- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Can I do This Without Adverse Action?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Can I do This Without Adverse Action?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can I do This Without Adverse Action?

I do have a decent card with a credit union 5k limit not the highest but they wont go much higher. I was really happy to get the opportunity though. I agree with the Lending Club idea I got one of their loans to pay off higher interest installment loan. I don't have much experience with peer to peer lending one thing I did not like was the hefty fee they witheld before you get the money. The fee seems ok to begin with........but the payoff is immediately a lot more than the original loan which is also another hiden fee IMHO.

Starting Score: EQ 680 EX 731 TU 697

Starting Score: EQ 680 EX 731 TU 697Current Score: EQ 742 EX 752 TU 743

Goal Score: 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can I do This Without Adverse Action?

I dont have any high utilization on revolving credit.

I would love to get in the NFCU it seems I cant get in and I dont know any members.

I still dont know why my score seems to be held down just enough for approvals at much higher rates. I just checked my fico scores today and it makes no sense the highest score lost a few points. the other two gained. It is only a matter of time that the other two will be lowered as well.It has been like this for years. the score will gain 6 points then lose 4. Gain 4 then lose 6.the score does not improve much.

Starting Score: EQ 680 EX 731 TU 697

Starting Score: EQ 680 EX 731 TU 697Current Score: EQ 742 EX 752 TU 743

Goal Score: 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can I do This Without Adverse Action?

I did get the AMEX..... I was so excited about it! Started with a good limit 8100. I think it will help me. Initially, I had credit cards I never used and the accts were closed. I only had one mortgage and a car loan. It was like that for years and I paid cash for everything. I was told I needed credit cards to have a healthy credit history. My score never seemed to go over 670. Just enough to pay the highest interest and fees on everything. My utilization is really good It is usualy between 5 and 20% Once it was at 45% but only for a month during an emergency.

Starting Score: EQ 680 EX 731 TU 697

Starting Score: EQ 680 EX 731 TU 697Current Score: EQ 742 EX 752 TU 743

Goal Score: 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can I do This Without Adverse Action?

The score was the same even before the derog it happened 14 months ago but 5 years prior to that every payment made on time. It took me a while to find out what "GW" meant. I sent a letter to the CEO and a rep called and made a few promises. They will not make good on her promises, I will need to get an attorney.

If the accounts are not on my credit report ..I would assume they have been deleted. How could anyone be mistakened about that? They are either on the report or not on the report.

Starting Score: EQ 680 EX 731 TU 697

Starting Score: EQ 680 EX 731 TU 697Current Score: EQ 742 EX 752 TU 743

Goal Score: 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can I do This Without Adverse Action?

Thank you ...its true. They are sometimes deleted. I didnt know that would happen. Until recently, I didnt know it would count against me.

I have memberships at all CRA's and a 4th with myfico. In fact, thats where I got all of my credit advice before I found this forum. Some of their advice makes little sense.

Example: One says my score is lower because banks like to see a good mixture of types of credit. I dont know how I could be any more diverse 3 mortgages in good standing; several car loans never missed a payment, credit cards with low utilization. Again my scores lose 3-8 points for no apparent reason and any ground I pick up this month will be taken away next month. As a result, 2 years of perfect payments will still have scores in the same range. A pessimist's prediction but really close to my reality.

Starting Score: EQ 680 EX 731 TU 697

Starting Score: EQ 680 EX 731 TU 697Current Score: EQ 742 EX 752 TU 743

Goal Score: 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can I do This Without Adverse Action?

@stillirise wrote:Thank you ...its true. They are sometimes deleted. I didnt know that would happen. Until recently, I didnt know it would count against me.

I have memberships at all CRA's and a 4th with myfico. In fact, thats where I got all of my credit advice before I found this forum. Some of their advice makes little sense.

Example: One says my score is lower because banks like to see a good mixture of types of credit. I dont know how I could be any more diverse 3 mortgages in good standing; several car loans never missed a payment, credit cards with low utilization. Again my scores lose 3-8 points for no apparent reason and any ground I pick up this month will be taken away next month. As a result, 2 years of perfect payments will still have scores in the same range. A pessimist's prediction but really close to my reality.

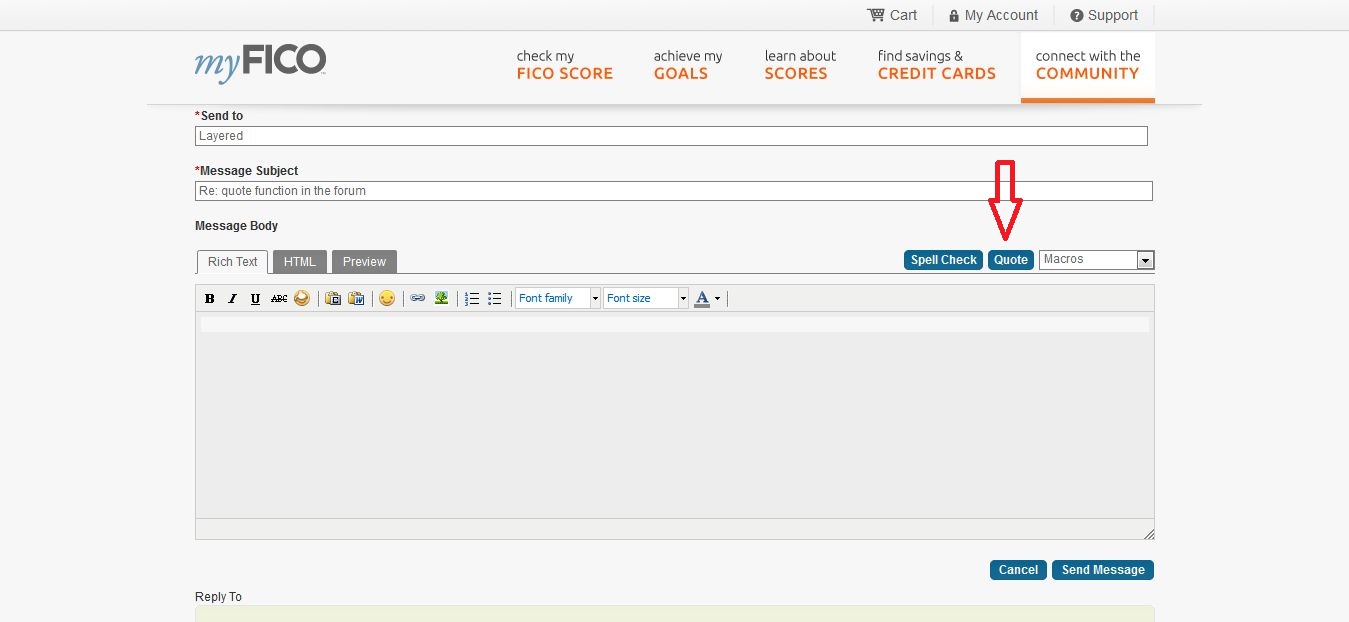

Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the Spell Check button -- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can I do This Without Adverse Action?

@09Lexie wrote:

@stillirise wrote:Thank you ...its true. They are sometimes deleted. I didnt know that would happen. Until recently, I didnt know it would count against me.

I have memberships at all CRA's and a 4th with myfico. In fact, thats where I got all of my credit advice before I found this forum. Some of their advice makes little sense.

Example: One says my score is lower because banks like to see a good mixture of types of credit. I dont know how I could be any more diverse 3 mortgages in good standing; several car loans never missed a payment, credit cards with low utilization. Again my scores lose 3-8 points for no apparent reason and any ground I pick up this month will be taken away next month. As a result, 2 years of perfect payments will still have scores in the same range. A pessimist's prediction but really close to my reality.

Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the Spell Check button -- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

![]() doh!

doh!

thank you good looking out...![]()

Starting Score: EQ 680 EX 731 TU 697

Starting Score: EQ 680 EX 731 TU 697Current Score: EQ 742 EX 752 TU 743

Goal Score: 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can I do This Without Adverse Action?

@RobertEG wrote:Yes, sometimes creditors will simply delete closed accounts with no balance, causing loss of their age in your AAoA, and possibly also your oldest acct.

Closed accts are still included in AAoA, but you have no control over possible deletion of the acct.

It's prudent business on their part, as they no longer need to maintain their reporting, or entertain any possible disputes should there, for example, be old derogs under the account. Housecleaning.

However, if you simply dont close them, but rather use them sporadically and pay them down to a small amount or to $0, they wont delete the account.

By keeping it open, you would also retain an indivicual revolving with low % util, or if paid to $0, also, improve your %cards with balance. As mentioned, FICO scores both the % util on individ accts and the % accts with balance.

The only reason I would close the higher APR cards is if they carry an annual fee that you wish to avoid.

At least that would avoid the double hit on AAoA, with the addition of an acct at 0 age, and the loss of an acct with age higher than your current AAoA.

Thank you ...its true. They are sometimes deleted. I didnt know that would happen. Until recently, I didnt know it would count against me.

I have memberships at all CRA's and a 4th with myfico. In fact, thats where I got all of my credit advice before I found this forum. Some of their advice makes little sense.

Example: One says my score is lower because banks like to see a good mixture of types of credit. I dont know how I could be any more diverse 3 mortgages in good standing; several car loans never missed a payment, credit cards with low utilization. Again my scores lose 3-8 points for no apparent reason and any ground I pick up this month will be taken away next month. As a result, 2 years of perfect payments will still have scores in the same range. A pessimist's prediction but really close to my reality.

Starting Score: EQ 680 EX 731 TU 697

Starting Score: EQ 680 EX 731 TU 697Current Score: EQ 742 EX 752 TU 743

Goal Score: 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can I do This Without Adverse Action?

I posted this back in January. Here is an update: I was pretty excited about the info I found on this board. I can't descibe the frustration I felt because my score seemed stuck for years.

I Applied for the Amex and got it...since then I also got the 61 day CLI not 3x but enough to make me happy.

I also went for the BoA low balance card got that one with a 12K limit.

Got a prequal letter for Sams Discover...did not take it really low limit. However, I really wanted a Discover card someone in here told me the Sams card wasnt a real Discover card.

I went to the Discover website and......I got the Discover card!

Woohoo!

I know my AAoA is now down. Yet my utilization is easier to hold in place with more available credit.

My credit score is doing what it usually does it flaps up and down in the same area no real gains there. If I do anything wrong though.....it crashes to the dirt.

I feel like Im building a house of (credit) cards....trying to do everything just right and not topple it over.

Thanks to all of you for your valuable input...it is greatly appreciated.

Starting Score: EQ 680 EX 731 TU 697

Starting Score: EQ 680 EX 731 TU 697Current Score: EQ 742 EX 752 TU 743

Goal Score: 800

Take the myFICO Fitness Challenge