- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Experian Notations

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Experian Notations

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Experian Notations

My intentional repair began in 2018. For this inquiry I am going to just focus on Experian though TU and EQ are basically the same.

I have (2) baddies left on my report:

Midland Mortgage - a 120 day late August 2015 - This is actually incorrect. I don't know how you can have a OK OK OK OK and then a 120 day late but thats whats on the report. I sold my home in 2015 - there may have been a 30 day late but not 120 at this time period based on when the house closed and when the payoff took place. I have just left this alone as I don't want the account to update and whether I can get Midland to remove it is questionable.

Discover - a single 30 day late (for me entire account history with them) October 2014

The goodies:

0 collections, charge offs ... all since paid and have fallen off my reports based on 7 year from DOFD

Open CC Accounts

AMEX BC - $100 / $8000 (account open for about 2 years, recently AMEX bumped to 8k from 5k on their own)

NFCU CR - $0 / $25000 (account open for about 2 years)

USAA = $0 / $2,500 (account open for about 30 years, never late)

Open Installment - NFCU SSL

$239 balance on $3010 starting loan

5 year loan term till 2024

Even though I paid Discover religiously through all my credit troubles once I had everything paid off they closed my account in like March 2019. I don't know that I actually want an account but from time to time I check the prequal. (Note: I also regularly receive prescreen offers from Discover but its obvious the departments do not coincide their efforts).

All prequals always denied with the statement "Based on Prior Discover Accounts". They use Experian.

My real question is, why are the notations Experian CR given as:

SERIOUS DELINQUENCY

TOO FEW ACCOUNTS CURRENTLY PAID AS AGREED

% OF BALANCE TO HIGH CREDIT ON BANKING REVOLVING OR ALL REVOLVING ACCT

SERIOUS DELIQUENCY - yes with the 120 is on there from 2015 I can understand

TOO FEW ACCOUNTS CURRENTLY PAID AS AGREED - they are all current, never late so I assume it is because of the # of active accts?

% OF BALANCE TO HIGH .... - makes no sense

Any CRA "commentary" experts out there that might shed some light on these notations?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Notations

What source are you using for your CR's and reason statements?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Notations

The denial "letter" from Discover prequal app.

The primary reason is the prior discover account statement but the others are contained as reasons coming from Experian CR.

I am not worked up about it as I have the scores and the credit/banking relationships that more than satisfy my requirements at this time.

Just curious if there was anyone with some insight on the points mentioned.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Notations

If it was a Disco denial letter, those should be EX8 reason statements. The one for "serious delinquency" just means at least one reported delinquency (iirc of greater than isolated 30D), as you've said. For "too few accounts currently paid as agreed", I believe all that that means is that the number of accounts that have ever been late is greater than zero, despite the misleading presence of the word "currently". (Edit: see below.) My spouse hasn't had a late payment in more than two years and still has that reason statement on EX8. For the statement regarding utilization, what were your reported balances on the date of your Discover application? If you had higher utilization then that you've since paid down, that would account for the presence of that reason code, but, if not, we'd prly need to look deeper.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Notations

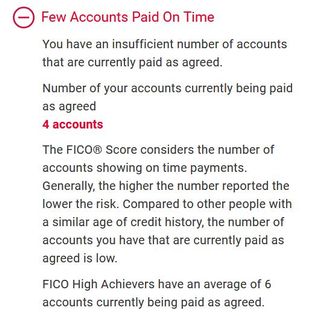

I looked over the EX8 reason statements and I think the analysis I gave of your second one was incorrect. Code 18 "number of accounts with delinquency" is for having more than 0 accounts that have ever been late. Code 19 "too few accounts currently paid as agreed" has the following explanation:

"The number of accounts with recent payment or activity information is too low because you have very few accounts or because you have few accounts with recent payment or activity information."

I recall this having been somewhat of a mystery reason statement for other people, and I've seen it pop on and off of my FICO8's w/o any reporting derogatories, tho in my case it was when a new accounts reported, I believe. In your case and my spouse's, it may have to do with having a thin, dirty file, since, at least for my spouse, it's a persistent code? My spouse's Experian account explains the code as follows:

Maybe those with more knowledge of reason statements, such as @Anonymous , @Anonymous , or @iv can provide some insight?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Notations

% OF BALANCE TO HIGH .... - makes no sense

This prequal check was today. Thats why the reason code makes no sense.

My current utilization posted on all three reports is $720 out of $32500 so < 3 percent as the bump in AMEX CL has not yet posted anywhere.

I always pay my accounts in full before the statement cuts so the only balance that I ever end up with is what I may charge to AMEX as there is a one week lag between due date and statement date. Not concerned with a balance post.

It usually is only a couple hundred.

Again, not something I am stressed about but with less than 3 percent utilization my balances for revolving accounts are certainly not too high.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Notations

@satio wrote:% OF BALANCE TO HIGH .... - makes no sense

This prequal check was today. Thats why the reason code makes no sense.

My current utilization posted on all three reports is $720 out of $32500 so < 3 percent as the bump in AMEX CL has not yet posted anywhere.

I always pay my accounts in full before the statement cuts so the only balance that I ever end up with is what I may charge to AMEX as there is a one week lag between due date and statement date. Not concerned with a balance post.

It usually is only a couple hundred.

Again, not something I am stressed about but with less than 3 percent utilization my balances for revolving accounts are certainly not too high.

Does your ACR show today as the date of your Disco SP? Prequals sometimes use old scores, tho if you always post only small balances that wouldn't be it. Also, with regards to your chargeoffs that have aged off, are they gone from your ACR, or do you use a different source for your reports?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Notations

All charge offs were paid in full or settled to 0 balance but they are all gone from ACR and all other sources of reports as they aged off in 2020.

Weird ain't it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Notations

@Slabenstein wrote:I looked over the EX8 reason statements and I think the analysis I gave of your second one was incorrect. Code 18 "number of accounts with delinquency" is for having more than 0 accounts that have ever been late. Code 19 "too few accounts currently paid as agreed" has the following explanation:

"The number of accounts with recent payment or activity information is too low because you have very few accounts or because you have few accounts with recent payment or activity information."

I recall this having been somewhat of a mystery reason statement for other people, and I've seen it pop on and off of my FICO8's w/o any reporting derogatories, tho in my case it was when a new accounts reported, I believe. In your case and my spouse's, it may have to do with having a thin, dirty file, since, at least for my spouse, it's a persistent code? My spouse's Experian account explains the code as follows:

Maybe those with more knowledge of reason statements, such as @Anonymous , @Anonymous , or @iv can provide some insight?

It seems likely that Code 19 is a "thin-positive-open" issue - IE: discounting any accounts with negative marks (or certain types of negative marks?), is the remaining number of open accounts over the "thin file" threshold?

So you could (likely) hit this code with either a completely-clean, but thin file, or with a thick file that only had a few clean open accounts listed.

(I may be incorrect in assuming the open accounts are the ones that matter here - it's possible that a Closed/Paid-As-Agreed account does count for Code 19 in the same way as an Open clean account does. It's the use of "currently" that makes me think that Open status matters.)

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Notations

Payment history wants to see a variety of accounts paid as agreed, usually 6 is sufficient, but again, if they were all revolvers or all loans it’s not gonna stop the code. You got to have a variety of 6 accounts currently open and paid as agreed. The number could be different between young & mature profiles, as well.

matter fact, if you’re on a thin scorecard, I’m not sure you get this code. This is like a code on a thick file saying insufficient payment history to be able to adequately and accurately predict with granularity.

In other words to accurately predict payment history it needs a certain minimum amount of payment history and a variety of it and if that minimum is lacking, you get this code.