- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: What does Chase require for a card.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What does Chase require for a card.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does Chase require for a card.

Hi Everyone-

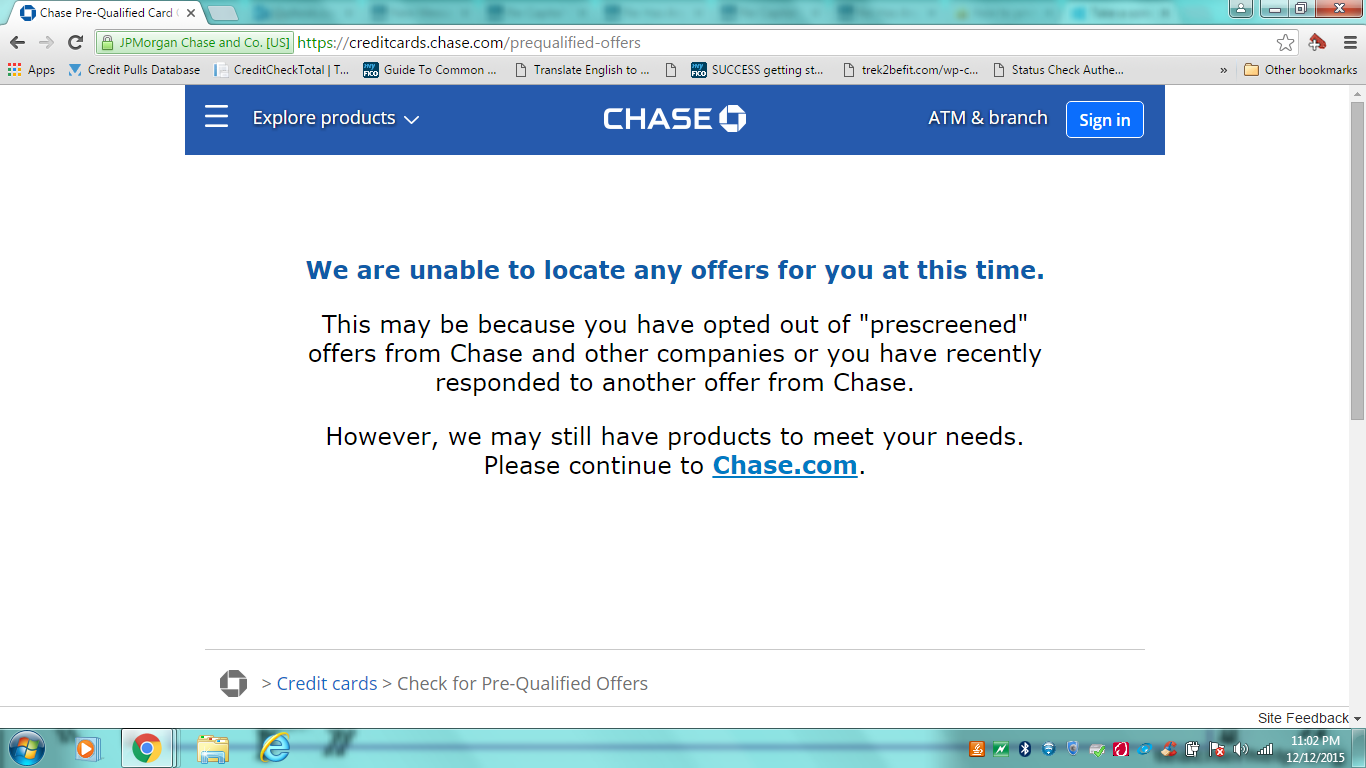

I check the Chase prequalify site at least once or twice a week and every time I check it is never showing me a card. It just gives me the message below.

I want to apply for one of their cards but want to see if I have a good chance of being approved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What does Chase require for a card.

A) do have any bad items on your CRAs ?

B) are you opted-out or had a fraud alert placed on your reports ?

C) are your reports frozen?

D) do you have more than 5 types of credit opened in the last 24 months?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What does Chase require for a card.

@Anonymous wrote:

A) do have any bad items on your CRAs ?

B) are you opted-out or had a fraud alert placed on your reports ?

C) are your reports frozen?

D) do you have more than 5 types of credit opened in the last 24 months?

A) do have any bad items on your CRAs ? Yes, on my Transunion report an account in collections since 2013 but trying to get it removed. A paid charge off on all three CRA's and just student loans.

B) are you opted-out or had a fraud alert placed on your reports ? I had one on there about a month ago but it was put on by CRA's and I had it removed last month.

C) are your reports frozen? No they are not frozen.

D) do you have more than 5 types of credit opened in the last 24 months? Yes

I was just approved for all of the cards you see below between August and November.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What does Chase require for a card.

You have 3 good cards, you should garden for a while and also get your scores little higher. Once you get rid of those baddies and have established some history Chase will give you a card or 2. Because you have about 5 or more new cards in past 2 years you will not be eligible for their non-branded cards but from I hear you may be eligible for their branded cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What does Chase require for a card.

Thanks, I guess gardening it will be hen lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What does Chase require for a card.

Sometimes people get opted out when a fraud alert is placed. Wouldn't hurt to opt in just in case (unless you have a collector you are worried about).

chase has a no more than 5 new accounts in 24 months rule on their sapphire, slate and freedom cards (although a few have been approved(

you are still eligible for their co-branded cards (United, Disney, etc) if your profile supports the UW of that particular card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What does Chase require for a card.

@Derrick1977 wrote:

@Anonymous wrote:

A) do have any bad items on your CRAs ?

B) are you opted-out or had a fraud alert placed on your reports ?

C) are your reports frozen?

D) do you have more than 5 types of credit opened in the last 24 months?

A) do have any bad items on your CRAs ? Yes, on my Transunion report an account in collections since 2013 but trying to get it removed. A paid charge off on all three CRA's and just student loans.

B) are you opted-out or had a fraud alert placed on your reports ? I had one on there about a month ago but it was put on by CRA's and I had it removed last month.

C) are your reports frozen? No they are not frozen.

D) do you have more than 5 types of credit opened in the last 24 months? Yes

I was just approved for all of the cards you see below between August and November.

Chase likes clean reports. I waited for my first card until all reports clear. That was the amazon visa. Since then, I got the freedom before the 5/24 rule. I now get that same screen, even with upgrade to signature. I would wait a year, try to goodwill the heck out of removing the paid charge offs, PFD the medical, then try for a co branded card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What does Chase require for a card.

Cool, thats exactly what I will do. I will definitely start gardening.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What does Chase require for a card.

I got a Chase Freedom with 2 charge offs (they were from 2013) and two collections on Experian. They also checked TU, which at the time had 9 medical collections and the two charge offs. Was instantly approved. Scores were in the low 600's. Also has a electric utility collection on both from 2012.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What does Chase require for a card.

@Anonymous wrote:I got a Chase Freedom with 2 charge offs (they were from 2013) and two collections on Experian. They also checked TU, which at the time had 9 medical collections and the two charge offs. Was instantly approved. Scores were in the low 600's. Also has a electric utility collection on both from 2012.

hi Donny, did you get the offer during the prequalify or did you just apply?