "loan" you take out and pay a set amount each month at the presumed rate you got your card?

That is how i read it as well.

I also read it as you aren't getting anything special on the a "better" interest rate persay just paying it off in less time thus saving money. Am I missing something here? Also saw the following "credit Lines opened through Upgrade feature APRs of 6.49%-29.99% and line amounts ranging $500 - $50,000" . Obviously if you got the 6.49 awesome, but somehow i suspect most will get 18-22% apr's that would use this, but to be seen.

I personally see nothing special with this, but heck i might be overlooking the obvious?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Card?

@CreditCuriosity wrote:

@simplynoir wrote:

@FinStar wrote:Thanks for sharing @Creditaddict. Very peculiar concept for a consumer type of card. I found this footnote interesting. I wonder if this is a standard APR for all Upgrade products or just an example of someone being approved at that rate:

3. Interest of $2,102.71 assumes $10,000 first draw and installment payments of $504.29 for 24 months. Installment payments calculated with 18% APR and 24-month term and is based on amortizing the draw amount and accounting for interest accrued between the draw date and the due date set at 51 days after the draw date.

I think they were making a comparison between the two at the same rate to make it easier to understand how you pay less interest

And unless I'm wrong they're basically treating the purchases as a "loan" you take out and pay a set amount each month at the presumed rate you got your card?

That is how i read it as well.

I also read it as you aren't getting anything special on the a "better" interest rate persay just paying it off in less time thus saving money. Am I missing something here? Also saw the following "credit Lines opened through Upgrade feature APRs of 6.49%-29.99% and line amounts ranging $500 - $50,000" . Obviously if you got the 6.49 awesome, but somehow i suspect most will get 18-22% apr's that would use this, but to be seen.

I personally see nothing special with this, but heck i might be overlooking the obvious?

Honestly, this sounds like AMEX's Pay It Plan but treated as a loan you pay off because it sounds like you can set the length of time you can pay the purchase off. It's why it mentions that you can "Prepay any amount at any time with no penalty"

Basically, your payment will be the same every month and it can be paid off early if you have the funds. I can see how mentally that can help people since you can treat it like a car/rent payment and it gets an added function getting funds deposited to your bank account if you need money for other things a credit card cannot be used for. In that regard I can see it being useful if you presumably got a low rate

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Card?

@CreditCuriosity wrote:

I personally see nothing special with this, but heck i might be overlooking the obvious?

No, I think you are failing to overlook the obvious! It's certainly not a good "standard" credit card replacement as it looks like there is never a grace period, and no rewards, so at best if you get a very low APR it might be good as a balance transfer card equivalent (I assume no fee). But it also makes it very convenient to charge up a PLOC-equivalent, so there's a danger there!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Card?

This is an interesting concept but I have the same issue with it as I do with Citi Flex Loan and other types of hybrid loans -- it's still a credit card with a credit limit and thus this card will affect your utilization.

The fixed nature of the payments isn't really that appealing either. One of the best things about credit cards is the flexibility they give you versus the rigid structure of a traditional installment loan. You can pay more but pay less than you sign up for and you're in trouble.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Card?

Hi I just called UP greade card to get info on this type of account. Thay do not do hard pull only soft pull to find out what your credit line and intrest rate will be. Onceyou except the ooffer you will need to send them a copy of your tax return for 2 years and then you will get a hard pull. I don't like this account did not get good feel when talking to person on phone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Card?

CLs: (As of 12/2022)

First Tech World Mastercard: $10k

American Express: $1K

AAdvantage: $2.8K

Wells Fargo Platinum: $4.6K

Discover It (blue): $4.5K

Discover It (red): $4.5K

~6 other cards with limits under $2K

Auth'd user on 1 Capital One card.

All balances stay under 5%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Card?

It's hard to trust anyone who uses and presents a table like this:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade Card?

Soft pull sounds great and posts are finding the process shady?