- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: What would you do

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What would you do

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would you do

I would get the Barclay Sallie Mae because you get 5% cashback on books/Amazon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would you do

Another one for Sallie Mae due to the awesome rewards, but if you are applying for American Express Blue Cash, it would be good to do it before the end of the year for the backdating.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would you do

@Anonymous wrote:

One more question . If You were gonna apply to 3 of the cards mentioned above , how would you do it ? All at the same time or spread them out ?

Barclays will pull TU and Chase and Amex will pull EX.

My suggestion: Apply for Sallie Mae, then Amex, and then Chase.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would you do

@Luscher wrote:

Chase Freedom, Discover IT, AMEX BCE, Sallie Mae. Any of those would be great choices

+1 for Chase and AMEX

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would you do

@Anonymous wrote:

One more question . If You were gonna apply to 3 of the cards mentioned above , how would you do it ? All at the same time or spread them out ?

I would do it this way. because I did it this way:

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would you do

Sorry can't quote you I'm on iPhone . So you basically waited a few months between apps ? You went on a mini spree when you first started .

Thanks everyone for your suggestions .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would you do

@Anonymous wrote:

@Anonymous

Sorry can't quote you I'm on iPhone . So you basically waited a few months between apps ? You went on a mini spree when you first started .

Thanks everyone for your suggestions .

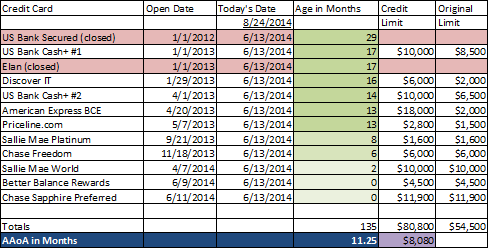

I went on 2 sprees of 3 cards each. At least 3 months between sprees. Just make sure you are picking good cards that you can actually use for the long term.

my AAoA was low anyways, so decimating it with lots of cards early on didnt matter as much as having all those cards now ageing together. I can apply for cards now and only lose about 1 month of average age per new card.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would you do

I would do it as a spree. Stop when you get rejected/credit limit is too low.

1) Sallie Mae. Groceries and Amazon every month would be great for you

2) AMEX BCE (although this will be redundent if you get Sallie Mae). I've lose my enthousiasm for AMEX, but its possible they have something decent in the future, and backdate could be useful.

3) Chase Ink. I'm going out on a limb and saying you have a cell phone and pay for it yourself, otherwise, skip this

4) Chase AARP. I ate out at restaurants, or at least pizza, once a week

5) Chase Freedom. Good signup fee, if you're elligible

6) CapOne QS, if you get a signup fee

7) Citi Double Cash

8) Discover IT

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would you do

@Anonymous wrote:I would do it as a spree. Stop when you get rejected/credit limit is too low.

1) Sallie Mae. Groceries and Amazon every month would be great for you

2) AMEX BCE (although this will be redundent if you get Sallie Mae). I've lose my enthousiasm for AMEX, but its possible they have something decent in the future, and backdate could be useful.

3) Chase Ink. I'm going out on a limb and saying you have a cell phone and pay for it yourself, otherwise, skip this

4) Chase AARP. I ate out at restaurants, or at least pizza, once a week

5) Chase Freedom. Good signup fee, if you're elligible

6) CapOne QS, if you get a signup fee

7) Citi Double Cash

8) Discover IT

I wouldn't try for 3 Chase cards at the same time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What would you do

Most of the suggestions above are great, but it also depends what you'll spend your money on and what you do even. I'm a college student as well and had some finance and consulting internships where I had to travel and my Amex SPG card helped me rack up a massive amount of points without truly spending a dime. So if you have the opportunity to travel (e.g. work or study abroad) a travel card would also fare nicely with a good cashback card or two.