- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- 2 questions about new accounts and inquiry codes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

2 questions about new accounts and inquiry codes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 questions about new accounts and inquiry codes

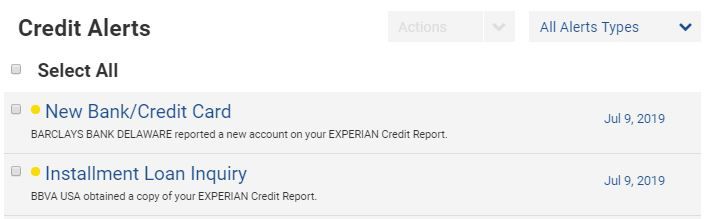

So, I applied for Barclays on 07/08/2019 and was initially denied, called back that day to talk to a credit analyst and they did a manual review and approved me. I got an alert on 07/09/2019 that there was a new account on my report with Experian and it was Barclays, thought it was a mistake. Log into Experian credit check this morning and yup its on my Experian report as of 07/10/2019. I don’t even have the account number or the credit in my hands yet, how is this possible?

So, with the attitude of since I’m doing a credit spree and Ill garden, I decided to take 1 more inquiry hit and applied for a BBVA CC; was denied. But the inquiry was coded as an installment loan inquiry? Anyone else have that experience with BBVA?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 questions about new accounts and inquiry codes

When a FI pulls a report, they request a certain score, mortgage, Auto, BankCard, or classic. Some banks use mortgage scores for everything. I think the inquiry is coded based on the type of score they request. However with credit unions all bets are off!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 questions about new accounts and inquiry codes

Yes, Barclays reports new accounts very quickly, usually the day after approval. And I also app'd for a BBVA card this week and approved. As I recall the inquiry alert said "installment loan" but as I look at my Experian report now it's coded as "BBVA USA All Banks - non specific".

EDIT: @Anonymous may have nailed it. My BBVA app this week was in branch, the teller really encouraged me to apply for a 2nd card, and after approval I asked her what my EX score was and she said 703, my Fico8 EX score is 715. And I checked and don't see a backdoor # for BBVA, if you can find a # or maybe call the # on the letter you'll receive to ask for a recon, they sure have been accommodating for me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 questions about new accounts and inquiry codes

Seems I had a higher credit score but only 1 card and like 4 inquries at the time than you Dave but that doesnt matter lol . I tried to call in to BBVA to recon since I had an approval with Barclays recon, rep stated that there was no recon with BBVA, Ill wait for the letter and see if there is a number, otherwise I am closing my BBVA checking account which is what I wanted to do anyways.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 questions about new accounts and inquiry codes

DaveInAZ did you notice which algorithm they used?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 questions about new accounts and inquiry codes

@Anonymous wrote:So, I applied for Barclays on 07/08/2019 and was initially denied, called back that day to talk to a credit analyst and they did a manual review and approved me. I got an alert on 07/09/2019 that there was a new account on my report with Experian and it was Barclays, thought it was a mistake. Log into Experian credit check this morning and yup its on my Experian report as of 07/10/2019. I don’t even have the account number or the credit in my hands yet, how is this possible?

So, with the attitude of since I’m doing a credit spree and Ill garden, I decided to take 1 more inquiry hit and applied for a BBVA CC; was denied. But the inquiry was coded as an installment loan inquiry? Anyone else have that experience with BBVA?

Yes I frequently see credit card related inquiries that are described as "installment loan inquiry". I don't know why.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 questions about new accounts and inquiry codes

@Anonymous wrote:Seems I had a higher credit score but only 1 card and like 4 inquries at the time than you Dave but that doesnt matter lol . I tried to call in to BBVA to recon since I had an approval with Barclays recon, rep stated that there was no recon with BBVA, Ill wait for the letter and see if there is a number, otherwise I am closing my BBVA checking account which is what I wanted to do anyways.

If BBVA denied the application due to credit reasons, they are not prone to reconsideration, unfortunately. Very rare would they reconsider and only *if* it's due to verification instances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content