- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

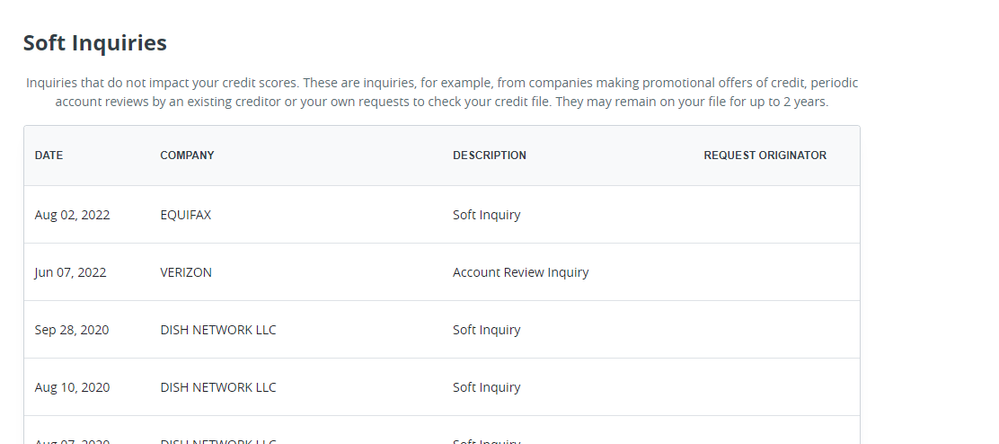

- Re: Account Review Inquiries?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Account Review Inquiries?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Account Review Inquiries?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Review Inquiries?

More than likely creditors/banks are performing soft inquiries/account reviews to see where customers are at with their finances. Some banks like Chase and AMEX these are routine especially after apps to make sure there are no red flags such as excessive credit seeking and so on. It makes sense with the current financial climate right now they would want to do these more often with their customers as a sort of...preventive measure if you will. You have nothing to worry about really if your scores are fine

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Review Inquiries?

Agree, it's a risk management process - companies want to know as soon as possible if their customers are maxing credit cards, filing BK, etc..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Review Inquiries?

Agree. Long story short they don't want to be the one left holding the bag if a customer has unexpected hardships financially

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Review Inquiries?

Ok thanks...so they dont want another 2008

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Review Inquiries?

@AzCreditGuy Are you a Verizon VISA cardholder? If not, they are soft pulling for potential pre-approval offers (for the card) to be made, either via pop-up when you are on the Verizon website(s) or via mailer. If you are a cardholder, its also possible they do at minimum a monthly review to provide a monthly credit score (likely Vantage).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Review Inquiries?

@Who_wuda_thought wrote:@AzCreditGuy Are you a Verizon VISA cardholder? If not, they are soft pulling for potential pre-approval offers (for the card) to be made, either via pop-up when you are on the Verizon website(s) or via mailer. If you are a cardholder, its also possible they do at minimum a monthly review to provide a monthly credit score (likely Vantage).

I am not a Verizon CC holder, I have been in the garden for almost 3 years and dont plan on getting new cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Review Inquiries?

Looks like they also occur when unsecuring a card as well. I received an AR from Discover right before they did a combo unsecure/CLI.

June 2022 FICO 8:

June 2022 FICO 9:

June 2022 FICO 10:

June 2022 FICO 10T:

Dec 2025 FICO 8:

Dec 2025 FICO 9:

Dec 2025 FICO 10:

Oct 2025 FICO 10T:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Review Inquiries?

Account review is nothing but an existing creditor checking current state of your finances. In this case, you aren't on pre-paid plan, Verizon is making sure you still meet eligibility for post-pay and/or equipment if applicable.

In a more traditional sense, lender is doing AR for the same reason. If you still meet criteria, business as usual. If not, CLDs, closures, and any other form of AA. They monitor our reports same way we monitor it (albeit not five times per day).

In addition to AR, most of them subscribe to various alert service (product sold by CRA) that alerts them if certain conditions are met. A new collection or late payment would be one example. Another example would be alert set as "Notify if utilization above XX%.

Those alert services is why things start cascading fast, even though it may look like lender didn't do SP since the change happened, they don't have to, CRAs are great at snitching.

The reason you see different names on SPs is to distinguish a purpose such as you pulling your report, credit monitoring service, existing account monthly/quarterly SP, you checking pre-approvals/prequals etc.

In a nutshell, it's just SP but description is used to tell you why it was performed.

I'm surprised you just noticed it, it's been like that since dawn of time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Review Inquiries?

Is it possible that the cards come with "Free Credit Scores", and the inquiries are the result of the cardholder clicking on the "Free Monthly Credit Score" button when logged into each respective card's website?

13Oct22 Exp F8: 812

13Oct22 Exp F8: 812