- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Credit Spree and What is considered to Many In...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Spree and What is considered to Many Inquiries

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Spree and What is considered to Many Inquiries

@Revelate wrote:

@iv wrote:

@Revelate wrote:Uh.

FICO 8 does count AU's, it just has an anti-abuse algorithm so that some AU's on individual credit reports are not counted.

This is, of course, true. You know this, I know this.

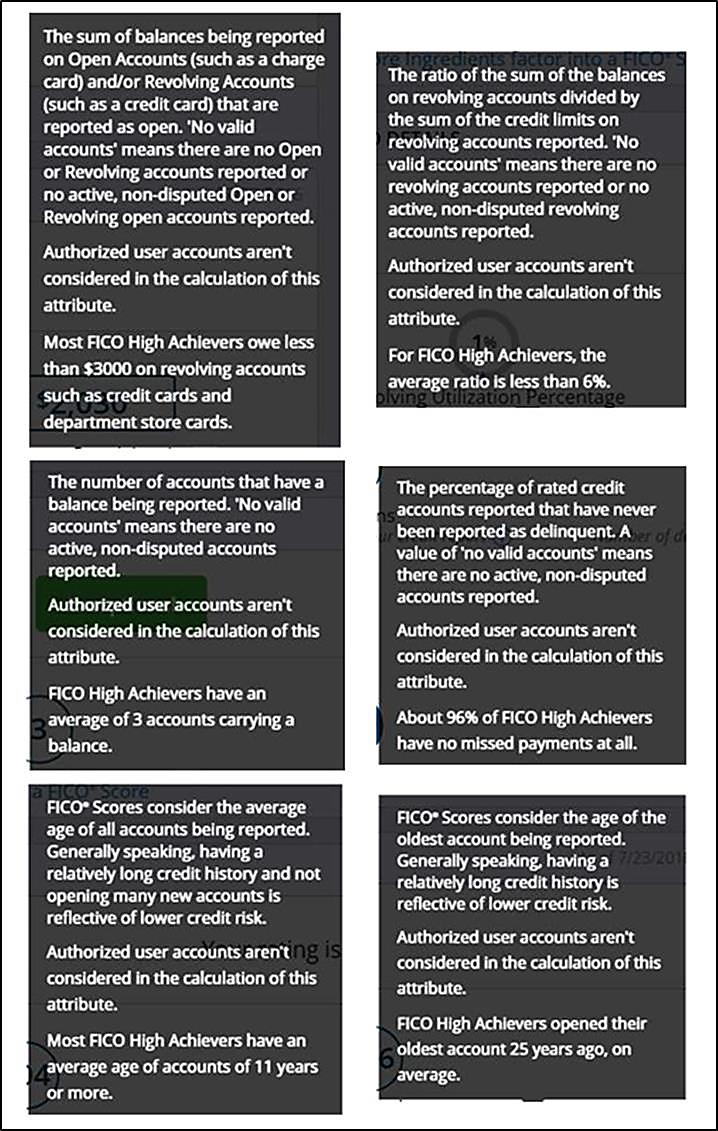

But from the number of times myFICO has "Authorized user accounts aren't considered in the calculation of this attribute" as a popup in the Score Ingredients info section... you'd think they were trying to ease everyone into accepting AUs being 100% discounted.

Oh I never saw that; I did catch a couple of other errors in the posted FICO Consumer verbiage over time and they corrected them so it might just be a sloppy posting and we can do similar.

You're right though they might be trying to do that... clearly the lenders want it and we're not their customers (well FICO Business's customers anyway).

I never indicated that AU accounts were not counted at all in fico08, or fico09. They do not carry the same weight in those models as a primary account does though. You can thank some shady credit repair services for that. Some of them were opening accounts in their names, and naming clients as AU on those cards, and making favorable credit behavior on those cards. This practice was making clients scores climb artificially. Fico got wind of the practice and adjusted their alogrithms to give less value to AU accounts.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Spree and What is considered to Many Inquiries

@Revelate wrote:Uh.

FICO 8 does count AU's, it just has an anti-abuse algorithm so that some AU's on individual credit reports are not counted. FICO 9 isn't really used yet, and if suddenly the stay at home parent suddenly loses their credit score like happened with the initial FICO 8 rollout, we'll hear a similar outcry and a likely predictable similar response (FICO's backtracking).

Deleting AU's needs to be done with more rigor, namely, what are the open dates and payment history on the AU's vs. the rest of your cards? If it's non-trivially longer and is a clean tradeline, I'd never whack an AU: it might get discounted, OTOH it might *not*. I play for credit score maximization, why would I leave points on the table needlessly? If I had a pretty AU I'd keep it and I'd challenge anyone to provide one reasonable explanation why it makes sense to pre-emptively airstrike them in that scenario.

You can always, always delete it later if a late or whatever shows up, and the limits in this question are so irrelevant that you'll lose what, 10 points even if they're maxxed out? /yawn.

If it's an ugly AU, then kick it to the curb... otherwise hold it for now.

ETA: FICO 04 and earlier absolutely do count AU's, and those (EQ 04, TU 04, EX 98) still underwrite 99.99% of the mortgages in the United States and as such in my estimation is way more important than any FICO 8 pull and absurdly more so than any FICO 9 one currently. Optimize for the most expensive purchases in one's life from a credit scoring perspective, if some other credit score discounts them so what?

I agree that AU accounts count 100% in the fico scores used for mortgages, but count less in those most widely used for credit cards. I also see no benefit being removed from an AU that is being handled responsibly. Truth be told though, with the small credit limits on those AU accounts it will not make much difference either way.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Spree and What is considered to Many Inquiries

@sarge12 wrote:

@Revelate wrote:Uh.

FICO 8 does count AU's, it just has an anti-abuse algorithm so that some AU's on individual credit reports are not counted. FICO 9 isn't really used yet, and if suddenly the stay at home parent suddenly loses their credit score like happened with the initial FICO 8 rollout, we'll hear a similar outcry and a likely predictable similar response (FICO's backtracking).

Deleting AU's needs to be done with more rigor, namely, what are the open dates and payment history on the AU's vs. the rest of your cards? If it's non-trivially longer and is a clean tradeline, I'd never whack an AU: it might get discounted, OTOH it might *not*. I play for credit score maximization, why would I leave points on the table needlessly? If I had a pretty AU I'd keep it and I'd challenge anyone to provide one reasonable explanation why it makes sense to pre-emptively airstrike them in that scenario.

You can always, always delete it later if a late or whatever shows up, and the limits in this question are so irrelevant that you'll lose what, 10 points even if they're maxxed out? /yawn.

If it's an ugly AU, then kick it to the curb... otherwise hold it for now.

ETA: FICO 04 and earlier absolutely do count AU's, and those (EQ 04, TU 04, EX 98) still underwrite 99.99% of the mortgages in the United States and as such in my estimation is way more important than any FICO 8 pull and absurdly more so than any FICO 9 one currently. Optimize for the most expensive purchases in one's life from a credit scoring perspective, if some other credit score discounts them so what?

I agree that AU accounts count 100% in the fico scores used for mortgages, but count less in those most widely used for credit cards. I also see no benefit being removed from an AU that is being handled responsibly. Truth be told though, with the small credit limits on those AU accounts it will not make much difference either way.

Payment history is payment history. Size of limit is irrelevant to that (tne majority) of the FICO calculation. If they're clean and increasing one's AAOA, keep them.

Regarding your other post, where did the idea that AU's were counted less in the algorithm for FICO 8? If they're counted at all it's the full monty as near as it can be determined.

There have been some comments that mortgage lenders will try to discount AU tradelines and do some feng shui hand-waving estimate at score, but that's as far as it goes to my knowledge.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Spree and What is considered to Many Inquiries

@Revelate wrote:

@sarge12 wrote:

@Revelate wrote:Uh.

FICO 8 does count AU's, it just has an anti-abuse algorithm so that some AU's on individual credit reports are not counted. FICO 9 isn't really used yet, and if suddenly the stay at home parent suddenly loses their credit score like happened with the initial FICO 8 rollout, we'll hear a similar outcry and a likely predictable similar response (FICO's backtracking).

Deleting AU's needs to be done with more rigor, namely, what are the open dates and payment history on the AU's vs. the rest of your cards? If it's non-trivially longer and is a clean tradeline, I'd never whack an AU: it might get discounted, OTOH it might *not*. I play for credit score maximization, why would I leave points on the table needlessly? If I had a pretty AU I'd keep it and I'd challenge anyone to provide one reasonable explanation why it makes sense to pre-emptively airstrike them in that scenario.

You can always, always delete it later if a late or whatever shows up, and the limits in this question are so irrelevant that you'll lose what, 10 points even if they're maxxed out? /yawn.

If it's an ugly AU, then kick it to the curb... otherwise hold it for now.

ETA: FICO 04 and earlier absolutely do count AU's, and those (EQ 04, TU 04, EX 98) still underwrite 99.99% of the mortgages in the United States and as such in my estimation is way more important than any FICO 8 pull and absurdly more so than any FICO 9 one currently. Optimize for the most expensive purchases in one's life from a credit scoring perspective, if some other credit score discounts them so what?

I agree that AU accounts count 100% in the fico scores used for mortgages, but count less in those most widely used for credit cards. I also see no benefit being removed from an AU that is being handled responsibly. Truth be told though, with the small credit limits on those AU accounts it will not make much difference either way.

Payment history is payment history. Size of limit is irrelevant to that (tne majority) of the FICO calculation. If they're clean and increasing one's AAOA, keep them.

Regarding your other post, where did the idea that AU's were counted less in the algorithm for FICO 8? If they're counted at all it's the full monty as near as it can be determined.

There have been some comments that mortgage lenders will try to discount AU tradelines and do some feng shui hand-waving estimate at score, but that's as far as it goes to my knowledge.

I had read that AU was discounted on a website, since your denial of this my research has revealed that indeed AU accounts were to be left out of reporting on fico08, but later fico backtracked so indeed you are correct for legitimate AU accounts. They do supposedly monitor for abuse. I can also see your point of payment history and AAoA. I will not try to press a weak (as in wrong) position by discussing utilization on these. I hate to say I'm wrong...hate more being wrong...which I am on both counts!

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Spree and What is considered to Many Inquiries

I do wonder if I may have read a webpage written prior to fico backtracking...will try to better verify my information in the future.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Spree and What is considered to Many Inquiries

@sarge12 wrote:I do wonder if I may have read a webpage written prior to fico backtracking...will try to better verify my information in the future.

No worries dude, this forum is about education and I think I can safely speak for everyone in suggesting all of us have gotten at least one piece of information incorrect. There are indeed references on the Internet which were written prior to the outcry and backtrack... including some FICO marketing releases as nothing is ever truly deleted from the Internet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Spree and What is considered to Many Inquiries

@Revelate wrote:

@sarge12 wrote:I do wonder if I may have read a webpage written prior to fico backtracking...will try to better verify my information in the future.

No worries dude, this forum is about education and I think I can safely speak for everyone in suggesting all of us have gotten at least one piece of information incorrect. There are indeed references on the Internet which were written prior to the outcry and backtrack... including some FICO marketing releases as nothing is ever truly deleted from the Internet.

Except some peoples e-mails maybe.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Spree and What is considered to Many Inquiries

@sarge12 wrote:

@Revelate wrote:

@sarge12 wrote:

@Revelate wrote:Uh.

FICO 8 does count AU's, it just has an anti-abuse algorithm so that some AU's on individual credit reports are not counted. FICO 9 isn't really used yet, and if suddenly the stay at home parent suddenly loses their credit score like happened with the initial FICO 8 rollout, we'll hear a similar outcry and a likely predictable similar response (FICO's backtracking).

Deleting AU's needs to be done with more rigor, namely, what are the open dates and payment history on the AU's vs. the rest of your cards? If it's non-trivially longer and is a clean tradeline, I'd never whack an AU: it might get discounted, OTOH it might *not*. I play for credit score maximization, why would I leave points on the table needlessly? If I had a pretty AU I'd keep it and I'd challenge anyone to provide one reasonable explanation why it makes sense to pre-emptively airstrike them in that scenario.

You can always, always delete it later if a late or whatever shows up, and the limits in this question are so irrelevant that you'll lose what, 10 points even if they're maxxed out? /yawn.

If it's an ugly AU, then kick it to the curb... otherwise hold it for now.

ETA: FICO 04 and earlier absolutely do count AU's, and those (EQ 04, TU 04, EX 98) still underwrite 99.99% of the mortgages in the United States and as such in my estimation is way more important than any FICO 8 pull and absurdly more so than any FICO 9 one currently. Optimize for the most expensive purchases in one's life from a credit scoring perspective, if some other credit score discounts them so what?

I agree that AU accounts count 100% in the fico scores used for mortgages, but count less in those most widely used for credit cards. I also see no benefit being removed from an AU that is being handled responsibly. Truth be told though, with the small credit limits on those AU accounts it will not make much difference either way.

Payment history is payment history. Size of limit is irrelevant to that (tne majority) of the FICO calculation. If they're clean and increasing one's AAOA, keep them.

Regarding your other post, where did the idea that AU's were counted less in the algorithm for FICO 8? If they're counted at all it's the full monty as near as it can be determined.

There have been some comments that mortgage lenders will try to discount AU tradelines and do some feng shui hand-waving estimate at score, but that's as far as it goes to my knowledge.

I had read that AU was discounted on a website, since your denial of this my research has revealed that indeed AU accounts were to be left out of reporting on fico08, but later fico backtracked so indeed you are correct for legitimate AU accounts. They do supposedly monitor for abuse. I can also see your point of payment history and AAoA. I will not try to press a weak (as in wrong) position by discussing utilization on these. I hate to say I'm wrong...hate more being wrong...which I am on both counts!

Actually, my AU account does not factor into Fico 08 with regards to all the statements from Fico pasted below. These statements are displayed when clicking on the "?" under various summaries in the score tab.I have some rather excruciating detail from back to back 3B reports taken a few weeks apart in July/August. Refer to below links for some data I presented on how my AU BOA revolver and AMEX charge are treated by the various Fico scoring models.

BTW - The card I am AU on is my wife's card - used exclusively for joint expenses. We pay the bill out of a joint account. Not sure what is required to be considered legitimate but I would think AU on a spouses card would qualify. I've been AU on it for 20 years. The card and payment history does show up on my 3B report and CRA reports.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Spree and What is considered to Many Inquiries

TT, based on that someone with just AU accounts would not have a FICO score or am I misreading it?

We know that isn't the case under FICO 8 based on anecdotal reports. Also while I hate to admit it, things posted in the product have been flatly wrong previously and were changed after I pointed them out... I strongly suspect this is one of them unless it changed for FICO 9, and I'd submit that when they made that change for FICO 8 initially there were screams, I can't fathom their being able to go down the same road again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Spree and What is considered to Many Inquiries

@Revelate wrote:TT, based on that someone with just AU accounts would not have a FICO score or am I misreading it?

We know that isn't the case under FICO 8 based on anecdotal reports. Also while I hate to admit it, things posted in the product have been flatly wrong previously and were changed after I pointed them out... I strongly suspect this is one of them unless it changed for FICO 9, and I'd submit that when they made that change for FICO 8 initially there were screams, I can't fathom their being able to go down the same road again.

Hope TT credit reporting data is wrongly reported to him, in any case I refuse to unapologise!!!!

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20