- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO Score Stress Indicators/Indexes

Presummably thanks to COVID-19, a new stress index is popping up. Equifax calls it the FICO Score Stress Indicator, and Equifax calls it FICO Resilience Index (now shown in myFICO). I tried to research this topic before I posted, so my apology if I missed it or have cross-posted.

I'm not sure when or how this index is going to be used (or currently being used), but suffice it to say, we can let our imaginations run wild until we see something concrete. If you have installment loans and/or carry balances, you run real risks of flagging in these indexes. Admittedly, I'm scoring an average 770 FICO score, but I'm a "high risk" according to the Equifax version of the index.

This is something that needs to be watched, and may even see some uses during these economic times - regardless of your FICO score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

This is very interesting. Probably a good topic and get more feedback in Credit in the News but the Mods know what they're doing so if it needs to be moved I'm sure they will.

I was unaware of this. Thanks for sharing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Equifax wrote:

More sensitive customers tend to have:

Higher number of active account

Higher total balances

Less experience managing a mix of credit

More recently opened a new trade line

https://assets.equifax.com/assets/usis/FICO_score_stress_indicator_ps.pdf

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

I've moved it to GC as this is not dealing with scoring per se, nor does this product changes/affects scores.

This is really no different than other add ons sold by CRA to those lenders who are willing to pay extra for someone else to tell them what's going on.

There are probably too many to count, but some are not advertised publicly, so when one makes an appearance, it seems so ominous, when in reality it's business as usual.

I wouldnt sweat it too hard as majority of the lenders are already utilizing something similar, except most rely on their own proprietary in-house algorithms and internal risk scoring.

There will certainly be some changes due to current situation, but not as a result from this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO Resilience Index?

Hello all!

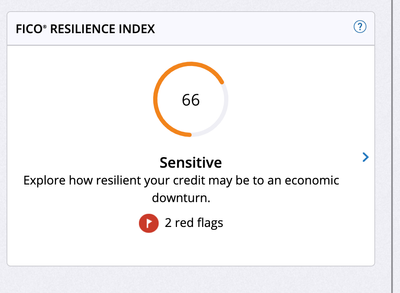

I updated my FICO 3 bureau report this month and noticed a new feature/score pop up on my dashboard. It ic called the FICO Reslience Index. Has anyone else noticed this recently? Strangely enough, it is only showing up for my Equifax report, which is my worst out of the 3 due to some inaccuracies and charge-offs currently showing. I am in this process of getting this stuff fixed, but I think many of us understand the difficulty in completing such a simple task.

Anyway, has anyone else gotten this message? Are you seeing it for any bureau other than Equifax? What is your score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

Interesting. Haven't seen anything like this. Looking forward to the discussion of how this sort of logic would be assembled.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

Definitely interesting. Probably based on trended data as well as your place of employment listed on the bureaus. If you work in the restaurant business, you'll score lower.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

There's a thread about it that has more info and links - https://ficoforums.myfico.com/t5/General-Credit-Topics/FICO-Score-Stress-Indicators-Indexes/td-p/596...

I am curious about this score but not enough to blow $30.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

@Anonymous wrote:There's a thread about it that has more info and links - https://ficoforums.myfico.com/t5/General-Credit-Topics/FICO-Score-Stress-Indicators-Indexes/td-p/5962374/jump-to/first-unread-message

I am curious about this score but not enough to blow $30.

Thanks for sharing this! Yeah, I currently have the boujee monthly 3 bureau subscription because I am in the process of some disputes and getting some inaccuracies removed. Once all that is done, I will not be paying for it anymore.

I also find it interesting that I am only seeing it from Equifax. My other two scores are higher, so maybe that's why?

It says the 2 reasons I am eing "red flagged" are a high amount of revolving debt (2 unpaid charge-offs on EQ) and the second reason is that I have a "high percentage of revolving accounts." In the little explanation box, it says, "Our predictive analysis shows that people who have a moderate mix of mortgage, installment loans (like auto) and credit cards may be more resilient in the event of an economic downturn."

Soo too many revolving accounts is a red flag apparently.