- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: BillMeLater (BML)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

BillMeLater (BML)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BillMeLater (BML)

Hopefully this is just a scam, but on the off chance I actually DID forgot to pay this off back in 2009, is this going to hurt my credit even though it would be way past 7 yrs of the DoFD? Why has there been zero collections attempts until now and nothing in my credit report at all about this credit line? Will it start to report on my CR?

I'm hoping someone could shed some light, it's taken me a long time to rebuild my credit and I don't want this to destroy my progress.

2018 EQ: 547

2018 EX: 539

2019 TU: 685

2019 EQ: 690

2019 EX: 685

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BillMeLater (BML)

That particular debt collector is well known for buying and trying to collect on zombie debt. There should be something on the letter that states the account is too old to be reported or something similar. If it does, you can just disregard it as long as you are past your state statute of limitations as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BillMeLater (BML)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BillMeLater (BML)

2018 EQ: 547

2018 EX: 539

2019 TU: 685

2019 EQ: 690

2019 EX: 685

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BillMeLater (BML)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BillMeLater (BML)

@Anonymous wrote:That particular debt collector is well known for buying and trying to collect on zombie debt. There should be something on the letter that states the account is too old to be reported or something similar. If it does, you can just disregard it as long as you are past your state statute of limitations as well.

+1

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BillMeLater (BML)

@FicoMiko wrote:

I'm not seeing anything on it that says it is too old to collect? It is definitely passed the state SOL too. So you're saying they cannot put it on my CR in collections?

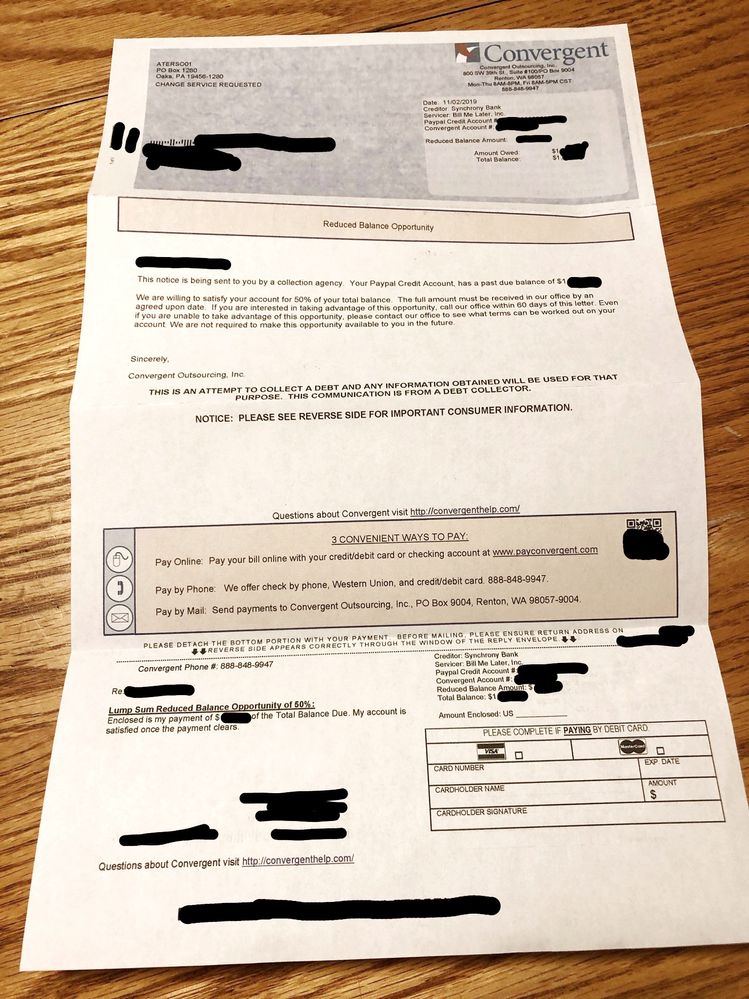

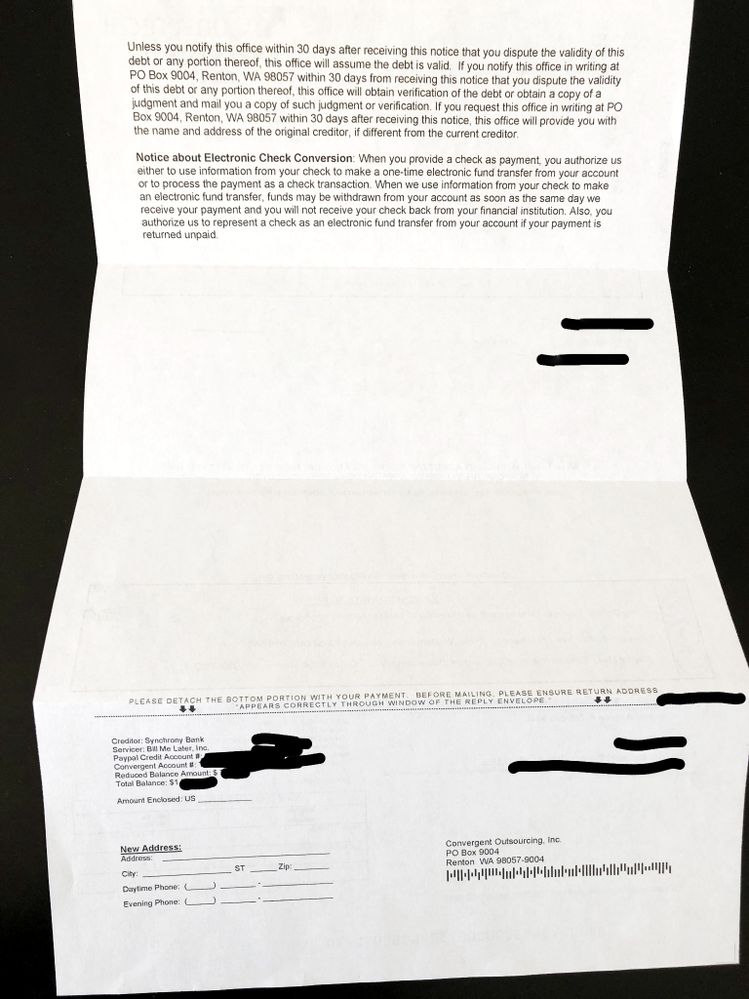

Can you post a copy of the letter (ID crossed out)?

Also, if you're not 100% sure of last payment date, DOFD, or SOL, you can always send a letter by "certified--return receipt mail" denying the debt and requesting dicumentation/verification that the debt is even yours.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BillMeLater (BML)

@CreditInspired wrote:

@FicoMiko wrote:

I'm not seeing anything on it that says it is too old to collect? It is definitely passed the state SOL too. So you're saying they cannot put it on my CR in collections?Can you post a copy of the letter (ID crossed out)?

Also, if you're not 100% sure of last payment date, DOFD, or SOL, you can always send a letter by "certified--return receipt mail" denying the debt and requesting dicumentation/verification that the debt is even yours.

Exactly, do NOT pay, do NOT acknowledge, paying even a penny right now will bring the entire zombie debt back to life and put you in legal bind.

https://www.wikihow.com/Deal-with-Zombie-Debt

Send certified letter ask for proof you own the debt. Even if you do, it already pass the date when you are legally bound to pay.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BillMeLater (BML)

2018 EQ: 547

2018 EX: 539

2019 TU: 685

2019 EQ: 690

2019 EX: 685

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BillMeLater (BML)

Hopefully the pictures above help! I don't know when the DoFD is but I'm pretty sure the listed debt is much higher than what the original debt was. Meaning, if I didn't pay then I must have not paid since the beginning?

2018 EQ: 547

2018 EX: 539

2019 TU: 685

2019 EQ: 690

2019 EX: 685