- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 10/10T Changes Could Lower Your Credit Score

Done

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 10/10T Changes Could Lower Your Credit Score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 10/10T Changes Could Lower Your Credit Score

@Anonymous wrote:

@AnonymousDid you say EQ uses EQ5 and EQ9 for this? Please elaborate.

Yes.

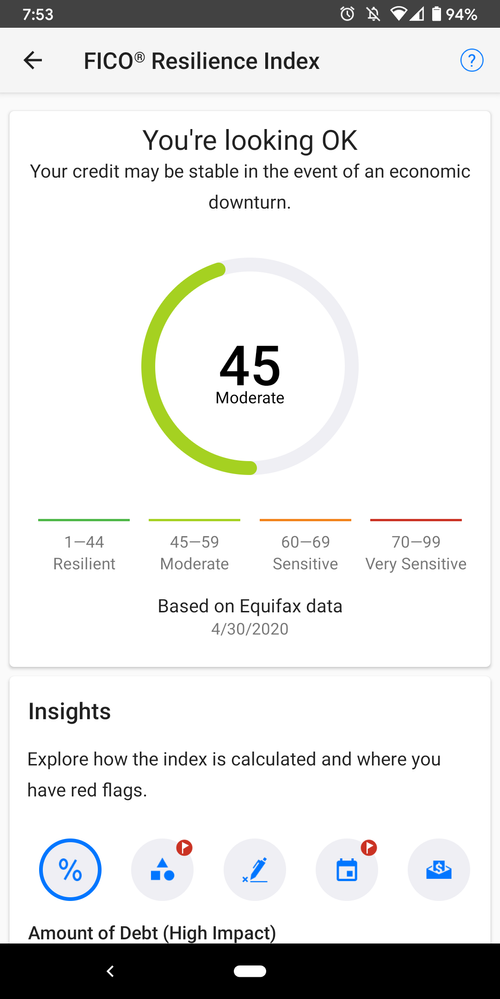

"Meet FICO® Resilience Index, a new analytic tool to help capture consumer credit risk linked to unexpected economic stress. A 2-digit score ranging from 1 to 99 (with higher values representing higher sensitivity to financial stress), FICO Resilience Index is designed for use in conjunction with FICO Scores 5, 8, and 9 and is delivered with up to five reason codes that help lenders better understand the output as well as support adverse action communication, if necessary.

Download the product sheet for FICO Resilience Index today to learn more."

https://www.equifax.com/product-sheets/fico-resilience-index/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

EQ FICO Resilience Index - Leaderboard as of May 15, 2020

Member Name | Score | Red Flags | Remarks |

| LaHossBoss | 41 | 0 | 6 unpaid CAs, 2 paid COs, Open Loan 34%, SLs reporting defaulted, Recent accounts (2mo), AAoA 9y 3mo |

| EW800 | 46 | 2 | 850 FICO 8s and 9s |

| tacpoly | 46 | 2 | |

| Thomas_Thumb | 48 | 2 | Perfect credit profile. |

| sjt | 51 | 2 | Was 52 then 47 now 51. 830+ all FICO 8s |

| LaHossBoss SO | 52 | 2 | Unpaid CAs, SLs defaulted |

| angelwingz | 53 | 2 | |

| Trudy | 54 | 1 | |

| CassieCard | 55 | 2 | Was 53. Now homeless and shoplifting for fun and profit. |

| CreditObsessedinFL | 58 | 2 | |

| sarge12 | 59 | 2 | Serving time in a women's prison. Won't leave. FICO 8s 819+ |

| NRB525 | 63 | 2 | |

| Revelate | 63 | 2 | EQ 8 826 and EQ 5 799. Putting it on his dating profile because it says 'Sensitive'. It's going to work. |

| Birdman7 | 64 | 2 | Sleeping. |

| RehabbingANDBlabbing | 66 | 2 | |

| Dumbee | 67 | ? | |

| Remedios | 67 | 2 | Was 65. Got prison tattoo and it got worse. |

| Kenro | 72 | ? | High 700s across all FICO 8s. |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 10/10T Changes Could Lower Your Credit Score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:EQ FICO Resilience Index - Leaderboard as of May 15, 2020

Member Name

Score

Red Flags

Remarks

LaHossBoss 41

0

6 unpaid CAs, 2 paid COs, Open Loan 34%, SLs reporting defaulted, Recent accounts (2mo), AAoA 9y 3mo EW800 46

2

850 FICO 8s and 9s tacpoly 46

2

Thomas_Thumb 48

2

Perfect credit profile. sjt 51

2

Was 52 then 47 now 51. 830+ all FICO 8s LaHossBoss SO 52

2

Unpaid CAs, SLs defaulted angelwingz 53

2

Trudy 54

1

CassieCard 55

2

Was 53. Now homeless and shoplifting for fun and profit. CreditObsessedinFL 58

2

sarge12 59

2

Serving time in a women's prison. Won't leave. FICO 8s 819+ NRB525 63

2

Revelate 63

2

EQ 8 826 and EQ 5 799. Putting it on his dating profile because it says 'Sensitive'. It's going to work. Birdman7 64

2

Sleeping. RehabbingANDBlabbing 66

2

Dumbee 67

?

Remedios 67

2

Was 65. Got prison tattoo and it got worse. Kenro 72

?

High 700s across all FICO 8s.

![]()

![]()

![]()

![]() I was just thinking of a nap, too! You're awesome @Anonymous !!

I was just thinking of a nap, too! You're awesome @Anonymous !!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Revelate wrote:

@Anonymous wrote:

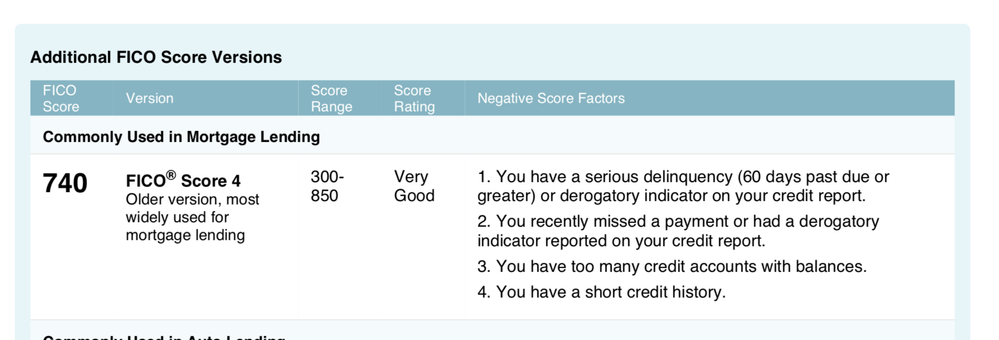

Yeah I haven’t had a lot of time to browse the site lately. I’ve pretty much just been responding notifications most of the time, so I missed it, but looking forward to reading it! Thank you for the link. I wonder if its serious delinquencies or just minors? Probably just minor.I don't know; previously 60D late was counted as a serious delinquency and that was confirmed not only by reason code but also by scorecard assignment by what reason codes flatly weren't there.

I never would have conjectured that say a 60D late could shift categories of seriousness but I can't explain it any other way. If 60D goes at 2 years what happens at 5 years for 90D for example? I still remember the one individual with a 90D hit a 798 on TU FICO 8... and for that matter what if this doesn't happen on EQ which has traditionally always punished my negatives more harshly than TU?

This really just blows up some of my previously held opinions.

"Inquiring Minds Wonder" if your memory was correct and an adjustment was made to the scoring system? Food for thought. Reminds me to go grocery shopping "oh joy"

Nah, FICO has only publicly adjusted a score twice in the last 20 years AFAIK post release, the first was the whole FICO 8 AU debacle where every stay at home parent with just AU's lost their credit scores overnight. The second was the HELOC changes, which we're still not really sure if FICO 04 was modified or just FICO 8 nearish release. Admittedly there could have been other quieter changes before those, but changing something like FICO 04 right now? We're talking about the score that underpins the ENTIRE mortgage market, trillions of dollars in real money. That's not done lightly, and I'm highly understating that.

As for my own memory I'm not that old yet ![]() . Example from a report 3-31-19 and I have others (I randomly just double-clicked in my credit reports folder on any TU report) and it's pretty clear this is bottom 4 scorecards aka derogatory. 30D late never had that reason code even when it was just added:

. Example from a report 3-31-19 and I have others (I randomly just double-clicked in my credit reports folder on any TU report) and it's pretty clear this is bottom 4 scorecards aka derogatory. 30D late never had that reason code even when it was just added:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:EQ FICO Resilience Index - Leaderboard as of May 15, 2020

Member Name

Score

Red Flags

Remarks

LaHossBoss 41

0

6 unpaid CAs, 2 paid COs, Open Loan 34%, SLs reporting defaulted, Recent accounts (2mo), AAoA 9y 3mo EW800 46

2

850 FICO 8s and 9s tacpoly 46

2

Thomas_Thumb 48

2

Perfect credit profile. sjt 51

2

Was 52 then 47 now 51. 830+ all FICO 8s LaHossBoss SO 52

2

Unpaid CAs, SLs defaulted angelwingz 53

2

Trudy 54

1

CassieCard 55

2

Was 53. Now homeless and shoplifting for fun and profit. CreditObsessedinFL 58

2

sarge12 59

2

Serving time in a women's prison. Won't leave. FICO 8s 819+ NRB525 63

2

Revelate 63

2

EQ 8 826 and EQ 5 799. Putting it on his dating profile because it says 'Sensitive'. It's going to work. Birdman7 64

2

Sleeping. RehabbingANDBlabbing 66

2

Dumbee 67

?

Remedios 67

2

Was 65. Got prison tattoo and it got worse. Kenro 72

?

High 700s across all FICO 8s.

What are you doing to me @Anonymous, some of the inmates saw this and now they are protesting having to be in the same prison with someone with very little resilience. I am now the laughing stock of cellblock D.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Haven't kept on this thread for a while but if we're submitting dps...

I'm at 45 with 2 red flags:

High percentage of revolving accounts and

Short credit history.

Rebuild start: 5/15/19

Financial Institutions:

Wells Fargo | NFCU | Penfed

Products:

Discover It CB $2.1k | WF Propel $22.5k | PenFed PCR $20k | NFCU Platinum $10k | NFCU More Rewards $25k | NFCU Flagship $30k | NFCU CLOC $500 | NFCU SSL 60mo | NFCU Auto loan