- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- FICO Resilience Index - a new nonsense number

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@joeyv1985 wrote:the Resilience Index focuses more on keeping your credit utilization low, avoiding too many accounts, and maintaining a long credit history.

Uuugh. I worked so hard to get back where I'm at since the last recession. I'm not going down without a fight. Thanks for pointing this out CassieCard.

I think you're doing just fine, with an EX 8 score of 755!

Recent inquiries and new accounts are likely to be a lender's greatest concern these days.

Thanks Cassie

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

My apologies @Anonymous , I did not realize you had to click on each flag for the explanation, so thank you for asking for clarification, which made me go back and look more closely. It is still the same 2 flags, with the headings you identified.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@CreditobsessedinFL wrote:

My apologies @Anonymous , I did not realize you had to click on each flag for the explanation, so thank you for asking for clarification, which made me go back and look more closely. It is still the same 2 flags, with the headings you identified.

All good! I changed it back to 2 flags here: https://ficoforums.myfico.com/t5/General-Credit-Topics/FICO-Score-Stress-Indicators-Indexes/m-p/6084167/highlight/true#M300214

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Anonymous wrote:

To begin with, it should only have the possibility of being used by Equifax Pullers. Then how many of those are actually going to use it?Experian has a webpage for the Resilience Index, directed at lenders, of course.

One of these months we might see our EX FICO Resilience Index score show up on the dashboard there.

Really??!! Does TU have a version too ? @Anonymous

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

To begin with, it should only have the possibility of being used by Equifax Pullers. Then how many of those are actually going to use it?Experian has a webpage for the Resilience Index, directed at lenders, of course.

One of these months we might see our EX FICO Resilience Index score show up on the dashboard there.

Really??!! Does TU have a version too ? @Anonymous

I haven't found anything specific to TU, but there's this (halfway down the page, CTRL-F for resilience) from the CEO of FICO:

"And while obviously, that's the prudent thing to do, we'd love for that to be a little more sophisticated and surgical and be able to evaluate some of the individuals below those cutoffs with more precision.

And that's really what FICO Resiliency Index does. It'll be bundled with the FICO Score. It will be widely available to anyone who's buying FICO Scores. It is currently in test, as you said, with Equifax and the Dow, Experian will have it out too. TU should follow. And yes, we have high expectations because it's been very well received today."

Yes...very well received....haha

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

That sucks I should’ve known. The Dow?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:That sucks I should’ve known. The Dow?

Maybe they use the index as part of some economic predictor? Like 'aggregate consumer/business resilience'. I couldn't find anything on that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO Resilience Index - a new nonsense number

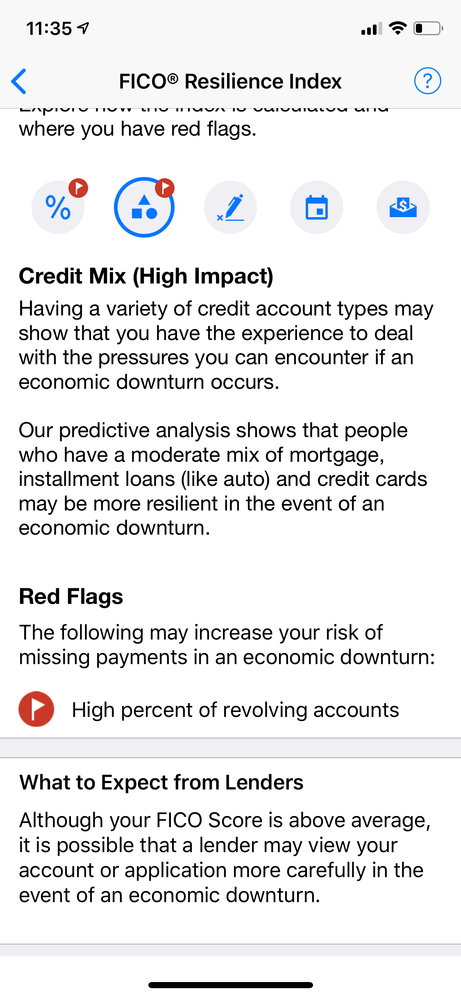

I checked my FICO file today and I see that my FICO Resilience Index has not changed one iota in the past month, so I thought I would present the facts and ask just what FICO is talking about. In my Resilience Index I am at 56 - the troublesome end of "Moderate" and 4 points from "Sensitive". In the FICO Resilience Index, the lower the number the better, from 1 to 99. My score has two red flags - Amount of Debt and Credit Mix. Let me discuss them each separately.

Amount of Debt -

Credit Mix -

This one is a little more complex. FICO looks at having a variety of credit types as a stregnth when facing financial stress. FICO is red-flagging me because all I have are credit cards - no installment loans. I admit it - all my loans have been paid off, and any credit card debt I have was charged within the past week and will be paid off by the end of the week. Would someone at FICO please explain to me how having no installment debt and at most 1% Util on the revolving debt is a financial weakness? I would think it is a financial stregnth. After all, if one has no debt, the probability of defaulting on that nonexistent debt is pretty low, and with no debt payments committed to, one's ability to weather a finacial crisis should be better than that of someone with a Debt to Income ratio of 30%.

Here are my FICO-8 scores.

**bleep**, looks to me like I'm a half an hour from bankruptcy. Too bad FICO doesn't show my $80,000 cash in the bank and my net worth of a half a million dollars.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Index - a new nonsense number

The 'credit mix' portion of FICO scoring is maddening, especially in this instance. We own our house and cars outright, so the only installment loan I have is a Self loan...just to HAVE something that's not a revolver.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content