- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Credit Score..How Can I Raise It?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Score..How Can I Raise It?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Score..How Can I Raise It?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Score..How Can I Raise It?

You are gonna have to provide more info.

What are your current FICO scores, what does your profile look like, example accounts, utilization, age of accounts. Are you building, rebuilding, any negatives?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Score..How Can I Raise It?

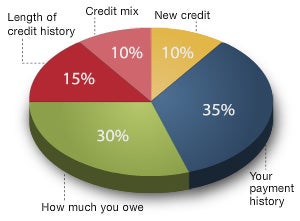

Pay your bills on time, keep your debt-to-credit ratio as close to zero as possible (but not actually zero), wait for your accounts get some age, have a good mix of different credit types, and limit how much new credit you apply for.

The "secret" to credit scoring really is that simple.

It gets a little more complicated if you have a whole bunch of bad stuff on your report, especially if a lot of those things are still unpaid. If you have unpaid bad debts, then your credit score should be the least of your concerns right now - handle the unpaid bad debts first, then deal with your scores later. Your scores aren't gonna go up as long as those bad debts keep getting reported as unpaid every month.

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Score..How Can I Raise It?

@Anonymous wrote:

What are some good ways to raise/boost my credit score?

If you called an auto mechanic and asked "What is wrong with my car?" without providing any info, what do you think they would tell you?![]() They will probably need some more info to answer your question, just like the people here do if you want some personal assistance. Welcome to the forums!

They will probably need some more info to answer your question, just like the people here do if you want some personal assistance. Welcome to the forums!