- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Resilience Index?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

@RehabbingANDBlabbing wrote:

@Anonymous wrote:There's a thread about it that has more info and links - https://ficoforums.myfico.com/t5/General-Credit-Topics/FICO-Score-Stress-Indicators-Indexes/td-p/5962374/jump-to/first-unread-message

I am curious about this score but not enough to blow $30.

Thanks for sharing this! Yeah, I currently have the boujee monthly 3 bureau subscription because I am in the process of some disputes and getting some inaccuracies removed. Once all that is done, I will not be paying for it anymore.

I also find it interesting that I am only seeing it from Equifax. My other two scores are higher, so maybe that's why?

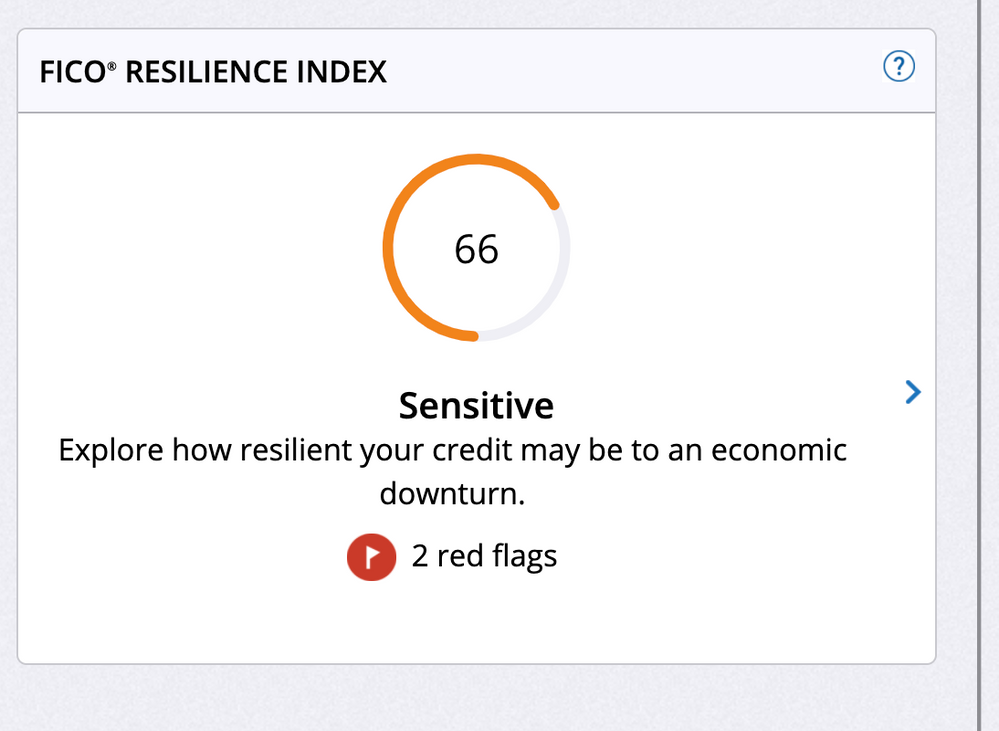

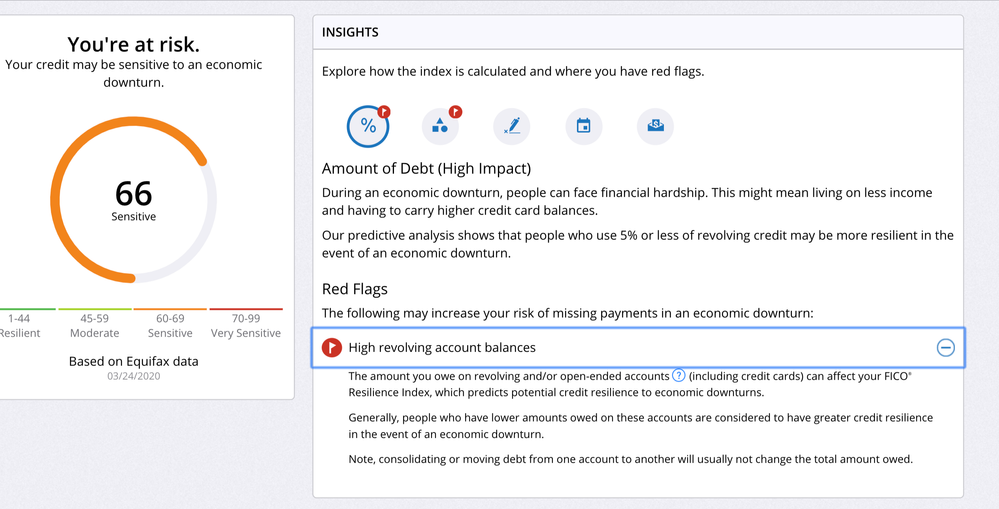

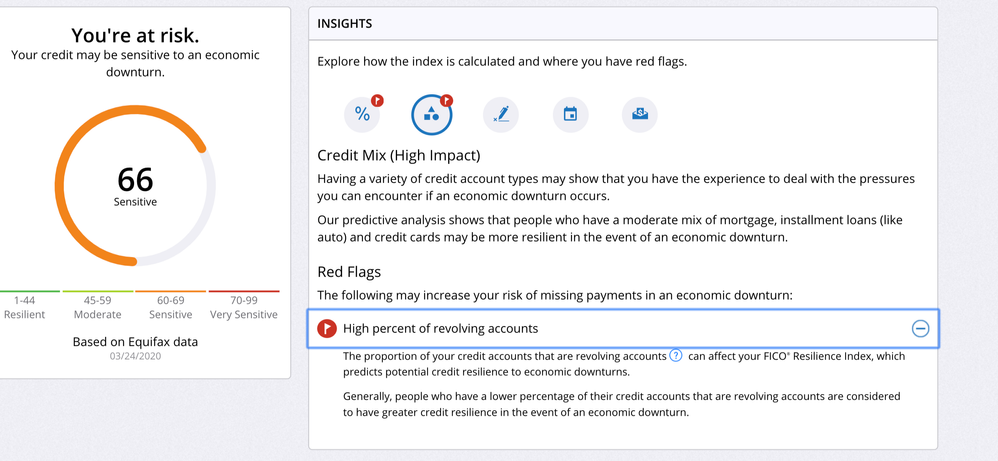

It says the 2 reasons I am eing "red flagged" are a high amount of revolving debt (2 unpaid charge-offs on EQ) and the second reason is that I have a "high percentage of revolving accounts." In the little explanation box, it says, "Our predictive analysis shows that people who have a moderate mix of mortgage, installment loans (like auto) and credit cards may be more resilient in the event of an economic downturn."

Soo too many revolving accounts is a red flag apparently.

I mean everything is a red flag. As long as I'm getting what I want from my lenders, I'm not trying to stress about it. Pick some solid lenders for your core like CUs for some stability in rough times and you can weather the storm. If this whole coronavirus thing has taught me anything, it's that my instincts about making sure I have CUs in my wallet was spot on. If some of my banks want to go all slashy slashy on my cards, there are other cards. Just would have me moving more business to credit unions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

I just saw this pop up on my 3 bureau report this month, which I pulled on 3/25. It is only showing up for my Equifax report, which is my worst score/report. No indexes are posted for my other two reports. My two "red flags" are a high percentage of revolving accounts (compared to other account types) and high revolving balances. The second one refers to two unpaid charge-offs showing on my EQ report. The rest of my balances total like $300 out of like $30k available, so it's definitely not any of my open accounts. I am also surprised i wasn't flagged for new accounts, because I have quite a few of those, but maybe the factors are weighted in terms of importance. I am looking forward to having those 2 inaccurate charge-offs removed soon, so hopefully my index score will improve.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

@Anonymous wrote:

@RehabbingANDBlabbing wrote:

@Anonymous wrote:There's a thread about it that has more info and links - https://ficoforums.myfico.com/t5/General-Credit-Topics/FICO-Score-Stress-Indicators-Indexes/td-p/5962374/jump-to/first-unread-message

I am curious about this score but not enough to blow $30.

Thanks for sharing this! Yeah, I currently have the boujee monthly 3 bureau subscription because I am in the process of some disputes and getting some inaccuracies removed. Once all that is done, I will not be paying for it anymore.

I also find it interesting that I am only seeing it from Equifax. My other two scores are higher, so maybe that's why?

It says the 2 reasons I am eing "red flagged" are a high amount of revolving debt (2 unpaid charge-offs on EQ) and the second reason is that I have a "high percentage of revolving accounts." In the little explanation box, it says, "Our predictive analysis shows that people who have a moderate mix of mortgage, installment loans (like auto) and credit cards may be more resilient in the event of an economic downturn."

Soo too many revolving accounts is a red flag apparently.

I mean everything is a red flag. As long as I'm getting what I want from my lenders, I'm not trying to stress about it. Pick some solid lenders for your core like CUs for some stability in rough times and you can weather the storm. If this whole coronavirus thing has taught me anything, it's that my instincts about making sure I have CUs in my wallet was spot on. If some of my banks want to go all slashy slashy on my cards, there are other cards. Just would have me moving more business to credit unions.

I could not have said it better myself. I just find this whole thing a bit frustrating considering I am finally starting to get my credit back into a good place. And you're right, how our lenders treat us right now will show us who they really are in the long run. I am definitely not putting all my eggs into one basket, which is why I opened a few new cards this year. I am blacklisted at a few places, so I definitely looked a bit out of the way to find some good cards at smaller banks and CUs.

A good example of a great lender is Target. They have stuck with me through when my credit was in the toilet in 2017 and I had several credit cards go into charge-off status. They did not close my account or do any adverse action. I kept paying them on time every month, because I could afford to, but I am thankful they didn't shut down my account. And I still have it to this day. Discover has also been really good to me as well. The only other cards I am seeking in the forseeable future are the AmEx BCP for groceries, Cap1 Savor for the SUB and ongoing cash back similar to Marvel MC, and maybe the travel credit card from SSFCU for SUB and travel related spending. And I know it will take a whilw to get these until I get some inaccuracies removed, but I am steadily making progress toward those long term goals.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

I have the same exact ones, with under 10% UTI. It'll be interesting to see how if reacts to paid off balances vs carrying them. I also have a bunch of new accounts, but isn't exactly saying that is a red flag.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

@RehabbingANDBlabbing wrote:

@Anonymous wrote:

@RehabbingANDBlabbing wrote:

@Anonymous wrote:There's a thread about it that has more info and links - https://ficoforums.myfico.com/t5/General-Credit-Topics/FICO-Score-Stress-Indicators-Indexes/td-p/5962374/jump-to/first-unread-message

I am curious about this score but not enough to blow $30.

Thanks for sharing this! Yeah, I currently have the boujee monthly 3 bureau subscription because I am in the process of some disputes and getting some inaccuracies removed. Once all that is done, I will not be paying for it anymore.

I also find it interesting that I am only seeing it from Equifax. My other two scores are higher, so maybe that's why?

It says the 2 reasons I am eing "red flagged" are a high amount of revolving debt (2 unpaid charge-offs on EQ) and the second reason is that I have a "high percentage of revolving accounts." In the little explanation box, it says, "Our predictive analysis shows that people who have a moderate mix of mortgage, installment loans (like auto) and credit cards may be more resilient in the event of an economic downturn."

Soo too many revolving accounts is a red flag apparently.

I mean everything is a red flag. As long as I'm getting what I want from my lenders, I'm not trying to stress about it. Pick some solid lenders for your core like CUs for some stability in rough times and you can weather the storm. If this whole coronavirus thing has taught me anything, it's that my instincts about making sure I have CUs in my wallet was spot on. If some of my banks want to go all slashy slashy on my cards, there are other cards. Just would have me moving more business to credit unions.

I could not have said it better myself. I just find this whole thing a bit frustrating considering I am finally starting to get my credit back into a good place. And you're right, how our lenders treat us right now will show us who they really are in the long run. I am definitely not putting all my eggs into one basket, which is why I opened a few new cards this year. I am blacklisted at a few places, so I definitely looked a bit out of the way to find some good cards at smaller banks and CUs.

A good example of a great lender is Target. They have stuck with me through when my credit was in the toilet in 2017 and I had several credit cards go into charge-off status. They did not close my account or do any adverse action. I kept paying them on time every month, because I could afford to, but I am thankful they didn't shut down my account. And I still have it to this day. Discover has also been really good to me as well. The only other cards I am seeking in the forseeable future are the AmEx BCP for groceries, Cap1 Savor for the SUB and ongoing cash back similar to Marvel MC, and maybe the travel credit card from SSFCU for SUB and travel related spending. And I know it will take a whilw to get these until I get some inaccuracies removed, but I am steadily making progress toward those long term goals.

Those are some good choices. I griped about SSFCU in the past for their tech and their policies but in retrospect, they went above and beyond to approve me for their card because you have to get a $5K minimum limit and my profile at the time didn't really support one (three cards - $6250, $2K, and $1K but the $6250 was 4 years old and started at $300) One thing to know about them - they don't do auto anything. If you want a CLI or an APR reduction, it's a HP. I wanted to PC my Power Cash Back to the travel card and they told me that you have to apply for and be approved for it as a new card, can't PC. But they were one of the lenders with the best COVID-19 options. Any loans with them were automatically deferred 90 days and credit cards 30 days. No phone call needed as long as you were current when this happened. That's a solid lender right there.

Just keep doing what you're doing and it will be all good.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

I feel like the PDF explanation could have had more explanations. I had to google DPD Rate and I'm still not 100% sure what it is but I'm pretty sure it's Delinquincy rate?

Also, I couldn't figure out which end of the spectrum is better? Usually higher score = better, but this model looks like lower score is better?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

I think that only people within a certain range have generated this index score. It looks like this will be used by most lending institutions now given our current state. Looks like another number we will all have to work to maintain now! https://www.youtube.com/watch?v=m8jTmdkzDOY

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

If you have a credit score, you have one.

I dont think you can get in anywhere else, though. You have to have a subscription here to see yours.

While it's unfortunate anyone felt the need to throw it out there right now, we all have to remember we're not the "real" customers, lenders are.

I doubt many will rely on a couple of digits to let them know how likely someone is to default. That's what the internal algorithm is for, and most have their own.

It's taking same factors into account as any FICO scoring model such as utilization, recency of new accounts, negatives, mix of credit.

That makes it even more puzzling as all of those are already "accounted" for in *regular* score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

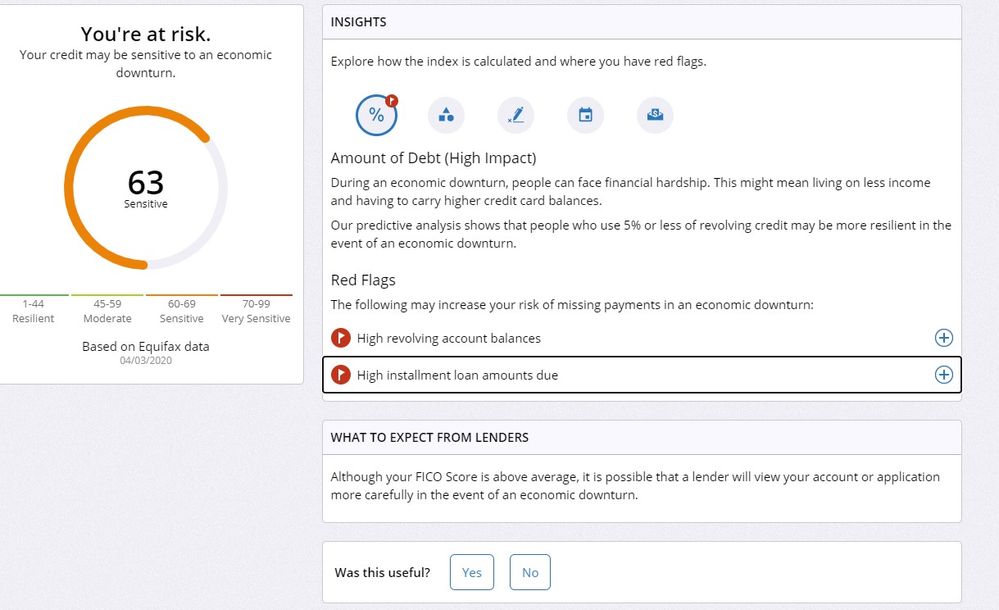

So after updating my 3-month MyFICO reports, I also have this Resilience index showing up. I am rated at 63 out of 99, higher score being worse.

There are only two red flags, associated with Amount of Debt, which apparently has a high impact on the Reslience index. Two reason codes: High Revolving Account Balances, and High Installment Loan Amounts due.

My Revolving account balances are at about $21k as of the latest MyFICO report snapshot. 6% Utilization on EX and EQ, 5% on TU where Apple Card is reporting. So low aggregate utilization percentage alone will not save you. A Dell Financing account is at 45% Utilization and a small LOC is at 32% utilization. Those factors may be increasing the red-flag situation.

The High Installment Loan Amounts seems to also include mortgage amounts.

The other factor categories are

Credit Mix (High Impact) with no red flags, so apparently a balance between revolving, installment, and mortgages.

Amount of New Credit - 3 new accounts in the last year, but apparently not enough to trigger a red flag here.

Length of Credit History - 20 years or more, so not surprising no red flags here.

Payment History - No missed payments anywhere so no red flags.

So I'm not sure how to improve the Resilience score, how much it will make a difference bringing down the revolving balances. They are either PIF items, or short term payment balances that should clear up in a few months. Whatever benefit comes from that, we'll see soon enough.

If the mortgage or installment items are the main weighting, then I don't see how the Resilience could be expected to improve.

The biggest factor in resilience is, do you have income continuing. In my role at work, and my skill set, I do not see any possibility of losing my job, unless the entire world shuts down for a year.

This would probably be more useful if they had a "user input" factor: "How confident are you that your job is secure?" It could even be a three-level choice: 1 = Very Confident 2 = Average 3 = High risk.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index?

Mine is 65

Main factors listed high utilization, which is at 6% till mid month when it should go to my usual 2%-3% and no open installment loan, which I now do have.

At the time it was generated, I had two paid off mortgages and 3 paid auto loans.

I'm not sure how often resilience index refreshes as it's still listing non existent reason for me