- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Hi I have an AZEO question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Hi I have an AZEO question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi I have an AZEO question

I really want to use this method but I was watching a youtube video about it tonight - and a comment I read concerned me. Here is the comment I read, I'd love to get some thoughts on this.

"AZEO does not work. Tried it and creditors will show up as NR on the credit report if you go a few months with no balance. Ie. The creditor did not report anything for 6 months straight. Purchase 1 item for $100, paid it off to zero, two months later I started getting 'OK' again"

First of all is this comment accurate? If so, as someone new to building my credit with 4 cards totaling a $1500 CL, should I do this now? I had planned to do it but now I'm not so sure.

Lastly if I do decide to use the AZEO method, should I switch cards every month as the one to report a balance? That way I wouldn't get the NR on the credit report if I only use the same card for AZEO month after month?

Thanks so much, plz help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hi I have an AZEO question

I can't say what motivated that comment on the video because we don't know exactly how that person used the cards and account. What I can say is when I did AZEO before buying my house I rotated which card reported a balance each month and had no issues like that. It worked fine for me. What you gain by doing that is not just the maximum FICO scoring but you lower the risk that a creditor will close your card or decrease your credit line for lack of usage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hi I have an AZEO question

@Cowboys4Life wrote:I can't say what motivated that comment on the video because we don't know exactly how that person used the cards and account. What I can say is when I did AZEO before buying my house I rotated which card reported a balance each month and had no issues like that. It worked fine for me. What you gain by doing that is not just the maximum FICO scoring but you lower the risk that a creditor will close your card or decrease your credit line for lack of usage.

Really? I thought this helped your credit score go up even only a slight bit.

So you recommend switching cards every month for the AZEO reporting? See I plan on using all of my cards regularly each month so i doubt these cards would close my account or lower my credit limit right? If I'm using the cards?

My worry is what will show up on the credit report if I only report my 1 same card with a balance. i don't want NR to show like the person who commented wrote happened with him.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hi I have an AZEO question

@MikeyMagic wrote:

@Cowboys4Life wrote:I can't say what motivated that comment on the video because we don't know exactly how that person used the cards and account. What I can say is when I did AZEO before buying my house I rotated which card reported a balance each month and had no issues like that. It worked fine for me. What you gain by doing that is not just the maximum FICO scoring but you lower the risk that a creditor will close your card or decrease your credit line for lack of usage.

Really? I thought this helped your credit score go up even only a slight bit.

So you recommend switching cards every month for the AZEO reporting? See I plan on using all of my cards regularly each month so i doubt these cards would close my account or lower my credit limit right? If I'm using the cards?

My worry is what will show up on the credit report if I only report my 1 same card with a balance. i don't want NR to show like the person who commented wrote happened with him.

It CAN help your score. Having all cards reporting no balance WILL hurt your score. If you are actively using all your cards your creditors shouldn't panic if you pay off each month. What I am saying is by rotating which card reports a balance you reduce the risk that all the other cards reporting no balance for 6 months or more start reporting NR instead of good. My guess is the person who made that comment didn't use the card and let it have no balance for 5 months probably over a year where the creditor simply stopped reporting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hi I have an AZEO question

@Cowboys4Life wrote:

@MikeyMagic wrote:

@Cowboys4Life wrote:I can't say what motivated that comment on the video because we don't know exactly how that person used the cards and account. What I can say is when I did AZEO before buying my house I rotated which card reported a balance each month and had no issues like that. It worked fine for me. What you gain by doing that is not just the maximum FICO scoring but you lower the risk that a creditor will close your card or decrease your credit line for lack of usage.

Really? I thought this helped your credit score go up even only a slight bit.

So you recommend switching cards every month for the AZEO reporting? See I plan on using all of my cards regularly each month so i doubt these cards would close my account or lower my credit limit right? If I'm using the cards?

My worry is what will show up on the credit report if I only report my 1 same card with a balance. i don't want NR to show like the person who commented wrote happened with him.

It CAN help your score. Having all cards reporting no balance WILL hurt your score. If you are actively using all your cards your creditors shouldn't panic if you pay off each month. What I am saying is by rotating which card reports a balance you reduce the risk that all the other cards reporting no balance for 6 months or more start reporting NR instead of good. My guess is the person who made that comment didn't use the card and let it have no balance for 5 months probably over a year where the creditor simply stopped reporting.

Oh okay. Yeah I'm glad I found out that rotating the card every month is a better approach, I was gonna keep having my Cap1 card report a small balance and pay off the other cards in full before the statement date. But not now. But there will probably be a few week overlap where 2 cards are reporting a balance on my report at the same time(1 from current statement and 1 from previous statement)as I rotate cards to show a balance. For example, my Cap1 reports on the 14th, my Chase Freedom Rise reports on the 28th. So I either pay the Cap1 balance in full and all cards will show a zero balance for 2 weeks until I leave a little balance on my Chase card. Or, I leave the Cap1 balance for another month, 2 weeks later leave a balance on my Chase card and then 2 weeks later leave no balance on my Cap1 card. See what I'm saying? For 2 weeks there will be either no balance on any card if I choose to do it that way, or 2 balances showing until I pay 1 off 2 weeks later.

I'm probably confusing everyone lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hi I have an AZEO question

@MikeyMagic wrote:

@Cowboys4Life wrote:

@MikeyMagic wrote:

@Cowboys4Life wrote:I can't say what motivated that comment on the video because we don't know exactly how that person used the cards and account. What I can say is when I did AZEO before buying my house I rotated which card reported a balance each month and had no issues like that. It worked fine for me. What you gain by doing that is not just the maximum FICO scoring but you lower the risk that a creditor will close your card or decrease your credit line for lack of usage.

Really? I thought this helped your credit score go up even only a slight bit.

So you recommend switching cards every month for the AZEO reporting? See I plan on using all of my cards regularly each month so i doubt these cards would close my account or lower my credit limit right? If I'm using the cards?

My worry is what will show up on the credit report if I only report my 1 same card with a balance. i don't want NR to show like the person who commented wrote happened with him.

It CAN help your score. Having all cards reporting no balance WILL hurt your score. If you are actively using all your cards your creditors shouldn't panic if you pay off each month. What I am saying is by rotating which card reports a balance you reduce the risk that all the other cards reporting no balance for 6 months or more start reporting NR instead of good. My guess is the person who made that comment didn't use the card and let it have no balance for 5 months probably over a year where the creditor simply stopped reporting.

Oh okay. Yeah I'm glad I found out that rotating the card every month is a better approach, I was gonna keep having my Cap1 card report a small balance and pay off the other cards in full before the statement date. But not now. But there will probably be a few week overlap where 2 cards are reporting a balance on my report at the same time(1 from current statement and 1 from previous statement)as I rotate cards to show a balance. For example, my Cap1 reports on the 14th, my Chase Freedom Rise reports on the 28th. So I either pay the Cap1 balance in full and all cards will show a zero balance for 2 weeks until I leave a little balance on my Chase card. Or, I leave the Cap1 balance for another month, 2 weeks later leave a balance on my Chase card and then 2 weeks later leave no balance on my Cap1 card. See what I'm saying? For 2 weeks there will be either no balance on any card if I choose to do it that way, or 2 balances showing until I pay 1 off 2 weeks later.

I'm probably confusing everyone lol.

Here's something else I just read. Is this true does anyone know?

"It's also worth noting that the one card you leave a balance on should not be a Chase card, ideally. Any time you pay your balance down to zero Chase will report it to the bureaus regardless of where you are in your billing cycle. So you might pay your $10 min payment to Chase 2 weeks into your AZEO and now you're showing all zeros."

Of course I was gonna leave a balance on my Chase card every few months as I pick a different card to do that. But now I'm not sure I should.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hi I have an AZEO question

@MikeyMagic wrote:I really want to use this method but I was watching a youtube video about it tonight - and a comment I read concerned me. Here is the comment I read, I'd love to get some thoughts on this.

"AZEO does not work. Tried it and creditors will show up as NR on the credit report if you go a few months with no balance. Ie. The creditor did not report anything for 6 months straight. Purchase 1 item for $100, paid it off to zero, two months later I started getting 'OK' again"

First of all is this comment accurate? If so, as someone new to building my credit with 4 cards totaling a $1500 CL, should I do this now? I had planned to do it but now I'm not so sure.

Lastly if I do decide to use the AZEO method, should I switch cards every month as the one to report a balance? That way I wouldn't get the NR on the credit report if I only use the same card for AZEO month after month?

Thanks so much, plz help.

Ignore YT videos. Use your cards and PIF before the statement date. Let one report 6%. Thats my sweet spot. Usage gets you CLI's. Whats posted doesnt do anything but show you left a balance at statement date. I've been AZEO since 2015. I'll switch it up swiping a card I havent used in a while to show usage. Then move to another. But the card that gives the most gets used the most in the long run.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hi I have an AZEO question

@MikeyMagic wrote:I really want to use this method but I was watching a youtube video about it tonight - and a comment I read concerned me. Here is the comment I read, I'd love to get some thoughts on this.

"AZEO does not work. Tried it and creditors will show up as NR on the credit report if you go a few months with no balance. Ie. The creditor did not report anything for 6 months straight. Purchase 1 item for $100, paid it off to zero, two months later I started getting 'OK' again"

First of all is this comment accurate? If so, as someone new to building my credit with 4 cards totaling a $1500 CL, should I do this now? I had planned to do it but now I'm not so sure.

Lastly if I do decide to use the AZEO method, should I switch cards every month as the one to report a balance? That way I wouldn't get the NR on the credit report if I only use the same card for AZEO month after month?

Thanks so much, plz help.

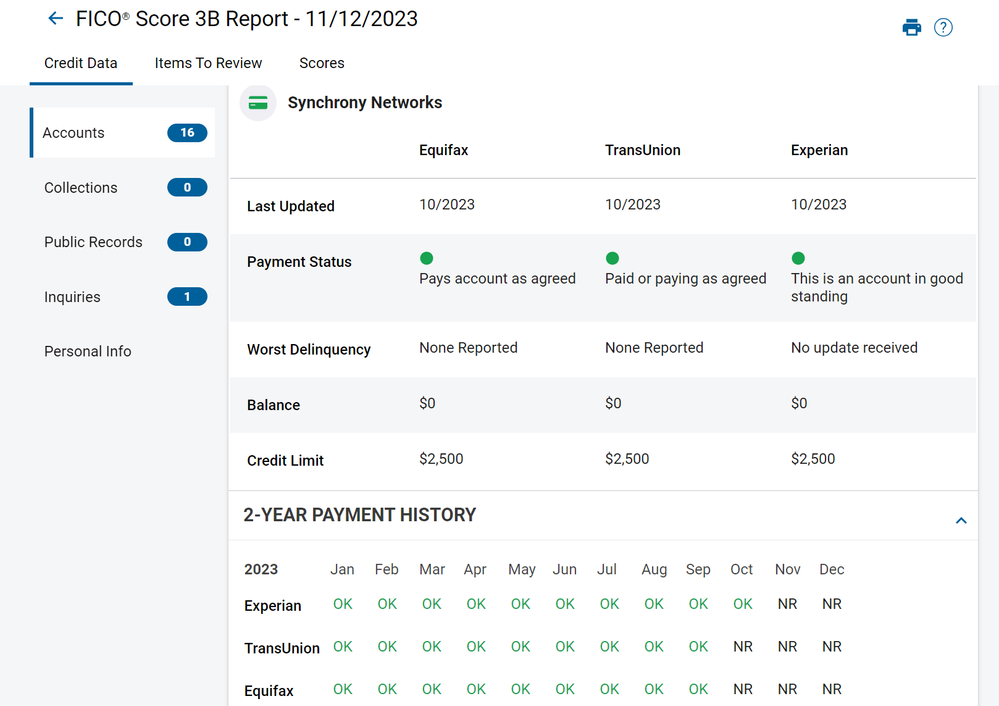

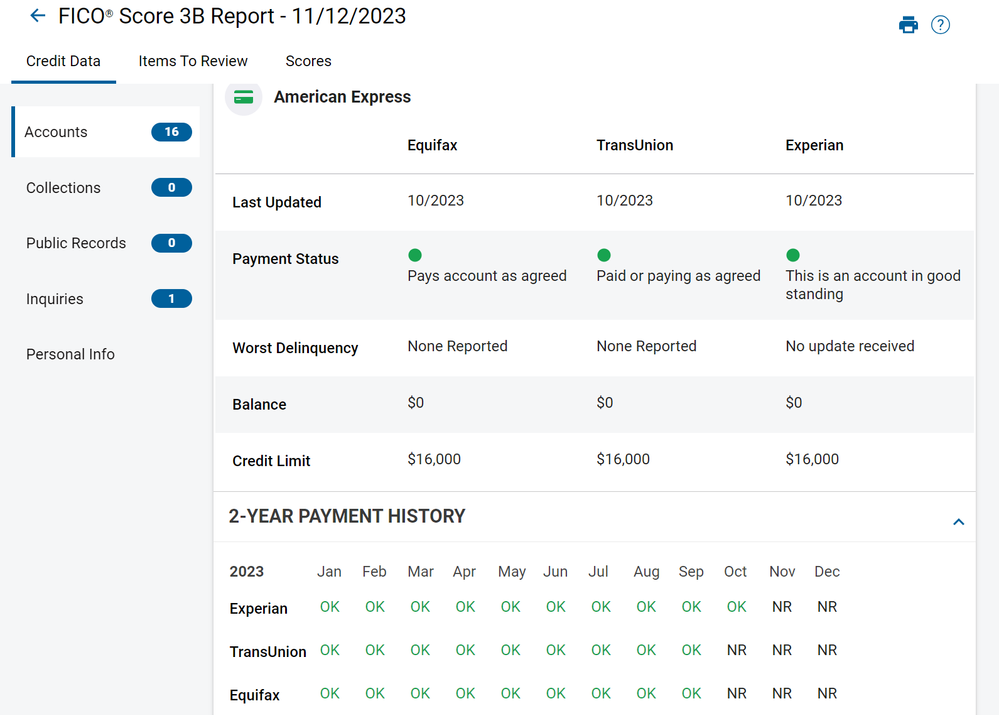

i've had this syncrony account and amex account for years, paid them off in March of 2022, and have not used since. of course it's a YMMV sitatuation, but I don't think what was said is truth.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hi I have an AZEO question

@MikeyMagic wrote:I really want to use this method but I was watching a youtube video about it tonight - and a comment I read concerned me. Here is the comment I read, I'd love to get some thoughts on this.

"AZEO does not work. Tried it and creditors will show up as NR on the credit report if you go a few months with no balance. Ie. The creditor did not report anything for 6 months straight. Purchase 1 item for $100, paid it off to zero, two months later I started getting 'OK' again"

First of all is this comment accurate?

No, it's completely false.

If so, as someone new to building my credit with 4 cards totaling a $1500 CL, should I do this now?

Sure you should, if you want to try to optimize the revolving utilization component of your FICO scores.

I had planned to do it but now I'm not so sure.

Lastly if I do decide to use the AZEO method, should I switch cards every month as the one to report a balance?

It doesn't matter.

What does matter is not using (a) store cards, or (b) Chase cards.

That way I wouldn't get the NR on the credit report if I only use the same card for AZEO month after month?

Thanks so much, plz help.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hi I have an AZEO question

@MikeyMagic wrote:

@Cowboys4Life wrote:

@MikeyMagic wrote:

@Cowboys4Life wrote:I can't say what motivated that comment on the video because we don't know exactly how that person used the cards and account. What I can say is when I did AZEO before buying my house I rotated which card reported a balance each month and had no issues like that. It worked fine for me. What you gain by doing that is not just the maximum FICO scoring but you lower the risk that a creditor will close your card or decrease your credit line for lack of usage.

Really? I thought this helped your credit score go up even only a slight bit.

So you recommend switching cards every month for the AZEO reporting? See I plan on using all of my cards regularly each month so i doubt these cards would close my account or lower my credit limit right? If I'm using the cards?

My worry is what will show up on the credit report if I only report my 1 same card with a balance. i don't want NR to show like the person who commented wrote happened with him.

It CAN help your score. Having all cards reporting no balance WILL hurt your score. If you are actively using all your cards your creditors shouldn't panic if you pay off each month. What I am saying is by rotating which card reports a balance you reduce the risk that all the other cards reporting no balance for 6 months or more start reporting NR instead of good. My guess is the person who made that comment didn't use the card and let it have no balance for 5 months probably over a year where the creditor simply stopped reporting.

Oh okay. Yeah I'm glad I found out that rotating the card every month is a better approach, I was gonna keep having my Cap1 card report a small balance and pay off the other cards in full before the statement date. But not now. But there will probably be a few week overlap where 2 cards are reporting a balance on my report at the same time(1 from current statement and 1 from previous statement)as I rotate cards to show a balance. For example, my Cap1 reports on the 14th, my Chase Freedom Rise reports on the 28th. So I either pay the Cap1 balance in full and all cards will show a zero balance for 2 weeks until I leave a little balance on my Chase card. Or, I leave the Cap1 balance for another month, 2 weeks later leave a balance on my Chase card and then 2 weeks later leave no balance on my Cap1 card. See what I'm saying? For 2 weeks there will be either no balance on any card if I choose to do it that way, or 2 balances showing until I pay 1 off 2 weeks later.

I'm probably confusing everyone lol.

You can use your Capital One card every month as your balance-reporting card.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682