- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@EW800 wrote:Anyone have any idea what the lowest Resilience Index Score is that we have seen thus far?

So far in this thread, it's @Anonymous , with a '41 Resilient' score and regular FICO 8 scores around 600.

It make sense to me - she's focused on improving her credit and it looks like so were a lot of others that ended up ok after the Great Recession, that had similar profile data to her's today.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Anonymous wrote:

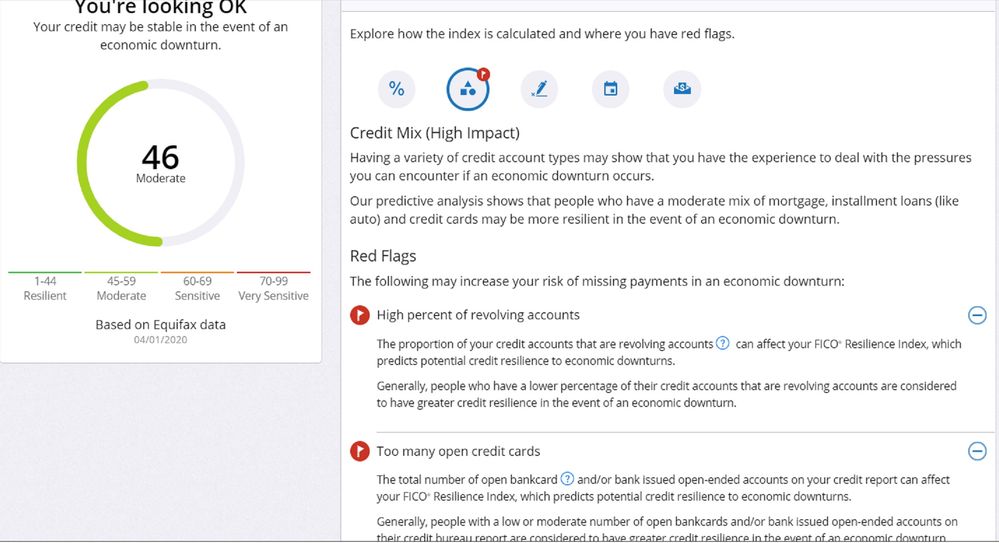

@EW800 wrote:My FICO Resilience Index Score is 46, which indicates "You're Looking OK", and about middle of the road on the pie chart. As a comparison to my FICO 8 and FICO 9 Scores, they are 850 across the board, which has been the case for about the last several months.

It appears that I have two red flags:

1) High Percent of Revolving Accounts. Well, I guess that would be accurate. I have about a dozen open revolving accounts, and just one open install account. I am not sure that I agree that this means I have less credit resilience in an economy downturn, but I guess FICO does not agree.

2) Too Many Open Credit Cards. I guess that is similar to above. I have about a dozen open credit card or store accounts. For the last several years, only one has ever shown with a balance at any given time. It appears that the fact that all but one are zero balance makes no difference, just the fact that I have several credit card accounts open.

Any idea if FCO is selling or giving this score/index number to any lenders?

@EW800 May I ask how many credit cards do you have open? And how many do you have both open and closed at Equifax? Because I'm quite surprised that I do not have that code myself having over 20 credit cards.

Do you have a lots of student loans or something? I know my # of SLs far outweighed my # of CC - def not as many as you. Just thinking out loud...

@Anonymous sorry about my delayed response. No, I do not have any student loans, open or closed. I have about a dozen open CC accounts, however only one ever shows a balance, typically about $25 or so. I have one open auto loan, that has had just a $100 balance for the past six months or so. It is 0%, so I am just letting it sit there to take advantage of the open installment loan points. I have two closed auto loans and one closed second mortgage account, all with perfect history.

It appears that the Resilience Index does not like how many open credit cards I have, even though all but one are $0 balance.

I did go through very ugly times toward the end of the last "great recession" (2011) with a foreclosure and a credit card settlement, so perhaps I am getting spanked by the Resilience Index for that, even though all that stuff fell off all of my reports almost a year ago?? I am not real sure why my Resilience Index is not better than it is.

Sept 2024: EX8: 847; EQ8: 850; TU8: 848 -- Middle Mortgage Score: 821

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sjt wrote:My score is 52. It seems odd that folks with high scores have just ok resilience scores.

@sjt I agree! I have 850's across all FICO 8's and FICO 9's, and my middle mortgage score is 824 (842, 824, 818), yet my Resilience Index Score is just "OK" at 46. I would love to know what the index truly does not like about my profile. Seems like it must be more than just how many open credit card accounts I have (about a dozen, with only one showing a balance at any given time).

Sept 2024: EX8: 847; EQ8: 850; TU8: 848 -- Middle Mortgage Score: 821

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@EW800 wrote:

@sjt wrote:My score is 52. It seems odd that folks with high scores have just ok resilience scores.

@sjt I agree! I have 850's across all FICO 8's and FICO 9's, and my middle mortgage score is 824 (842, 824, 818), yet my Resilience Index Score is just "OK" at 46. I would love to know what the index truly does not like about my profile. Seems like it must be more than just how many open credit card accounts I have (about a dozen, with only one showing a balance at any given time).

I think mine was 59 which was barely OK, but the developers of that index are idiots. 1) My debts including my house and all credit cards is under 20,000 dollars. 2) I have almost 400,000 dollars in savings I can withdraw at will. 3) My income is from 2200 dollars per month SSDI due to spinal cord damage, and does not change based on the economy. 4) I can pay all debt off next week if I choose to. 5) I could easily live off of the 2200 is SSDI alone, and never touch the 400k that is in the safest investment at Vangard Fiduciary Trust. My chances of default are about as low as anybody on Earth, and no resiliancy score can make that not so when I have almost 20 times my debt in savings. This SSDI income, and the 400k savings are not even considered by the idiots who came up with this new score. You just can't say how resiliant somebodys ability to pay back debt is without considering their total debt compared to total savings.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

They are penalizing us for too many open credit cards and available credit. I think they are oversimplifying DP and I don't think it will be useful to lenders, as they already do a monthly SP on our files and if they see anything unusual they won't hesitate to AA our butts.

Bank of America: Alaska Air Atmos Summit Visa Infinite

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Globe WLMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 816 / EQ: 825 / TU: 818

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@EW800 wrote:

@sjt wrote:My score is 52. It seems odd that folks with high scores have just ok resilience scores.

@sjt I agree! I have 850's across all FICO 8's and FICO 9's, and my middle mortgage score is 824 (842, 824, 818), yet my Resilience Index Score is just "OK" at 46. I would love to know what the index truly does not like about my profile. Seems like it must be more than just how many open credit card accounts I have (about a dozen, with only one showing a balance at any given time).

Your score is adversely impacted by too many open revolving accounts and too high a percentage of revolving accounts to total accounts. My ratio is 85% and that is too high. From what I have seen based on other posts, the ratio should be under 75%. Not sure what your AAoA is currently but, 8 years or higher is ideal according to summary statements.

My score is only 48. The red flags for me are too high a % of revolving accounts to total accounts and installment debt. I only have one loan, a mortgage. It is 95% paid off. It appears I am being dinged for the monthly payment obligation in absolute $.

For the most part it looks like utilization is secondary to total $ value balances on credit cards and aggregate B/L on installment loans is not considered. Total monthly payment obligations on installment loans is very important. A profile with multiple types of installment loans and a few revolving accounts is preferred. Considerable payment history is also beneficial. A new account is ok but too many is a red flag.

It appears that paid lates and paid collections won't adversely affect resilience score.

So what should an ideal profile be?

IMO from posts, red flags and alogorthm statements:

1) A profile with 3 or 4 open credit cards

- say oldest account 20 to 30 years age and youngest account minimum 3 years age.

- say average age of revolving accounts of at least 10 years.

2) An open car loan 5 or 6 years term with at least 3 years payment history.

- say monthly payments on car loan in the $200 to $300 range.

3) A SSL or personal loan with a small monthly payment obligation, say under $100.

4) An aggregate balance on credit cards under $100 combined with aggregate utilization under 5%

5) No unsettled derogatories

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sjt wrote:They are penalizing us for too many open credit cards and available credit. I think they are oversimplifying DP and I don't think it will be useful to lenders, as they already do a monthly SP on our files and if they see anything unusual they won't hesitate to AA our butts.

Income and savings are not on reports, so to lend credence you have to believe this....2 people with identical profiles showing on their credit report will be equally likely to have credit problems. So their theory is that even if one of them has 50,000 dollars in debt and 20 dollars in savings is equally resilient to someone with 50,000 dollars in debt and 50 million dollars in savings. That is BS, and even a minimum amount of common sense will tell you that is not the case. To some who are in 50,000 dollars debt that is their life savings, for others that is their bar tab with tips or a weekend trip to a resort. Many with a perfect credit history are 1 paycheck loss away from trouble all the time.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sarge12 wrote:Many with a perfect credit history are 1 paycheck loss away from trouble all the time.

That is so true, and exactly why humans alone do not set the scorecards and factor weighting. What seems intuitive - high ability to pay, better job, longer history, higher score - may not be the case for as many people as we think, after regression over a few years of credit profile data.

This is from an article written by a guy who works in the information technology field:

"According to a Nielsen study, 25% of families making $150,000 a year or more are living paycheck-to-paycheck. One in three earning between $50,000 and $100,000 need their next paycheck to survive. For those earning less than $50,000, that percentage increases to half"

( Why people who earn a lot of money still can’t pay the bills )

I also work in a similar field as him (Industry 4.0) and have witnessed exactly what he writes about. That was written around 2 years ago, and I always seem to find newer ones, like this:

A Shocking Number of Higher Earners Still Live Paycheck to Paycheck (March 2020)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@sarge12 wrote:Many with a perfect credit history are 1 paycheck loss away from trouble all the time.

That is so true, and exactly why humans alone do not set the scorecards and factor weighting. What seems intuitive - high ability to pay, better job, longer history, higher score - may not be the case for as many people as we think, after regression over a few years of credit profile data.

This is from an article written by a guy who works in the information technology field:

"According to a Nielsen study, 25% of families making $150,000 a year or more are living paycheck-to-paycheck. One in three earning between $50,000 and $100,000 need their next paycheck to survive. For those earning less than $50,000, that percentage increases to half"

( Why people who earn a lot of money still can’t pay the bills )

I also work in a similar field as him (Industry 4.0) and have witnessed exactly what he writes about. That was written around 2 years ago, and I always seem to find newer ones, like this:

A Shocking Number of Higher Earners Still Live Paycheck to Paycheck (March 2020)

Also be aware that I am not talking about net worth, but liquid assets that are free and clear of being security for anyones debts. Many who people think are extremely wealthy actually are not when all assets and debts must be liquidated. Living beyond ones means exist in every income group, and many mega-jackpot lottery winners run through their millions quicker than even seems possible. Suddenly those who once wore clothes bought at wal-mart suddenly had to have a world renown fashion designers latest creations. The reason real wealth was originally no longer allowed on reports is due to being unfairly discriminatory for minorities. Being of modest means does not equate into being less responsible in paying debt. This index however is suppose to indicate the resiliance of a debtor to withstand an economic downturn or job loss.

In the case of a debtor with 20 dollars savings, their only source of revenue to pay their debts are often their paycheck. The debtor with 50 million dollars in liquid assets is not dependant on a paycheck as their only, or even main source of revenue. That 50 million bucks in cash provides a great deal of resilience. In my case, even though I have only about 400k in liquid assets, my personal wants combined with bad health, I can't imagine even using half of that before I leave this World. I have no spouse or children, but do help my Sister and her grown children a lot.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Nostradamuz wrote:It is not a personal FICO score in the Equifax website, this is a FICO for business.

I think you're looking at a different product, which is quite easy to do on Equifax's website for business.

This is from the CEO of FICO:

"This is some really smart stuff that our guys came up with that helps us to differentiate among consumers and evaluate their credit. Within any particular FICO Score, they're that's at a point in time and a point in the economic cycle, and there are individuals who are more resilient and there are individuals who are less resilient."