- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- 3-in-1 credit report

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

3-in-1 credit report

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

3-in-1 credit report

Happy New Year everyone!

I am looking forward to 2018 because my bankruptcy will hit the 2 year mark on Jan 3rd and that means I can then be considered for a mortgage. I have been working this past year to improve my scores and am sitting nicely at 660+ (according to the MyFICO report I get each month) so that puts me well above the minimum requirements for my CU. I got my free credit reports late last spring but am thinking that I will pay for them here after the beginning of the year for one last peek because I want to start house hunting when spring rolls around and I want to see how they now look. I remember getting a 3-in-1 credit report years ago and I loved how convenient it was to look at and compare things so I thought if I was going to pay out of pocket anyway I may as well do it in that form. Is there any reason I shouldn't? Will I still be able to dipute inaccuracies okay if any snuck on or will it cause problems because I didn't get it directly from each CRA?

TIA for any tips or suggestions you might be able to share. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3-in-1 credit report

If you have the myFICO Ultimate product and are getting your mortgage scores every month, doesn't that mean you are getting a 3B credit report every month already? You talk about getting a 3B report "years ago."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3-in-1 credit report

Sorry that I was unclear. I do get the 3B report from MyFICO every month.

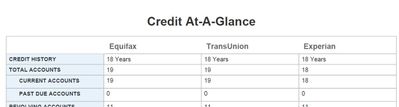

The report I got years ago was different, I got it from one of the actual bureaus (I don't recall which one but when I was looking to see if they still exist I did see one from Experian) and it seemed to have more details, similar to how my free reports from each of the 3 shows more. The main reason I was thinking of ordering one is because when I look at my 3B report on here each month, I keep seeing that I had a missed payment in the past month [image below] and that is what is holding my TU score down (beside the BK, of course) but I haven't had missed payment in years (rather than including all I will just include an image of the snapshot below). I look on the MyFICO 3B report and all of my accounts show green and nothing has been late, certainly not missed, so I thought maybe something was showing up at the actual bureaus and not here because I don't understand what it means when it says that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3-in-1 credit report

Yeah, I would certainly pull your true TU report and go over it with a fine tooth comb. Depending on what state you are in, that may be free, even if you already got your TU report from AnnualCreditReport.com < 12 months ago.

That negative flag seems to say that this most recent missed payment happened very recently ("0 months ago"). Is it possible that you have a loan that you think you are making on time payments to, but somehow the loan issuer or TU thinks you got behind on by a couple dollars a long while back, and therefore from that perspective you are always late each month?

Also worth exploring is pulling your credit reports from a couple other sources and see what they say. For example Credit Check Total offers a $1 trial offer that will give you a nice 3B report (you can cancel the offer the day after you get the report if you want).

Likewise WalletHub offers free daily TU reports. Karma offers weekly reports.