- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Experian CreditWorks

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Experian CreditWorks

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian CreditWorks

@UncleB wrote:@thornback usually replies still "make the trip" when a thread is moved, but before you retype it check your profile... the system might have auto-saved a draft copy.

Thanks UncleB -- I'm aware of the draft copy trick thing but, unfortunately, that did not work out this time. There is a draft in my profile under the new post title -- but it's completely blank... lol.

No worries, I already re-typed ![]()

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian CreditWorks

@thornback wrote:

@Anonymous wrote:

So if a Credit Card is paid off, the lander will send info to reporting agency witch is Experian, TransUnion or Equifax , then the score changes?

Now, let say i pay a credit card off, do they report it right away? or they do it every 30 days? or at 1 st of every month?

Lenders report your balances to all three bureaus once every single month. The date of reporting for most lenders is your statement closing date (not the due date, the statement closing date). If you look at your most recent billing statement for each lender, you will see a date range for that billing cycle; the last day of the billing cycle is your statement closing date. The balance on your account as of the statement closing date is the balance that will be reported to the credit bureaus.

Once the lender reports your balance for that month, the information will be updated on your credit reports by each bureau individually - this process can take anywhere from 1-10 days, depending on the bureau. In my experience, Experian updates within 24-48 hours of receiving new information; followed by Equifax within 72 hours; and Transunion is the slowest with a 3-5 day turnaround. Bureau updating time frames vary for everyone though so...

Whenever new information is recorded onto you reports, your score will either adjust accordingly or remain the same. Not all balance changes result in a score change - *refer to my post at the beginning of this thread where I explained utilization thresholds.

@Anonymous wrote:

Well i trying to pay some of my bills/credit cards off and wanted my score to go up to qualify for a home loan to buy a house.

My TU is 635 and EQ is 647. (from carmacredit site)

Remember in my earlier post when I explained that scores from Credit Karma should be ignored as they are of the Vantage 3 model, not FICO? Vantage 3 scores weigh aspects of your credit differently than FICO - it also responds to changes to your credit differently than FICO. Because of this, there is often a very large gap between your Vantage 3 and FICO scores. Lenders do not use Vantage scores to make credit decision, they use FICO.

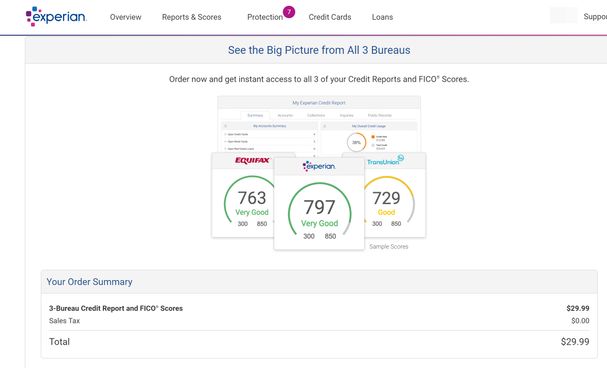

If you will be seeking a mortage soon, then you will need to monitor your FICO Mortage scores. The Experian service will only provide your Experian FICO Mortage score - it will not provide mortage scores for Transunion and Equifax (it will only give FICO 8 scores for TU & EQ).

To obtain and track your mortage scores for all 3 bureaus, you will need to purchase a myFICO.com Ultimate 3B subscription. myFICO costs more because it provides all 28 versions of your FICO scores (includes FICO8, FICO9, Mortgage, Auto, and Bankcard versions).

@Anonymous wrote:

Is there such place like

Experian's CreditWorks Premium service

https://www.experian.com/consumer-products/credit-monitoring.html

that you can have husband and wife on the same account? to monitor the credit ? or it must be separate because of the social security number?

No. As far as I know, they need to be separate accounts.

myFICO.com did offer a Family Plan in recent months, but the link is not working now and the plan is no longer listed as an option on their product page (?), so I guess it's no longer available. I know they had some issues with it so perhaps they're working out the kinks and it will be available again in the future.. I don't know.

Thank you for that clarification! on this post, really good info witch lot of it i am new and i am learning about it.

I have signed up at

https://www.experian.com/consumer-products/credit-monitoring.html

and paid the $4.99 for the first month, and i guess $24.99 after 30 days.

But on the other link you posted "myfico ultimate" not seen that option, i only see

https://www1.myfico.com/products/fico-scores-credit-monitoring

Thank you for your time and advice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian CreditWorks

@Anonymous wrote:

About the scores , are all thos combined to One score? or...

LoL... I just noticed this Q in your first post...

No. Each bureau gives their own FICO scores and also have unique FICO versions, giving you a total of 28 different FICO scores:

- 3 FICO-8 Classic scores (EQ, TU, and EX)

- 3 FICO-9 Classic scores (EQ, TU, and EX)

- 3 FICO-8 Auto scores (EQ, TU, and EX)

- 3 FICO-9 Auto scores (EQ, TU, and EX)

- 3 bureau specific Auto scores (EQ FICO AUTO score 5, TU FICO AUTO score 4, and EX FICO AUTO score 2)

- 3 bureau specific Mortage scores (EQ FICO 5, TU FICO 4, and EX FICO 2)

- 3 Bankcard FICO 8 scores (EQ, TU, and EX)

- 3 Bankcard FICO 9 scores (EQ, TU, and EX)

- 3 bureau specific Bankcard scores (EQ Bankcard score 5, TU Bankcard score 4, and EX Bankcard score 2)

- 1 Experian Score 3 (older model sometimes used by few lenders as a bankcard score)

And the only place way to see / monitor all of those scores is through a myFICO.com membership.

The Experian membership will give you all of the above scores for Experian only -- except for the FICO 9 versions -- they don't offer that one yet.

The Experian membership will not give you all of the scores for TU and EQ - only FICO 8 Classic for those two.

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian CreditWorks

@Anonymous wrote:

Thank you for that clarification! on this post, really good info witch lot of it i am new and i am learning about it.

I have signed up at

https://www.experian.com/consumer-products/credit-monitoring.html

and paid the $4.99 for the first month, and i guess $24.99 after 30 days.

But on the other link you posted "myfico ultimate" not seen that option, i only see

FICO®BasicFICO®AdvancedFICO®Premierhttps://www1.myfico.com/products/fico-scores-credit-monitoring

Thank you for your time and advice.

Sorry - -my mistake -- The basic only gives you reports & scores for one of the three bureaus so you would need either the Advanced or Premier, depending on how often you want updated scores.

The Advanced gives quarterly updates of all 28 scores; the Premier gives monthly updates for all 28 scores.

Both will update your FICO 8 Classic scores only whenever there is an alert of a change to your reports (you have to wait for your monthly or quartely update to see changes in all of the other scores).

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian CreditWorks

@thornback wrote:And the only place way to see / monitor all of those scores is through a myFICO.com membership.

Now debating to see monitor all, and if myfico.com does a better job than experian site, then i should get maybe prehaps "myfico advance" ?

Looks that is $29/m (did not see a trial) , Premier is kind going little high for me, but i just want to monitor my score and see the reports, kind what's happening behind the scenes.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian CreditWorks

@thornback wrote:@Anonymous wrote:

Thank you for that clarification! on this post, really good info witch lot of it i am new and i am learning about it.

I have signed up at

https://www.experian.com/consumer-products/credit-monitoring.html

and paid the $4.99 for the first month, and i guess $24.99 after 30 days.

But on the other link you posted "myfico ultimate" not seen that option, i only see

FICO®BasicFICO®AdvancedFICO®Premierhttps://www1.myfico.com/products/fico-scores-credit-monitoring

Thank you for your time and advice.

Sorry - -my mistake -- The basic only gives you reports & scores for one of the three bureaus so you would need either the Advanced or Premier, depending on how often you want updated scores.

The Advanced gives quarterly updates of all 28 scores; the Premier gives monthly updates for all 28 scores.

Both will update your FICO 8 Classic scores only whenever there is an alert of a change to your reports (you have to wait for your monthly or quartely update to see changes in all of the other scores).

No worries.

For me is critical for the next 2,3 months , as i want to see what's happening, as i want to purchase other home and i must get my score over 700, so i need those report and to see the scores every month. Not a pro at this and maybe going to far trying to figure out what plan to get...hmmm

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian CreditWorks

@Anonymous wrote:

@thornback wrote:And the only place way to see / monitor all of those scores is through a myFICO.com membership.

Now debating to see monitor all, and if myfico.com does a better job than experian site, then i should get maybe prehaps "myfico advance" ?

Looks that is $29/m (did not see a trial) , Premier is kind going little high for me, but i just want to monitor my score and see the reports, kind what's happening behind the scenes.

Thank you!

Haha... I can't help you. There is no trial for myFICO - ever.

I, personally, prefer Experian because i can check my score everyday and see changes immediately. myFICO doesn't alert for all changes to the score -- it only alerts for "alertable events" which are really only changes in balances and new accounts. Other than that, your score could change and you won't know until something else happens that qualifies as an "alertable event" and consequently updates your FICO 8 score.

When I was rebuilding, my reports were changing constantly so being able to see at least one of my scores on a daily basis was amazing. I also prefer their app / website -- not to mention, the cost.

But -- in your case, you will need to eventually know all 3 of your mortage scores -- and I honestly think the only time a myFICO membership is worth the cost is when you need to monitor specific scores like mortgage and / or auto.

When do you plan on applying for your mortage? If it's not til sometime next year, you could rely on Experian for now -- it will tell you your Experian mortgage score which is also updated daily (along with all the other versions except FICO 9) - this way you can monitor as your reports go through all of these changes with utilization. And then, when things stabilize a bit and changes aren't happening as often - and you get a bit closer to apping for your mortage - cancel the Experian membership and sign up for myFICO.

Of course, if you're now super curious about all of these other scores you just learned existed, you can just order a one-time myFICO 3 Bureau report for now. Or just jump in and sign up for one of the subscriptions... tough choices, I know...

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian CreditWorks

@Anonymous wrote:No worries.

For me is critical for the next 2,3 months , as i want to see what's happening, as i want to purchase other home and i must get my score over 700, so i need those report and to see the scores every month. Not a pro at this and maybe going to far trying to figure out what plan to get...hmmm

2-3 months, huh..

Ok.. how about this... Keep the 30 day trial membership with Experian so you can at least monitor daily for the next month - cancel when the trial ends so you're not charged the $24.99. And then sign up for myFICO after that (I guess you'll have to do the costly Premier option since you want monthly scores).

??

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian CreditWorks

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian CreditWorks

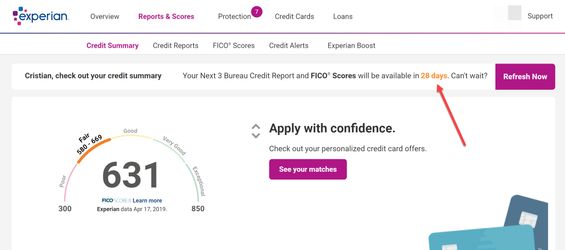

Looks like the

Experian's CreditWorks Premium service

https://www.experian.com/consumer-products/credit-monitoring.html

witch i paid $4.99 for the first months is updating the score every 30 days...hmmm

and if i click refresh now, i get this

I guess to see all the score is every 30 days, but the monitoring is every day from all 3 credit bureau. I may have to look at the fico premier,so i can see all scores every day if they update.

Thanks,