- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: What do you like about the Citi Double Cash Cr...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What do you like about the Citi Double Cash Credit Card? Is it worth it?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you like about the Citi Double Cash Credit Card? Is it worth it?

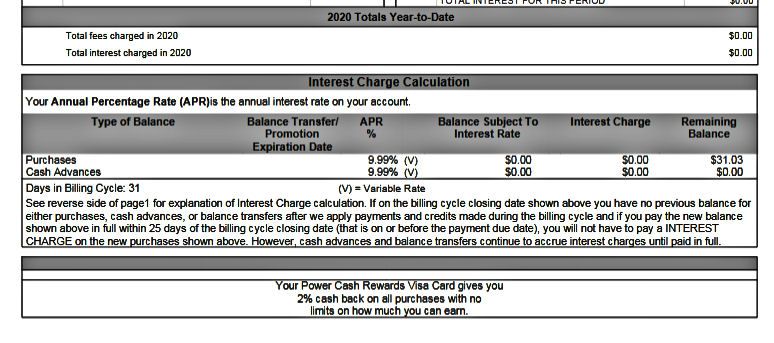

My PenFed Power Cash Rewards at 9.99% purchase APR

(Opened November 2019) ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$926K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you like about the Citi Double Cash Credit Card? Is it worth it?

@Anonymous wrote: Thank you for the links! I'm currently reading through these massive threads and I noticed a comment by @hzynneb that makes me question how long this card will be around for.

And I quote, "Feasibility of a 3% cash back card with average APR of less than 10% is another question. I doubt they will tolerate any form of MS or large spending compare to your income. Alliant, a much bigger credit union, was the first one to offer a 2.5/3% card I believe. They been shutting people down, and just recently put a 10k limit on monthly spent with $99 AF. So we’ll see how long this whole thing last. I just hope I get a card out of it by now…. "

I'm still going through the threads and will determine how much effort it would take me to get this card. So, it's the effort of acquiring the card, managing another CU account, and the risk that they may change the reward structure, put in spending limits, and/or add an annual fee in the future. But, I thank you for the reading material.

You're welcome! There have been naysayers about whether this card will "stick" for the long-term since it first came out. So far, coming up on a year and it's still chugging along! Never any guarantees, but no risk, no rewards right? Even if some aspects of the card are nerfed or curtailed, I think it still would be highly competitive in others. Even as just a low-fee, low-APR card, it's competitive with some of the offers from lenders like PenFed. Even if they capped the rewards at a dollar figure or lowered it to 2%, it would still be a solid card.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$926K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you like about the Citi Double Cash Credit Card? Is it worth it?

@Anonymous wrote:

@MrDisco99 wrote:I'll probably get the PPMC eventually as one of my end game cards.

I would love to know what everyones "end game cards" would be. I think many of us would benefit from that sort of knowledge. Can anyone look at my siggy and see if there's something I'm missing? My wife and I don't travel much, so that eliminates a bunch of travel cards.

Hmm, I think for most people the "end game cards" would include 1) a card that provides 2% cash back minimum on all purchases, unless you place high value in being in the Chase Ultimate Rewards and/or Amex Membership Rewards ecosystem for travel, 2) a card that provides at least 3% cash back/travel rewards on groceries*, 3) a card that provides at least 3% cash back/travel rewards on restaurants, 4) a card that provides at least 3% cash back/travel at gas stations, 5) a card that either provides 3% cash back/travel rewards on travel or provides a link to CUR, Amex MR, Citi ThankYou Rewards, or similar programs, and 6) one or more cards that provide 5% cash back on either quarterly rotating categories and/or pre-identified categories that you designate.

Some cards hit one or more of the above categories. For example, among no annual fee cards (the cards I tend to focus on primarily), the Wells Fargo Propel American Express provides 3% cash back/travel rewards on travel, restaurants, and gas, as well as streaming. The Chase Freedom Unlimited and Chase Freedom Flex provide 5% cash back on travel booked through the CUR portal and 3% cash back on restaurants (and drug stores), plus each card meets or sort of meets one of the other criteria above (CFU with 1.5% cash back on other purchases, the CFF with 5% rotating quarterly categories). These and cards that provide at least 3% cash back on categories that are big for you would be prime "end game cards". (For me personally, during non-COVID times I attend a lot of pro sports events and music concerts, so the Capital One SavorOne, which provides 3% cash back on entertainment, is a definite "end game" card.)

Using some of the cards above as examples, you could hit all six categories I identified in the first paragraph with just four no annual fee cards - the Chase Freedom Flex (categories 3, 5, 6), the Wells Fargo Propel (categories 3, 4, 5), many credit union cards (category 1), and the American Express Blue Cash Everyday (category 2). If you add either the Discover It cash card and/or the US Bank Cash+ card (or the latter's cousin, the Elan Financial Services Max Cash Preferred card), you could add additional category 6 cards.

*I just found out today that the Bank of the West Cash Back World Credit Card offers 3% on groceries, as well as restaurants and gas (i.e. it meets categories 2, 3, 4) and has no annual fee and no rewards cap, but it is only available in states where Bank of the West has branches.

Current credit cards:

American Express: Hilton Honors

Bank of America: Customized Cash Rewards Visa

Capital One: SavorOne MC

Chase: Amazon Visa, Freedom Unlimited Visa, Freedom Flex MC

Citi: Sears/ThankYou Rewards MC, My Best Buy Visa, Custom Cash MC

Comenity: AAA Travel Advantage Visa

Discover: Cash It

Elan: S&T Bank Max Cash Preferred Visa

FNBO: Amtrak Guest Rewards MC

PSECU: Founder's Visa

U.S. Bank: Cash+ Visa

Wells Fargo: Autograph Visa

Store cards: Kohl's

Next target credit cards: Wells Fargo Bilt Mastercard (probably), Truist Enjoy Travel Visa (maybe)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you like about the Citi Double Cash Credit Card? Is it worth it?

@Aim_High wrote:You're welcome! There have been naysayers about whether this card will "stick" for the long-term since it first came out. So far, coming up on a year and it's still chugging along! Never any guarantees, but no risk, no rewards right?

While I agree, USAlliance lasted about a year at 3%!

I guess people can do the calculation, there is a small cost in joining one of the needed orgs, + however you value your time. Then how long must the card last at 3% to overcome those costs compared to using a 2% card. (And any cost you associate with an HP and new account).

However, as @Aim_High has said, even if it nerfs to a 2% card, it's still pretty good with a low rate and low fees. Perhaps not one you would go out and get, but not a disaster. In contrast, the nerfed USAlliance is pretty useless, with a highish APR, FTF, and $25 increments.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you like about the Citi Double Cash Credit Card? Is it worth it?

I don't find *applying* to a Citi DC or a Paypal card appealing at all, unless needing an intro APR offer, without a SUB. To make up for a lack of a SUB takes so much uncategorized, non-MSR spend that it will never make up for it vs. a 1.5% (or even any 1%) card with a SUB, except for very high spenders that should already be applying for bigger SUB cards for as much of their spend as they can. Just get a card with a decent SUB. On 2% cards, Penfed and SDFCU have SUBs and Fidelity has in the past. Fidelity also has up to 3% everything on their card if you're rich. If choosing to PC to it, then the DC becomes much more interesting, e.g. a year after grabbing a Premier/Prestige with a good SUB.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you like about the Citi Double Cash Credit Card? Is it worth it?

I like my Citi Double Cash card, but it isn't a card that necessarily excites me and it certainly isn't the card that it used to be. For the most part, I like the Citi website as well as the Citi app. I don't mind the 1% now and 1% later rewards structure given it might make the card more sustainable in the long run. The $25 minimum redemption doesn't bother me given I don't want to be processing cash back every week anyway. Similarly, I don't care if my points expire after many months since I will be redeeming them every few weeks anyway.

However, what I don't appreciate is that I didn't get a sign-up bonus and the card has a foreign transaction fee. I can live with those two particular issues because I have had the card for a number of years at this point so I have earned a lot of cash back by using the card and I have other cards with no foreign transaction fees.

There are drawbacks in having and using the Citi Double Cash card, but I find them to be manageable. It is true that there is no shortage of 2% cards these days, however, I find their drawbacks to be far more limiting to me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you like about the Citi Double Cash Credit Card? Is it worth it?

@LowAPRsMoreRewards wrote:I don't find *applying* to a Citi DC or a Paypal card appealing at all, unless needing an intro APR offer, without a SUB. To make up for a lack of a SUB takes so much uncategorized, non-MSR spend that it will never make up for it vs. a 1.5% (or even any 1%) card with a SUB, except for very high spenders that should already be applying for bigger SUB cards for as much of their spend as they can. Just get a card with a decent SUB. On 2% cards, Penfed and SDFCU have SUBs and Fidelity has in the past. Fidelity also has up to 3% everything on their card if you're rich. If choosing to PC to it, then the DC becomes much more interesting, e.g. a year after grabbing a Premier/Prestige with a good SUB.

I have heard Citi is doing a SUB on the double cash in branch.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you like about the Citi Double Cash Credit Card? Is it worth it?

@Credit12Fico wrote:I have heard Citi is doing a SUB on the double cash in branch.

GTK, thx. That would make it much more appealing to apply (but still must weigh value of card vs. any others with more lucrative SUBs).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you like about the Citi Double Cash Credit Card? Is it worth it?

@LowAPRsMoreRewards wrote:

@Credit12Fico wrote:I have heard Citi is doing a SUB on the double cash in branch.GTK, thx. That would make it much more appealing to apply (but still must weigh value of card vs. any others with more lucrative SUBs).

Yep, not to mention many other 2% cards have atleast one Visa or Mastercard perk, whereas Citi has none. Doublecash used to be class leading in benefits. It is now a Paypal Mastercard in a poorly tailored suit. Even some of the Paypal cards (the World version) have cell phone protection!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you like about the Citi Double Cash Credit Card? Is it worth it?

@Credit12Fico wrote:Even some of the Paypal cards (the World version) have cell phone protection!

Thanks for the insight, a few months ago I was automatically upgraded to the "PayPal Cashback World Mastercard" and didn't think anything of it. Now that you mentioned it, I did some research and found that there is very little info on what exactly the "PayPal Cashback World Mastercard" gives in terms of benefits besides the occasional mention of "cell phone protection" from MyFico.com members.

Based on my own experience with the card, it got a new "look", they added the word "World" to it, and I'm sure they make a bit more $$ per swipe than with the basic MC. I wish PayPal took a hint from the Apple Card and Amazon Prime Visa Signature card and created a more aesthetically pleasing design -- I think the 2% cashback with no foreign transaction fees and no minimum redemption is worthy of a better look.