- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Authorized users on credit card and credit bas...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Authorized users on credit card and credit based insurance scores

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized Users on cards and credit scores

"Not sure how AU accounts factor into the various CBIS models. The 3 may count against her and the 1 against you as additional new accounts."

Is there a way to find out?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized Users on cards and credit scores

Not specifically. LN does publish a complete list of negative reason codes. Unfortunately, I don't recall the list specifically making any reference to AU accounts. You can and probably should get a copy of your LexisNexis report. They stopped providing consumers with scores after 2018.

BTW - any open accounts that are closed can still count against you. They have to be removed from your credit file. LexisNexis uses information from Equifax as well as some of their own.

A couple important points regarding CBIS and insurance:

1. Many insurance companies (such as State Farm) don't pull new CBIS scores for existing customer renewals. Only if policy is changed. At one point I went insurance shopping and was quoted much lower rates thru AAA vs SF whom I had been using for decades. I was informed SF was using a CBIS score rating from when my policy was originally written. My agent had to submit a signed document from me requesting a CBIS rerate. My quoted premium dropped considerably after the rerate.

* Bottom line - if you aren't changing your policies they likely won't pull and rerate you based on an updated CBIS.

2. There are insurance companies in every state that don't consider CBIS when determining premiums. You may want to search for some and get quotes for comparison.

Again, terminating AU status does not necessarily delete the account from your report. New accounts that are closed but on your report may factor into # of new accounts for CBIS.

Also, I've read some posts on MyFICO mentioning the primary cardholder needs to terminate an AU account. The designated AU can dispute the account's presence on their EQ report once terminated/closed.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized Users on cards and credit scores

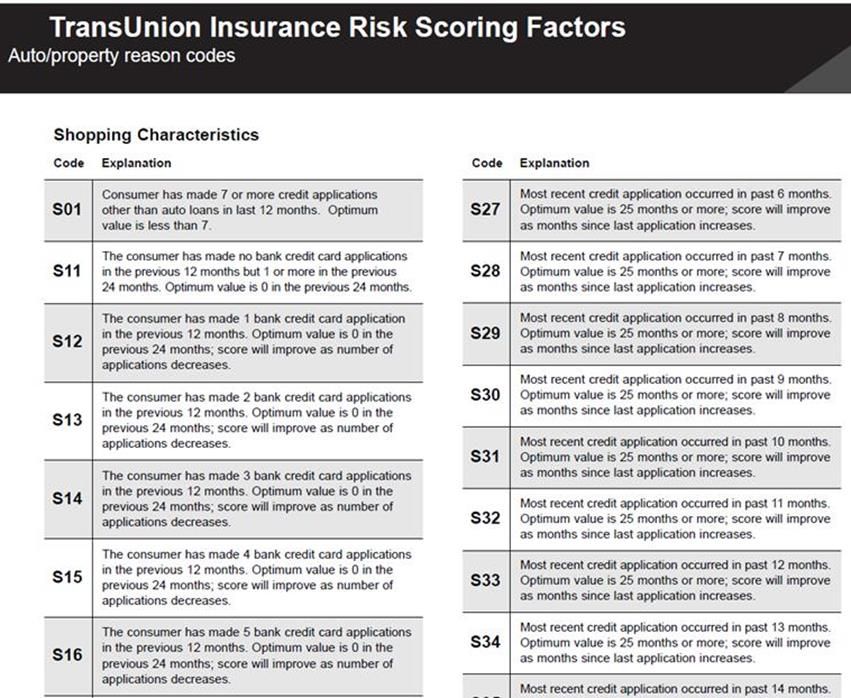

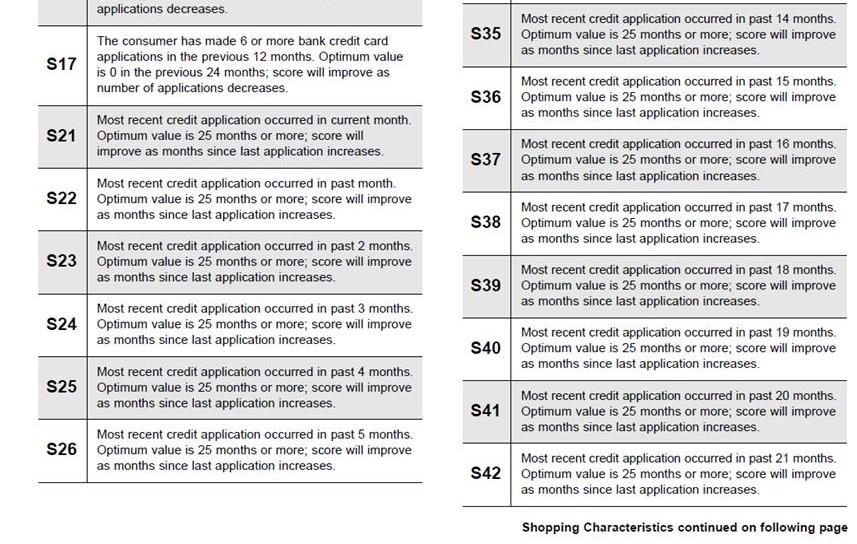

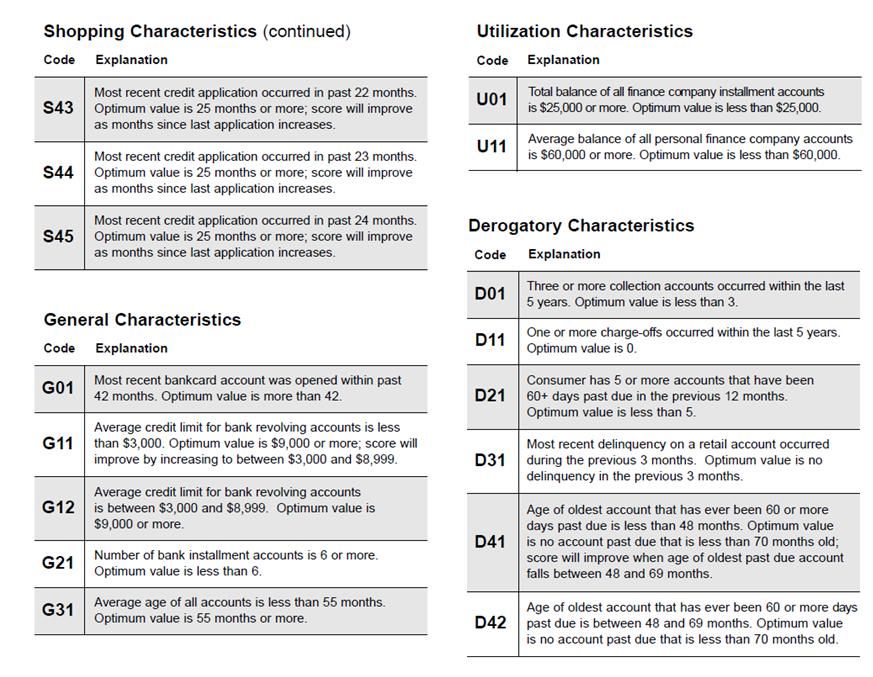

I found this in an old thread about CBIS.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized users on credit card and credit based insurance scores

Your Fico credit scores are likely to drop 20-30 points due to new accounts under 12 months age and the associated HPs. Your CBIS scores (which you likely don't have access to) could drop up to 50 points.

Note:

I believe there is a similar posting by the OP in the credit card topic forum.

A moderator should review both and somehow merge this thread with the one in CCs. Perhaps move the other thread over here to general credit since the focus is on new and AU accounts impacting Fico and CBIS.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized Users on cards and credit scores

Mods - Suggest moving this thread to the general credit topic board. Focus of discussion is impact of new/AU accounts on CBIS and Fico scores.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized users on credit card and credit based insurance scores

Yeah, I wasnt really sure where to put it and when this one got no responses I thought it was posted in the wrong forum.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized users on credit card and credit based insurance scores

@Ignatius_Reillyfloridablue wrote:Hello everyone, this is my first post.

I have what may be a confusing question.

I recently opened some new credit cards (an Amex Green and Gold and a Chase Freedom Flex).

I have excellent credit

FICO 822,

Vantage Score 3 819

Equifax 825

I added my wife as an authorized user on all 3 cards.

She recently opened a Chase Sapphire Preferred and added me as an authorize user.

Can anyone explain whart being added as an authorized user will do to

A. Your credit score and credit report?

B. What it will do to our credit based insurance score? I had never even heard of a credit based insurance score/report until after I opene the cards. I understand that the new cards themselves will hammer my insurance score, but whart will being listed as an authorized user do?

I have also read on here that it is possible to be removed as an authorized user on Chase cards and have it removed from your credit report, but have read that Amex can be more difficult.

Do authorized users even affect these reports? And if so, is it worth it to now have them removed?

Hello, @Ignatius_Reillyfloridablue

Can you please tell me if your query is solved or not BCZ I was facing a similar issue so need information?

Best Regard,

diana658h

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized users on credit card and credit based insurance scores

No its not solved in the sense of how exactly AU's affect insurance and credit scores. I have decided that I am going to remove all but one of the authorized user accounts/cards and then see what shows on credit reports. Thats really the only thing i can do at this point and then let time take care of any damage done.

Honestly Im not even worried about our "regular" (FICO, Vantage 3 etc.) credit scores, but am worried about the CB insurance scores.

I think I will leave my wife as an AU on one of the Amex cards and thats it. And Ill remove myself from the Chase Sapphire.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized users on credit card and credit based insurance scores

All Authorized users are removed. Will update in the future with what happens on our credit reports.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Authorized users on credit card and credit based insurance scores

That's probably for the best. Looking forward to seeing if they automatically drop off your credit reports. I suspect not.

You both are still going to have new accounts are associated HPs on file which will drop CBIS. The good thing is scores are not updated for renewals. In 2 years, if no further new accounts or HPs, request a rerate using an updated CBIS.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950