- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Discover Card Fico Score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover Card Fico Score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

@BungalowMo wrote:

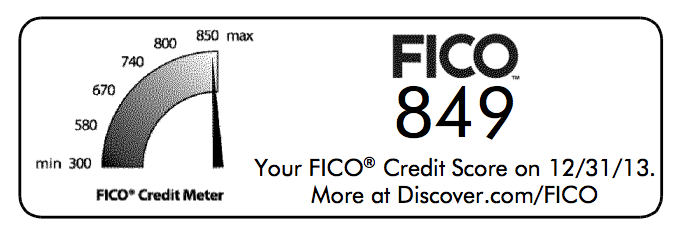

Just got my TU FICO on my Discover IT statement. I guess this is also an '08 score?

Did you get this on the hard-copy snail mail statement, or can we access this online?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

@Jazzzy wrote:

@BungalowMo wrote:

Just got my TU FICO on my Discover IT statement. I guess this is also an '08 score?Did you get this on the hard-copy snail mail statement, or can we access this online?

I see mine online

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

@Anonymous-own-fico wrote:I don't know what's going on here, lol.

Sweet!

CC's: AMEX (4), Alliant Visa, PenFed AMEX, Pen Fed Promise, Citi (3), Chase (5), US Bank Cash+, Huntington Voice, Nasa Plat Cash Visa, Barclay's Visa, Discover IT, Cap One QS, BOA (2), BMW Visa, 5/3 Real Life Rewards MC; FNBO Amex; Comenity Visa/MC (3), Ebates Visa Siggy, Nordstrom Visa, Walmart MC, Sam's Club MC; A few assorted store cards.

Current Scores (09/2017): EQ My Fico: 786; TU MyFico: 799; EX (My Fico): 797

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

Clearly it's a tu 08. Myfico has my TU at 706. Discover 724. How I wish that was my real fico.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

@myjourney wrote:MyFico has a different scoring TU model

Discover,Barclay,Walmart all use the same TU model TU08 which is a newer model

Thus you may see different scores but both models are true Fico's

Most mortgage companies use the MyFico model

Am sorry but I have to correct this:

Mortgage companies pull TU'04, not TU'08 / TU'98. The only score which MyFICO sells which is an accurate score for a mortgage is the Equifax one which is Beacon 5.0: identical to a tri-merge.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

I have a 90 point difference between my TU04 and TU08 - scores within 48 hours of each other and no difference in the report data

TU04 (mortgage app) - score is 731 and factors are: Number of established accounts (Code:028) and Amount owed on revolving accounts is too high (Code:011)

TU08 - (discover it) -score is 821 and factor is only: amount owed on revolving accts is too high

Util - 17% (all on one card).

AAoA - 11 years

36 total accts

EQ and EX on the mortgage app were in the 810-820 range

I have no idea why the TU04 score is so low. My TU98 myfico score is also about the same as the TU04, sadly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

As far as the OP's question... It's also possible that the new accounts pushed you into a different "bucket". Rebucketing has happened to me several times. When I expected my scores to go down from new accounts they went up! I just had a 15 point jump after adding three new accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

@negg wrote:Clearly it's a tu 08. Myfico has my TU at 706. Discover 724. How I wish that was my real fico.

That is a real Fico score

****** Last HP & New TL was March 6th 2014 *** GOAL: No HP's or New TL's for 2 + years and 840's Scores ******

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

@Anonymous wrote:Still trying to figure out if discover/walmart FICO scores are worth opening another account for.

Does any company use that FICO variety to make lending decisions?

Well the FICO8 is typically for credit card issuers if they choose to use that one as it is targeted at your credit card history. I have a couple of cards that say they use the FICO and that is also what they use to manage my account, so it just really depends. Also I have requested CLIs from the same card at different times and they will give me a copy for my score from different bureaus each time, so it really is just a crap-shoot of what they are going to use.

BUT... Here are the scores I get for free on cards I had/have:

Walmart: Trans. FICO (or 8, who knows)

First National Bank Omaha: Exp. FICO8

Merrick Bank: Trans. FICO8

US Bank: "Exp. Score"

Discover: Trans. FICO (Barclay's is the same score too)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Card Fico Score

@unc0mm0n1 wrote:I don't know why I thought you were a woman this entire time. Sorry, but thanks for the kind words. I'll let you know if my CS keeps the 50 point jump!

It's because MJ is a gentile flower ![]()