- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Alliant FCU Beware!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Alliant FCU Beware!! "Update"

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alliant FCU Beware!! "Update"

I have had my account since 2016 and just about a week ago I have fraud and someone used my account and tried to open up a loan and used my debit card. I called and told them it was fraud they did not close the debit card and sent me a new one. I called two weeks later and they said I allowed the debit card transactions and the loan. I said I have had my account since 2016 and I never used the debit card why would I start now? They said the money was lost and I asked to speak to fraud department and they said now asked for a leader and the leader said no. I told them to close the account I will go else were. I had a friend that had fraud an their account and they did not want to take care of it he got it done when kept pushing it. Mine was $10 so mine was not much but still. Everything with Alliant is very hard try getting a loan with them that's hard too. I took what was left ($500.00) and put it into DCU.

"Update"

They fixed the credit inq on my TU file and gave me back the money. No letters or anything. I called TU and they said it was removed it's horrible that what I went thru to try and get this done.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant FCU Beware!!

@Cory88 wrote:I have had my account since 2016 and just about a week ago I have fraud and someone used my account and tried to open up a loan and used my debit card. I called and told them it was fraud they did not close the debit card and sent me a new one. I called two weeks later and they said I allowed the debit card transactions and the loan. I said I have had my account since 2016 and I never used the debit card why would I start now? They said the money was lost and I asked to speak to fraud department and they said now asked for a leader and the leader said no. I told them to close the account I will go else were. I had a friend that had fraud an their account and they did not want to take care of it he got it done when kept pushing it. Mine was $10 so mine was not much but still. Everything with Alliant is very hard try getting a loan with them that's hard too. I took what was left ($500.00) and put it into DCU.

Sorry for your unfortunate experience![]()

I logged into check things out, my $4.00 in checking and $11.00 in Savings is still there.

Credit card remains untouched "Available Credit: $15,000.00"

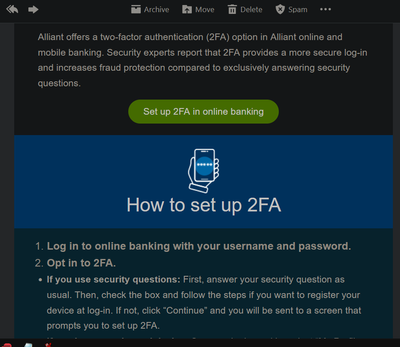

I'm guessing they have had some problems, as I got a warning "Beware" upon log-in;

I also received an email today.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant FCU Beware!!

Dont ever activate my debit cards other than my primary bank and always keep your reports locked. Sorry to hear this has happened to you, but least sounds like a trivial amount lost

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant FCU Beware!!

@CreditCuriosity wrote:

Dont ever activate my debit cards other than my primary bank and always keep your reports locked. Sorry to hear this has happened to you, but least sounds like a trivial amount lost

It was a small amount but not even willing to help. They said they sent letters to me but never got them. Me and a friend had always issues with disputes and when he did a loan it was a nightmare.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant FCU Beware!!

@Cory88 I find Aliant's responsible completly wrong and should never have happened. Any bank or CU should have closed that card in a heart beat. Report that issue to the CFPB and the FTC . Scratch Alliant off my list credit unions. Also set up your accounts to get as much as possible elctronically.

Here is a link to the FTC about debit cards.

https://consumer.ftc.gov/articles/lost-or-stolen-credit-atm-debit-cards

Discover IT 09/90, 19000, JC Penney 10/2008 4700, US Bank Cash 08/2010 12,000 Citibank Custom Cash 5/2015 11,100 State Dept. FCU 20,000 06/2023 , 02/2024 Redstone FCU Signature VISA 10,000 08/23/2024 Langley FCU Signature Cash Back Visa 10000

Bank: Ally Bank Credit Unions: Lafayette FCU Fortera FCU State Department FCU Pelican State CU Redstone FCU Hughes FCU, LangleyFCU

My personal blacklist Bank of America Synchronny Bank Wells Fargo Capital One TD Bank Comerica Bank

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant FCU Beware!!

Choosing not to "activate" a card doesn't guarantee it won't actually work for transactions. It's more a confirmation that you got the card but a lot of them will still be active anyway.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant FCU Beware!!

I've left one or two deactivated, but only because that the FI didn't provide a way to lock the card.

Given that activation is part of the process, demonstrates intent to use or not, it may give the card holder some additional defense if confronting the FI about fraudulent activity on a card which was never activated.

I've gotten in the habit of asking about debit and credit card locking and any automatic cancellation that may occur after a debit card remains dormant for a long time. Rejected a few debit cards for those reasons.

Probably best to just cancel any useless debit cards - also would avoid automatic renewal cards.

[2020-12-09]=[EQ8|786]-[TU8|746]-[EX8|772] .... gardening until I can't (again).

[2023-10-01]=[EQ8|797]-[TU8|776]-[EX8|775]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant FCU Beware!!

@M_Smart007 The banks in an article I read spent over 4 billion dollars on fraud. First in having the computer systems block the obivious fraud.Secondly sending an alert if the account is setup for a possible fruadulant transaction. The third part of the spending is trying to recover the money that was taken by fraud. No amount of spending by the banks is going to stop a consumer from tapping on link in a text message "from the bank" or clicking on a link in a email. So banks and credit unions will put out warning message(s) to try to prevent the fraud in the first place. Then their is the fraud phone calls some one representing themselves as from the consumers bank. The fraudster says some amount money was deposited into your account in error and needs your help to return it back. If you look at the account the fraudster is referring to yes there is a larger amount in that account. The fraudster was already able to hack into your on line banking and made a transfer from another of the consumers account to the account it question. The ways and means fraudsters have of separting a consumer from their mney never ceases to grow. Why do they these type of scams it is simple because it works all too well. The bank or credit union ends spending time in trying to get the money back.

Discover IT 09/90, 19000, JC Penney 10/2008 4700, US Bank Cash 08/2010 12,000 Citibank Custom Cash 5/2015 11,100 State Dept. FCU 20,000 06/2023 , 02/2024 Redstone FCU Signature VISA 10,000 08/23/2024 Langley FCU Signature Cash Back Visa 10000

Bank: Ally Bank Credit Unions: Lafayette FCU Fortera FCU State Department FCU Pelican State CU Redstone FCU Hughes FCU, LangleyFCU

My personal blacklist Bank of America Synchronny Bank Wells Fargo Capital One TD Bank Comerica Bank