- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Using Credit Cards in Germany and Switzerland

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Using Credit Cards in Germany and Switzerland

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Using Credit Cards in Germany and Switzerland

I just returned from a ten day trip to Germany and Switzerland. It has been a couple years since I was there last. I thought some of my personal experience using U.S. credit cards would be helpful to some on this forum:

(1). Most important, I found Germany and Switzerland, which have traditionally been all cash economies, have transitioned such that I could use my cards just about anywhere from the small newsstands to all the restaurants and supermarkets. Even discounters like Aldi and Rewe in Germany, as well as Migros and Denner in Switzerland had systems that would even take AMEX.

(2). I mainly used NFCU Flagship, SDFCU, AMEX and BoA Alaska Air. My experience was that most card readers rejected my cards as a tap transaction and requested that I insert the cards for the Chip to be read. Then the unit defaulted on Chip & Signature. However, I found that Apple Pay was outstanding-- anytime I used Apple Pay to tap a card reader, it always accepted the card when the reader otherwise would have rejected the card itself as a tap transaction and then asked for Chip & Signature. I bought some big-ticket items by tap using Apple Pay. (In contrast, I get the sense in the U.S. that tap purchases are often rejected when you attempt to make a purchase amounting to several hundred dollars.). Thus, Apple Pay was a big time saver when shopping.

(3). Just as others mentioned, the one Chip & PIN situation I encountered was when buying subway tickets in Munich or tickets for the Swiss trains at unmanned automats. Those units defaulted to asking me for my PIN after I put the NFCU Flagship card in the machine. After I entered the PIN, the machines issued the tickets. I had some problems with paying machines in park houses (parking lots) in Switzerland, perhaps they were not connected live to the internet. In most Swiss municipalities I found a Swiss app in the U.S. App Store (Parking Pay) that let me set up a parking timer and pay for parking by having the app charge my AMEX card with a 25 cent (I.e. 25 Rappen, CHF 0.25) service charge per transaction.

(4). I found the merchant categories fairly generous for travel. Anywhere I bought admission tickets, which NFCU categorizes as 3% travel rebate, I was able to obtain the 3% rebate for accompanying gift shop and restaurant purchases. (In contrast Disney World and Disneyland may have their theme park tickets categorized as such, which gives the 3% rebate with NFCU Flagship, but food and store purchases in the park are not categorized as travel. I even purchased glasses once at Costco with the AAA card expecting to get the 5 percent warehouse store rebate and ended up with only 1 percent as the opticians have different item codes from the rest of the store, even though it all charged as Costco. U.S. stores appear to have much more refined credit card codes than in Europe.)

(5). I used the Charles Schwab ATM card for local cash withdrawals. I had a problem twice where the ATM stated that the card was defective and could not process, but when I went to another of the same bank's ATMs, the other ATM processed the withdrawal flawlessly as a Chip & PIN transaction.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using Credit Cards in Germany and Switzerland

As someone about to get posted to Germany, I appreciate you writing this up!

My tentative plan is to use my USBAR (via Samsung Pay) and my NFCU Flagship as my backup. I've read that since Covid, Germany definitely embraced credit cards/contact less payments more than it had previously.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using Credit Cards in Germany and Switzerland

Thanks for the notes and your recent experiences. They can be helpful, if somebody wants to visit beautiful Switzerland and Germany. Visa/MC cards should be acceptable anywhere, while Amex should be acceptable at major places. Limited places may accept Discover (if any).

The debit card is called Maestro. So, do not get confused.

PS: Did you bring Swiss chocolates? ![]()

Fico8: EX~EQ~TU~840 (12 month goal~850).

Fico8: EX~EQ~TU~840 (12 month goal~850).BOA (CCR, UCR), Chase (CFF, CSP, Amazon, CIC, CIU), US Bank (Cash+, AR, Go, Ralphs), Discover, Citi (CCC, DC, SYW), Amex (BCP, HH, Biz Gold, BBC, BBP), Affinity CR, Cap1(Walmart), Barclays View.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using Credit Cards in Germany and Switzerland

I know there are some things in germany that dont work unless you have a german credit card, iirc its like some unmanned ticket stations at railway stations maybe and maybe parking garages but it isnt a lot.

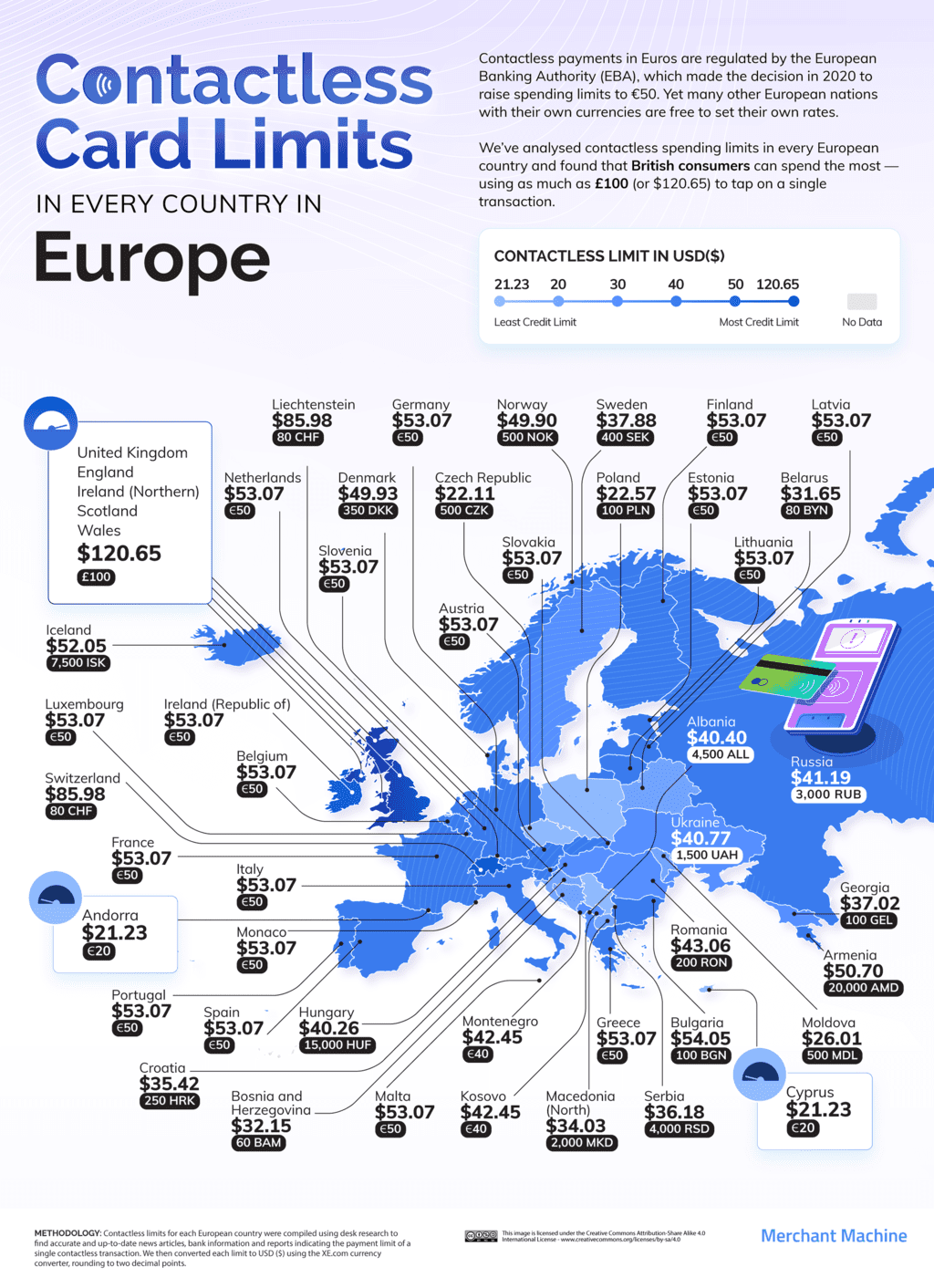

Also on that tap limit thing. That is normal as tap is treated different than apple pay. Most banks/merchants have low limits on tapping the card itself. iirc there isnt an actual codified limit in the US but most banks/merchants have it at like $100-120ish. here is a infographic for europe for example

Sock Drawer

Chopping Block

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using Credit Cards in Germany and Switzerland

@swankytiger wrote:I know there are some things in germany that dont work unless you have a german credit card, iirc its like some unmanned ticket stations at railway stations maybe and maybe parking garages but it isnt a lot.

Also on that tap limit thing. That is normal as tap is treated different than apple pay. Most banks/merchants have low limits on tapping the card itself. iirc there isnt an actual codified limit in the US but most banks/merchants have it at like $100-120ish. here is a infographic for europe for example

Do you know if Samsung Pay is treated similar to Apple Pay in that it bypasses the cap?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using Credit Cards in Germany and Switzerland

@30mm_goes_BRRRT wrote:Do you know if Samsung Pay is treated similar to Apple Pay in that it bypasses the cap?

Yes, readers don't necessarily know which mobile wallet type is being used. It bypasses the low cap.

But......! I haven't experienced this in the US, but in the UK one of the major supermarkets had a 250 GBP limit on mobile pay (I don't know if that is for credit cards as well), so for my 280 pound bill, I paid 30 in cash

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using Credit Cards in Germany and Switzerland

yea the merchants can have it set like they want, ie walmart not accepting it at all.

Sock Drawer

Chopping Block

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using Credit Cards in Germany and Switzerland

@swankytiger wrote:I know there are some things in germany that dont work unless you have a german credit card, iirc its like some unmanned ticket stations at railway stations maybe and maybe parking garages but it isnt a lot.

Also on that tap limit thing. That is normal as tap is treated different than apple pay. Most banks/merchants have low limits on tapping the card itself. iirc there isnt an actual codified limit in the US but most banks/merchants have it at like $100-120ish. here is a infographic for europe for example

As for US, I've tapped Amex for $3K before and it went through almost instantly.

For EU, my daughter took a trip that hit Germany, Italy, Switzerland, Austria and France. I AU'd her on my CSP and a Cap One MC for the trip, which worked pretty much flawlessly in all the above. Whether she tapped or chip'ed, I don't know.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Using Credit Cards in Germany and Switzerland

@swankytiger wrote:yea the merchants can have it set like they want, ie walmart not accepting it at all.

Yes, I charged one $5K transaction in the UK with no problem. The listed limits on taps really don't apply to mobile pay, presumably due to the additional authentication (With tap, you could have just found/stolen someone's card)