- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Credit.com starting new monitoring product

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit.com starting new monitoring product

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit.com starting new monitoring product

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit.com starting new monitoring product

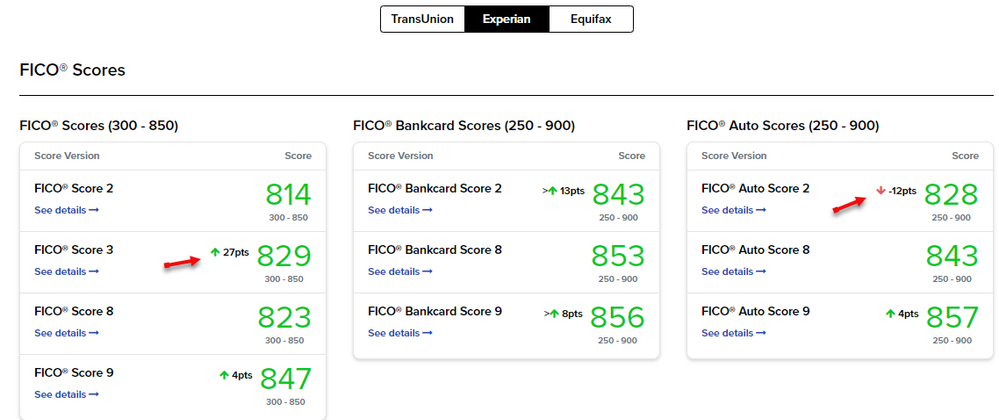

I hit the one month point with the new monitoring product and they updated the EX and TU scores. EQ scores were not available until a week after I signed up so apparently EQ won't update for another week or so. As I've mentioned before, no interim score or activity alerts between monthly reports. They do update all 28 scores every month, which might be worth $25 to some people. With the $5 intro pricing, it certainly is to me. The 28 score breakdown does show a handy month to month change indicator:

I have no idea why my EX FICO 3 would go up 27 points while my Auto 2 score went down 12. Other than paying on two consolidation loans and 2 car loans every month not much is changing on my report. Just a curiosity, though, I'm not going to worry about it.

AoOA: closed: 40 years, open: 30 years; AAoA: 14 years

Amex Gold, Amex Blue, Amex ED, Amex Delta Blue, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA, Sync Lowes, total CL 203k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit.com starting new monitoring product

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit.com starting new monitoring product

@FlaDude wrote:I hit the one month point with the new monitoring product and they updated the EX and TU scores. EQ scores were not available until a week after I signed up so apparently EQ won't update for another week or so. As I've mentioned before, no interim score or activity alerts between monthly reports. They do update all 28 scores every month, which might be worth $25 to some people. With the $5 intro pricing, it certainly is to me. The 28 score breakdown does show a handy month to month change indicator:

I have no idea why my EX FICO 3 would go up 27 points while my Auto 2 score went down 12. Other than paying on two consolidation loans and 2 car loans every month not much is changing on my report. Just a curiosity, though, I'm not going to worry about it.

@FlaDude that is pretty weird. Do you have any derogatories whatsoever?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit.com starting new monitoring product

@Anonymous wrote:@FlaDude that is pretty weird. Do you have any derogatories whatsoever?

I had a 30 day late that dropped off EQ and EX in May or June and was reflected in the June scores. That was my only derog. The late hadn't been on TU so my TU scores were always higher, starting in June all three were similar. No new credit or inquiries (youngest is 11 months, AAoA about 11 years). I do have an old account that has been closed almost 10 years (opened 15 years ago) so it should drop off in next couple of months, I'll have to compare reports and see if I missed another dropping off, but I don't think so. In any case I have a thick enough profile that losing one 15 year old account shouldn't have much effect on the average. It does seem strange, but of no real importance.

AoOA: closed: 40 years, open: 30 years; AAoA: 14 years

Amex Gold, Amex Blue, Amex ED, Amex Delta Blue, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA, Sync Lowes, total CL 203k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit.com starting new monitoring product

@Anonymous wrote:

@FlaDude wrote:I hit the one month point with the new monitoring product and they updated the EX and TU scores. EQ scores were not available until a week after I signed up so apparently EQ won't update for another week or so. As I've mentioned before, no interim score or activity alerts between monthly reports. They do update all 28 scores every month, which might be worth $25 to some people. With the $5 intro pricing, it certainly is to me. The 28 score breakdown does show a handy month to month change indicator:

I have no idea why my EX FICO 3 would go up 27 points while my Auto 2 score went down 12. Other than paying on two consolidation loans and 2 car loans every month not much is changing on my report. Just a curiosity, though, I'm not going to worry about it.

@FlaDude that is pretty weird. Do you have any derogatories whatsoever?

With those credit scores I would imagine there has to be at least 2 to 3 derogs holding his scores down.

BUT on the real side anyone getting the scores or updated scores while your credit reports are locked or did you have to leave them unlocked for a period of time so credit.com could give them/update them?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit.com starting new monitoring product

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit.com starting new monitoring product

@FlaDude wrote:

@Anonymous wrote:@FlaDude that is pretty weird. Do you have any derogatories whatsoever?

I had a 30 day late that dropped off EQ and EX in May or June and was reflected in the June scores. That was my only derog. The late hadn't been on TU so my TU scores were always higher, starting in June all three were similar. No new credit or inquiries (youngest is 11 months, AAoA about 11 years). I do have an old account that has been closed almost 10 years (opened 15 years ago) so it should drop off in next couple of months, I'll have to compare reports and see if I missed another dropping off, but I don't think so. In any case I have a thick enough profile that losing one 15 year old account shouldn't have much effect on the average. It does seem strange, but of no real importance.

@FlaDude oh good you got more points to look forward to next month if your youngest revolver is 11 months!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit.com starting new monitoring product

@Anonymous wrote:@FlaDude oh good you got more points to look forward to next month if your youngest revolver is 11 months!

I'm not sure if will have any effect, but a car loan I'm cosigner on will also go below 28.9% utilization.

AoOA: closed: 40 years, open: 30 years; AAoA: 14 years

Amex Gold, Amex Blue, Amex ED, Amex Delta Blue, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA, Sync Lowes, total CL 203k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit.com starting new monitoring product

@Iusedtolurk wrote:With those credit scores I would imagine there has to be at least 2 to 3 derogs holding his scores down.

I will say that scores like that are fairly new to me. Like many others here I've had some issues that kept my scores down. Not as bad as some, a few 30 day lates here and there, and a mountain of CC debt (80k) with lots of maxed out cards. Now I'm down to a hill of debt with none of it on my credit cards (in two loans in my name and a CC in my wife's name) that should be paid by February.

My reports are all unlocked, although I should probably lock them since I don't expect to apply for anything for a while.

AoOA: closed: 40 years, open: 30 years; AAoA: 14 years

Amex Gold, Amex Blue, Amex ED, Amex Delta Blue, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA, Sync Lowes, total CL 203k