- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Credit in the News

- Credit Karma will pay $3 million to users targeted...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Karma tricked customers into thinking they were pre-approved for credit cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Karma tricked customers into thinking they were pre-approved for credit cards

"The Federal Trade Commission on Monday ordered personal finance company Credit Karma to pay $3 million to customers the agency alleges were deceived into applying for products they weren't eligible for." https://www.cbsnews.com/news/credit-karma-federal-trade-commission-3-million-deceptive-claims/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Karma will pay $3 million to users targeted with false preapproved offers

Credit Karma tricked customers into thinking they were pre-approved for credit cards, FTC says https://www.cbsnews.com/news/credit-karma-federal-trade-commission-3-million-deceptive-claims

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma will pay $3 million to users targeted with false preapproved offers

And of course CK vehemently denies the claims. ![]()

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma tricked customers into thinking they were pre-approved for credit cards

Man Credit Karma could be such a great tool and is for a quick glance at your credit as a whole. But they really do weird things.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma tricked customers into thinking they were pre-approved for credit cards

Speaking of CK, I feel like the marketing of the Upgrade cards are deceptive. It should be more clear that you are not signing up for a standard credit card everyone would commonly know. Although I'm sure they covered themselves in the fine print.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma tricked customers into thinking they were pre-approved for credit cards

I've been critical of CreditKarma in the past and been heavily flamed for the effort; this revelation from the FTC comes as no surprise to me.

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma tricked customers into thinking they were pre-approved for credit cards

![]() this is my shocked face

this is my shocked face

FICO 5 ,4, 2 - 10/2023 FICO 8 - 10/2023 FICO 9 - 10/2023 FICO 10 - 10/2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma tricked customers into thinking they were pre-approved for credit cards

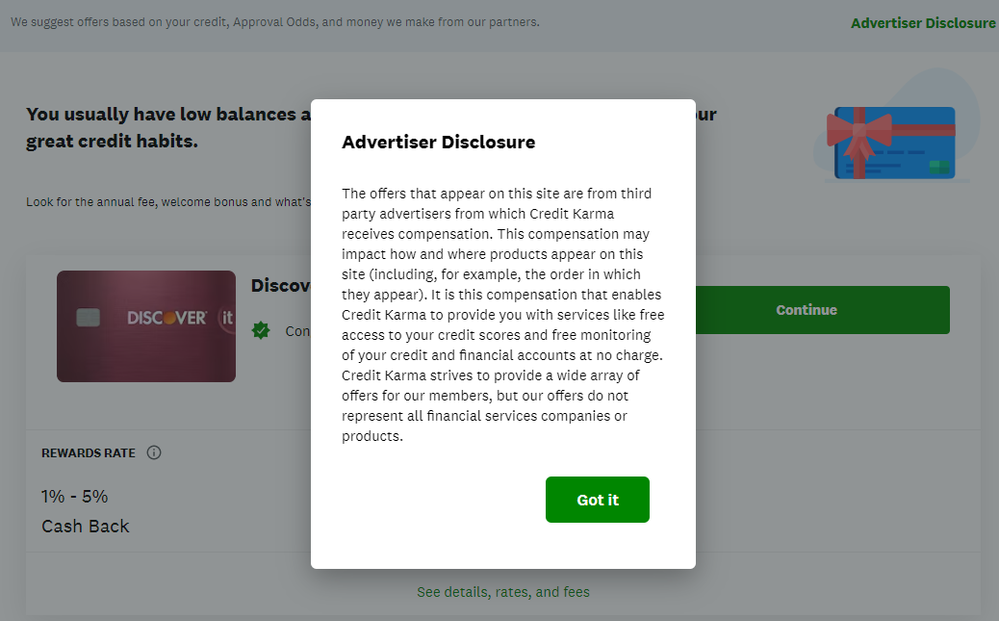

Upgrade is not the only shady thing they still have going - when I check my CK profile, they dress up arguably terrible cards from Credit One, Merrick, Mission Lane, etc and dress down nice cards from Citi, US Bank, Wells Fargo, and Amex. They have the Credit One Platinum rated the same as the Amex Platinum charge card, like excuse me what? They make the Citi Custom Cash look like one of the worst offerings available and slap "fair" approval odds on those nice cards, while decorating the subprimes with guarantee banners. OUTSTANDING odds for Mission Lane! Fair odds for the BCE that I actually got approved for.

That marketing is designed to scare you from apping for the prime cards and steer you to the predators licking their lips at the thought of having your money for their lunch. CK probably gets referral money to promote those and I don't recall if they disclose such relationships anywhere. So unethical...

__

Rebuilding, FICO 8s as of December 2024:

VS4: 703

VS4: 703

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma tricked customers into thinking they were pre-approved for credit cards

@DXness wrote:Upgrade is not the only shady thing they still have going - when I check my CK profile, they dress up arguably terrible cards from Credit One, Merrick, Mission Lane, etc and dress down nice cards from Citi, US Bank, Wells Fargo, and Amex. They have the Credit One Platinum rated the same as the Amex Platinum charge card, like excuse me what? They make the Citi Custom Cash look like one of the worst offerings available and slap "fair" approval odds on those nice cards, while decorating the subprimes with guarantee banners. OUTSTANDING odds for Mission Lane! Fair odds for the BCE that I actually got approved for.

That marketing is designed to scare you from apping for the prime cards and steer you to the predators licking their lips at the thought of having your money for their lunch. CK probably gets referral money to promote those and I don't recall if they disclose such relationships anywhere. So unethical...

Click on the "Advertiser Disclosure" link:

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma tricked customers into thinking they were pre-approved for credit cards

Well, my wish is "Gee, wouldn't it be nice to have an agency in charge of finning consumers for refusing to educate themselves, eating Tide pods, banning Kinder eggs because parents cannot bother with supervising their kids"

It's also very interesting how some can be pro and anti regulations at the same time depending on what's happening