- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: 3-month Plan For Maximizing Score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

3-month Plan For Maximizing Score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3-month Plan For Maximizing Score

@Thomas_Thumb wrote:

@Jazee wrote:I need my score maximized in 3 months. Currently my Fico 8 is 737, TU 668, EQF 671. I have 4 credit card accounts (one of which is Amazon Store Card), 3 of the four credit accounts are about 3 years old and one is about 20 years old. An Auto loan 3 years into 5-year loan. No other debt accounts. 1 hard inquiry with removal date (according to Experian Sep 2024). No collections or charge offs.

The thing weighing the score down is just my credit uilization: 70%. I expect to be a 60% in 1 month, and 40-50% in another 3 months. Not buying a house this year.

The obvious answer everyone would of course respond with is pay off as much debt as possible. So I'm looking for things to do other than that to maximize my score in 3 months.

The only other slight weekness is my credit mix with no mortgage or personal loan. Yet my score is I think too low to apply for a personal loan and that's going to lower my average account age. My cards are with USAA, NFCU, and Amazon (Synchrony). The Amazon card is already $10K which it's almost always $0 balance or lower than 5% utilization. NFCU My Sig Card with the lowest APR is the majority of my debt with a $25K and 90% utilization, so that's not going up. I have another card with NFCU which is 70%

Note: Fico scores individual card utilization based on card with highest UT %.

This is a new fact for me. So for FICO, having a card ar $2k limit at 90% UTI and a card with $30k limit at 5% UTI worse to than having say 10% on the $2k and 25% in the 30k with much higher total UTI?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3-month Plan For Maximizing Score

@Jazee wrote:

@Thomas_Thumb wrote:

@Jazee wrote:I need my score maximized in 3 months. Currently my Fico 8 is 737, TU 668, EQF 671. I have 4 credit card accounts (one of which is Amazon Store Card), 3 of the four credit accounts are about 3 years old and one is about 20 years old. An Auto loan 3 years into 5-year loan. No other debt accounts. 1 hard inquiry with removal date (according to Experian Sep 2024). No collections or charge offs.

The thing weighing the score down is just my credit uilization: 70%. I expect to be a 60% in 1 month, and 40-50% in another 3 months. Not buying a house this year.

The obvious answer everyone would of course respond with is pay off as much debt as possible. So I'm looking for things to do other than that to maximize my score in 3 months.

The only other slight weekness is my credit mix with no mortgage or personal loan. Yet my score is I think too low to apply for a personal loan and that's going to lower my average account age. My cards are with USAA, NFCU, and Amazon (Synchrony). The Amazon card is already $10K which it's almost always $0 balance or lower than 5% utilization. NFCU My Sig Card with the lowest APR is the majority of my debt with a $25K and 90% utilization, so that's not going up. I have another card with NFCU which is 70%

Note: Fico scores individual card utilization based on card with highest UT %.

This is a new fact for me. So for FICO, having a card ar $2k limit at 90% UTI and a card with $30k limit at 5% UTI worse to than having say 10% on the $2k and 25% in the 30k with much higher total UTI?

Although IMHO @Thomas_Thumb is the most knowledgeable FICO student on the board, I would not accept his opinion as gospel on this point. In my own personal testing I found that the number of highly utilized accounts did matter. Specifically I was testing, in EX FICO 8, whether the number of > 50% accounts had a score impact, even though the accounts were at the same utilization level. And my conclusion was that reducing the number of > 50% accounts having identical utilization levels did in fact increase the EX FICO 8 score.

I didn't really understand your hypothetical above, but if you want to know is it better to have two 20% cards than one 35% card and one 5% card, the answer is yes.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3-month Plan For Maximizing Score

@Jazee wrote:

@Thomas_Thumb wrote:

@Jazee wrote:I need my score maximized in 3 months. Currently my Fico 8 is 737, TU 668, EQF 671. I have 4 credit card accounts (one of which is Amazon Store Card), 3 of the four credit accounts are about 3 years old and one is about 20 years old. An Auto loan 3 years into 5-year loan.

The thing weighing the score down is just my credit uilization: 70%. I expect to be a 60% in 1 month, and 40-50% in 3 months.

I'm looking for things to do other than that to maximize my score in 3 months.

My cards are with USAA, NFCU, and Amazon (Synchrony). The Amazon card is already $10K which it's almost always $0 balance or lower than 5% utilization. NFCU My Sig Card with the lowest APR is the majority of my debt with a $25K and 90% utilization, so that's not going up. I have another card with NFCU which is 70%

Note: Fico scores individual card utilization based on card with highest UT %.

This is a new fact for me. So for FICO, having a card ar $2k limit at 90% UTI and a card with $30k limit at 5% UTI worse to than having say 10% on the $2k and 25% in the 30k with much higher total UTI?

That's not exactly true. The card at 90% utilization does trigger a significant score penalty. In the 2nd case you have no score penalty associated with individual cards but cranking up the total balance will hurt. Fico looks at total balance in addition to aggregate utilization.

Aggregate utilization is an independent scoring factor. Let's look at case 1 based on constant balance with reallocation of funds and then a paydown with no reallocation.

In case 1 aggregate balance is $3300 resulting in an aggregate UT of 10.3% assuming only those 2 cards. Score penalty is significant. Keeping the same total balance, score would be higher by lowering the $2k card from $1800 to $500 (25% UT) and increasing the $30k card to $2800 (9% UT) from $1500 - same $3300 total balance.

Paydown strategy:

$3300 balance on $32k CL is 10.3%. Reducing AG UT below 9% should garner some points. Let's say you can make a $1000 payment. I would apply it all toward the low limit card with an $1800 balance. The new balance of $800 on a $2k CL drops Card UT to 40% , well below the 49% threshold. If the payment had been applied to the $30k CL card, a small score gain from lowering AG UT could be realized but, you would miss out on the added boost of dropping highest card UT from 90% to 40%.

A single card at 90% UT, either high CL or low CL is bad. Slay your beast! As a minimum, get your card under 89% to avoid a max out penalty. The next step would be under 69%.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3-month Plan For Maximizing Score

I would add that having an account remain at or near 90% might trigger balance chasing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3-month Plan For Maximizing Score

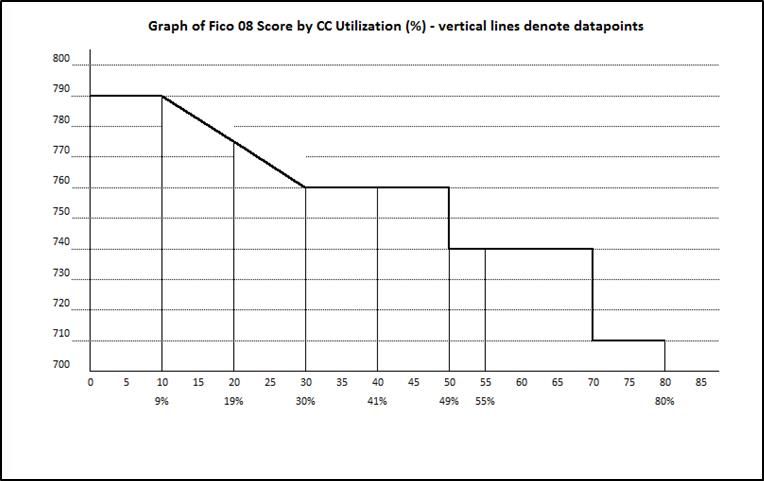

Here is a chart of utilization vs score for a 1 card test subject. The data was initially presented on a non Fico forum as a table. A member re-listed it on MyFICO back in 2015. Based on 1 card only, individual card utilization equals aggregate utilization. Actual data points provided at: 9%, 19%, 30%, 41%, 49%, 55% and 80%.

The data was converted to a graphical format to compare fit against previously identified 10%, 30%, 50% and 70% thresholds. It suggested there should be a potential step change threshold at 19% or a sloped region between 9% and 30%. The sloped version was chosen for the graph as being more likely. Based on a belief that utilization rounds up to the next highest whole number for scoring considerations and to add a margin of safety; UT threshold guidelines were established as 9%, 29%, 49%, 69% and 89%.

Areas of interest in the graph are between 9% and 30% where score declines (note 19% datapoint) followed by 30%, 41% and 49% where score is constant and 55% where it again dropped.

Additional note: aggregate utilization is weighed more heavily than individual card utilization.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3-month Plan For Maximizing Score

@SouthJamaica wrote:

@Jazee wrote:

@Thomas_Thumb wrote:

@Jazee wrote:I need my score maximized in 3 months. Currently my Fico 8 is 737, TU 668, EQF 671. I have 4 credit card accounts (one of which is Amazon Store Card), 3 of the four credit accounts are about 3 years old and one is about 20 years old. An Auto loan 3 years into 5-year loan. No other debt accounts. 1 hard inquiry with removal date (according to Experian Sep 2024). No collections or charge offs.

The thing weighing the score down is just my credit uilization: 70%. I expect to be a 60% in 1 month, and 40-50% in another 3 months. Not buying a house this year.

The obvious answer everyone would of course respond with is pay off as much debt as possible. So I'm looking for things to do other than that to maximize my score in 3 months.

The only other slight weekness is my credit mix with no mortgage or personal loan. Yet my score is I think too low to apply for a personal loan and that's going to lower my average account age. My cards are with USAA, NFCU, and Amazon (Synchrony). The Amazon card is already $10K which it's almost always $0 balance or lower than 5% utilization. NFCU My Sig Card with the lowest APR is the majority of my debt with a $25K and 90% utilization, so that's not going up. I have another card with NFCU which is 70%

Note: Fico scores individual card utilization based on card with highest UT %.

This is a new fact for me. So for FICO, having a card ar $2k limit at 90% UTI and a card with $30k limit at 5% UTI worse to than having say 10% on the $2k and 25% in the 30k with much higher total UTI?

Although IMHO @Thomas_Thumb is the most knowledgeable FICO student on the board, I would not accept his opinion as gospel on this point. In my own personal testing I found that the number of highly utilized accounts did matter. Specifically I was testing, in EX FICO 8, whether the number of > 50% accounts had a score impact, even though the accounts were at the same utilization level. And my conclusion was that reducing the number of > 50% accounts having identical utilization levels did in fact increase the EX FICO 8 score.

I didn't really understand your hypothetical above, but if you want to know is it better to have two 20% cards than one 35% card and one 5% card, the answer is yes.

My hypothetical was that UTI on one card is the most significant factor, then have lower total UTI with a very low limit card at very high UTI was worse than having a higher total UTI with no single card at a very high UTI. Your contention seems reasonable in that it makes a difference but a large difference in total UTI will outweigh the individual card UTI mix.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3-month Plan For Maximizing Score

Makes sense.

I'm testing a couple different new online banks as I'm not fully happy with mine. Grabbing a few extra bucks in the sign up bonuses in the process. One I gave a try is Chime. Don't plan on going with them as not a "real bank" in my opinion. Some interesting unique features though. One thing is they send all new account holders a secured Visa Credit card. This institution is very targeted at young customers trying to build credit. Was planning on just tossing and not activating the card. Is there any benefit to keeping and using it. Would be a hassle to keep refilling and using with any regularity so seems it would only lower my average account age.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3-month Plan For Maximizing Score

@Jazee wrote:Makes sense.

I'm testing a couple different new online banks as I'm not fully happy with mine. Grabbing a few extra bucks in the sign up bonuses in the process. One I gave a try is Chime. Don't plan on going with them as not a "real bank" in my opinion. Some interesting unique features though. One thing is they send all new account holders a secured Visa Credit card. This institution is very targeted at young customers trying to build credit. Was planning on just tossing and not activating the card. Is there any benefit to keeping and using it. Would be a hassle to keep refilling and using with any regularity so seems it would only lower my average account age.

If they issued it to you it will probably show up in your reports and affect your aging stats, whether you activate it or not.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682