- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Authorized User

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Authorized User

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Authorized User

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized User

@Anonymous wrote:

Ive been working on my credit for about 5 months... its going great but whats holding me back is my credit age... if you have NOONE at all in family with good credit... how do I increase my credit age? This is really stressing me out... i want to buy a home at the turn of the year... TY

Once you have a credit card or loan in your name, the age of your credit increases monthly. Also, if you apply for new credit, the age decreases.

Being added as an AU will not help when you apply for a mortgage. Lenders need to see credit in your name so they can determine how you handle your credit responsibilities. The reason being an AU in this instance doesn't help is because the AU is not responsible for the debt.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized User

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized User

@Anonymous wrote:

So basically, I will have to wait 1 year to have enough credit age in order to apply for mortgage?

Sometimes some lenders may accept other things like history of rent, utility payments, cell/phone payments, etc.

To give us a better picture of where you're at, can you provide us with some more datapoints:

- name of credit cards, loans, etc., in your name

- income (employment or self-employment)

- credit limit on each and outstanding balances

- dates accounts opened

- any baddies (lates, BK, judgement/liens). If yes, please provide dates and/or whether 30days, 60days, 90days late

- any returned checks or NSF fees

This will allow us to give you more specific info and guide you in the right direction

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized User

However, because mortgages are manually reviewed, UWs will know the inflation is somewhat artificial.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized User

I will be applying for a mortgage within the year or so and my lender that work with on some real estate deals I do, recommened that I get put on a AU card, while not all lenders are the same, I trust my lender. I would like to see some experiences had from others before giving up your opinions on the matter, I have been seeing this on the board a lot lately, some opinions that could deter a persons credit direction.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized User (Update)

Just got off the phone with Experian, the AU account has been added as of today. Transunion is garbage and still refusing even after giving them documents that prove the AU account is valid.

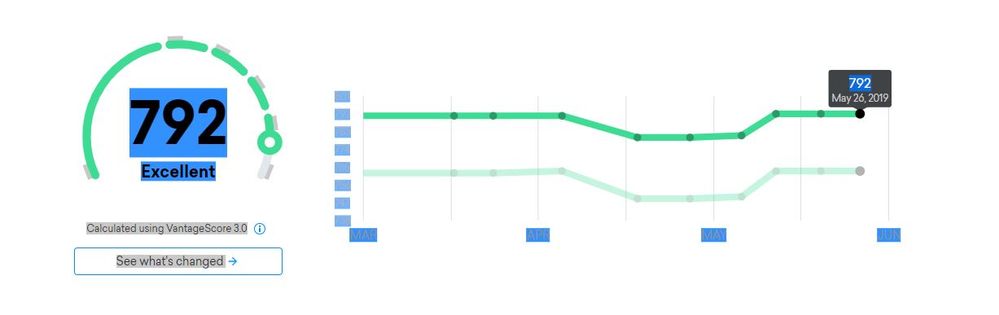

Below is a snapshot of Vantage which I know is useless but presents the scores as Equifax showing the AU account (792) and Transunion not showing AU account (763)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized User (Update)

Here are my Experian Vantage scores with the AU not showing up as well (763) I expect this to bump up to 793, again I know these scores are useless but they show how a AU account can help out and it will on my Fico scores