- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Credit Report Data - Accuracy and Debt Collection ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Report Data - Accuracy and Debt Collection and Negatives

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Report Data - Accuracy and Debt Collection and Negatives

I used to be on this site years ago, I was a bit dismayed - and honestly taken aback by some feedback provided to me.

But - now, a bit older and wiser, I have decided to come back, and then share what I have learned and on my journey in Credit Reporting, and specifically the Metro2 specs that I have finally - been able to find, and make some sense of.

While I am not an attorney, credit counselor or credit repair guru - I am a bit of a techie who loves data.

I do not advocate for anyone - not to pay their bills.

I instead believe that life happens to us all - and when we fall down, please make sure you get the facts and reporting correct about me, and for that matter us all. No shaming in/on this thread for someone or anyone - owing money.

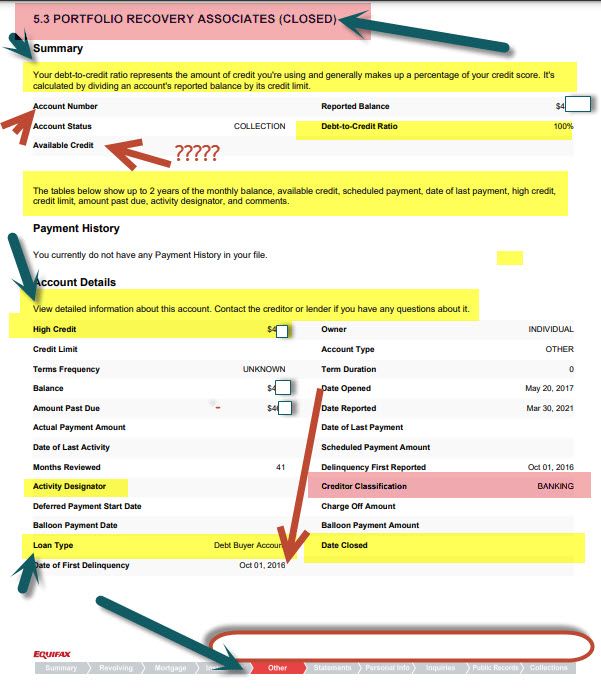

One of my first posts - was trying (without insight/access to Metro2) to figure out why, or better - how this tradeline was reporting in this fashion.

At first glance it looked somewhat reasonable - heck, back then, who even knew what fields are intended to be, or not. Plus, this was actually already paid off. It just sat there, like an anchor from a ship. But ---- I am adding another tradeline to this view, its mine - and, for your consumption.

(*** When you look at your own credit report - only raw credit reports are allowed. Go to annualcreditreport.com, and pull a report from EACH CRA one at a time, save to PDF. Why am I saying this? Because - most sites pulling your data in from a CRA - has views/translations etc - that can be unreliable. I will share an example in a future post).

I am going to use the Annual Credit Report for Equifax - this is the easiest to start with. No other source (other than a printed report directly from them) will help you see this.

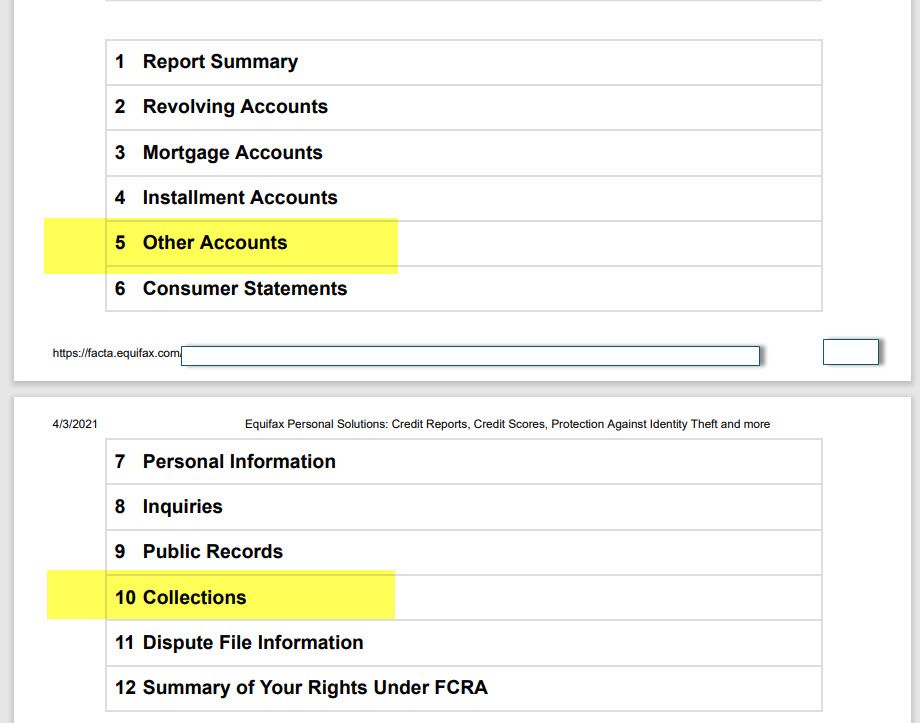

Equifax has - a section that is dedicated to Debt collectors - look for the description, on page 1-2, its should say

“ 10 Collections “ - here is the description from their report

“10. Collections Collections are accounts with outstanding debt that have been placed by a creditor with a collection agency. Collections stay on your credit report for up to 7 years from the date the account first became past due. They generally have a negative impact on your credit score. “

Please note another section of the report “ Other Accounts “

“ Other Accounts “ here is a description from their report - “5. Other Accounts Other accounts are those that are not already identified as Revolving, Mortgage or Installment Accounts such as child support obligations or rental agreements.”

Please - PLEASE, read the descriptions/text above all details - they explain what they are supposed to be doing, and it applies to creditors.

The questions start with (there is allot more to this, but lets start here) ----

- Why are these debt collectors NOT the COLLECTION section of this report?

- Why are they in the “OTHER” account section?

- Why would their header name - contain “CLOSED” and there is no closed date?

- Why - or better how, would a Debt Collector have a DEBT TO CREDIT Ratio? (read the description highlighted in yellow)

- Why would they have a Creditor Classification = Retail?

- Where is the Original Creditor?

- Heck - what happened to the account number?

There are reasons ---- and these are example questions - but I want to start the conversation about the data in consumer reports - as a tool and for our education.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Report Data - Accuracy and Debt Collection and Negatives

PRA is a junk debt buyer so they are the owner of the account even though it may be a collection. Not all collections are owned by PRA and those typically report under collections. PRA bought this debt you have shown here.

Closed Date isnt required and they have chosen not to report the date they closed the collection. They have to operate from the OCs DoFD not their open/close dates. OC has the option of removing their reporting at any time and of course if its moved past the max time allowed of 7.5 yrs then its excluded by the CRAs, if this is true then the PRA TL should also be excluded.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Report Data - Accuracy and Debt Collection and Negatives

Unsure if my last post stuck - Thank you for your response. I am curious on your persepective of what is being displayed ---

It is understood what PRA is, and what Midlland, NCA etc are - but, I am about the data and Metro2 compliance.

The FTC etc - define them for us all to see.

In my experience - when a Data Furnisher publishes data on a tradeline, and its closed - that date (field) is populated in a consumer file.

The Metro2 File spec says ---- drum roll, = and this is not done (nor the date)

The Metro 2® Format was designed to allow reporting of the most

accurate and complete information on consumers' credit history.

It is imperative that all accounts are reported a minimum of once

per month and that they are reported with a final Account Status

Code when they are ultimately paid or closed.

Neither the Acct Status - nor, date is published - when there is a dedicated field, in all CRA's - used to determine when a tradeline is closed.

Is anyone - familiar with what happens when it is not? Using a Tradelines descr - to store an account status - in a system (any) is not normalized.

Why - would a Debt Collector be reporting in the OTHER Section of a consumer report ?

I am looking forward to your feedback