- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: How's your credit journey coming along?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How's your credit journey coming along?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

@Anonymous wrote:Thought it might be nice if some of us shared a few details about our credit journeyWhen did the journey start, any mistakes, frustrations, progress, what are you hoping to accomplish etc.,

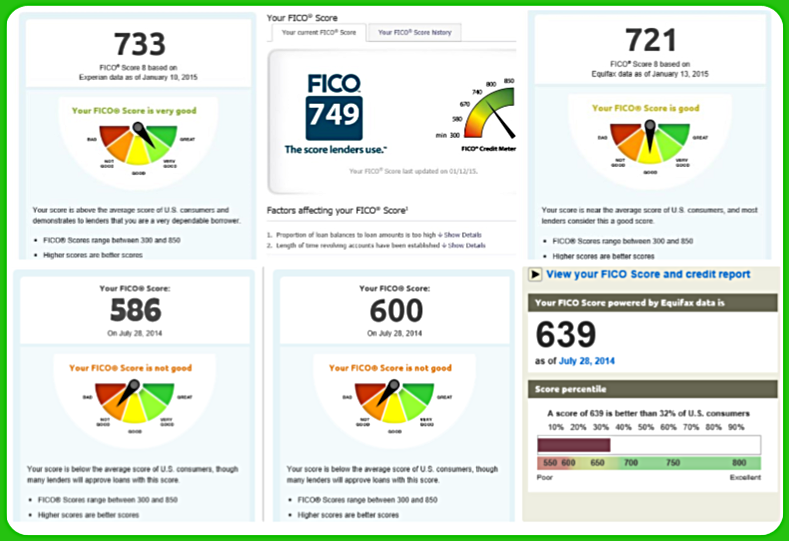

Start: July 2014AAoA: 10 monthsEX - Score 586 - 1 fraudulent collection, $2300 tow for a car I never owneddisputed and removed August 2014

TU - Score 600 - 1 fraudulent collection, $191 Comcast bill in my name with the wrong social numberdisputed and removed August 2014

EQ - Score 639 - Clean Report2 Student Installment Loans Opened 2012 & 2013 - $6000 totalZero Revolving Accounts/Credit CardsApprovals:Capital One Platinum $300 SL 07/2014 (closed 10/2014) / Chase Freedom $500 SL 07/2014 (closed 01/2015) / SmartConnect $600 SL 07/2014 (closed 10/2014) / Victoria Secret $800 SL 07/2014 (closed 10/2014) / Chase Sapphire $5000 SL 08/2014 / Sallie Mae $1300 SL - reconned to $2800 - 10/2014 / Discover $1500 SL 10/2014 / Amex BCE $3900 SL - initially denied, recon letter sent ended in highest SL reporting at the timeDenials:NFL Barclay Card - Resulted in emotional apping for SmartConnect and VS looking for an approval high 07/2014Citi Double Cash - Sent a recon letter same day as BCE but never heard a word back 10/2014, turned out to be a blessing in disguise as I'm no longer interested in this card.Mistakes:1.) Applied for Platinum and Freedom cards 07/24/2014 prior to pulling my FICO scores, only had free FAKOS. At the time wasn't aware of the difference at all. Pulled FICO reports 07/28/2014, definitely a difference.2.) Applying for cards based on emotion and seeking an approval after rejection. Not wise.3.) Applying for cards with zero knowledge of how inquiries accrue or effect ones credit profile.4.) Initially focusing on and obsessing over my scores rather than my overall profile.5.) Not having any sort of plan or strategy in place until 09/2014. This is key for me, I function much better when there's a plan in place.Progress:Clean reports across the board in August 2014, woohoo!Score increases across the board with collections removed and new accounts reporting 09/2014.Utilization kept below 10% at all times, payments well above minimum every month.12/2014 - 680ish scores for EX and EQ, low 700’s for TU01/2015 - Amex MSD change to 11/2000 reports, a few inquiries cross the six month mark, util drops from 8% to 6% - scores exceed first goal of 700’s across the board and second goal of 720’sMain Goals:Clean reports across the board - CheckUtilization below 10% and/or debt below $1000 at all times - CheckAbsolutely no late payments - CheckNo more store cards (nothing wrong with them, noticed they aren't personally useful) - CheckClose accounts that aren't needed - Check…..and I’d do it again without an ounce of regretClimb out of toy limit hell - CheckDiversify - Check700’s across the board within six months - CheckNew Goals:Garden until May 2015 then apply for Chase Ink CashNo new cards reporting to personal credit and dragging my AAoA back down after the MSD helpAttempt to get APR reductions and SP CLI’s on all cards during 2015760’s across the board by 01/2016So where are you in your journey? Feel free to share as much or as little as you like. This is a no judgment zone (so don't come round here judging me either k friends) we all have different paths to take and different methods that work for us. Lets respect the individuals journey.This website is absolutely amazing with a wealth of knowledge and I know I wouldn't have come this far without the community here!P.S. To the one incredibly rude and downright disrespectful jerk I encountered a couple months ago telling me what I could and couldn't do based on my scores/profile I’d like to say......…thank youFor being so incredibly WRONG!

****Scores from left to right - EX, TU, EQ****

Congrats on all your progress and achievements!

This is a great thread. After I retrace all my steps, I'll post my journey thus far.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

Thanks for sharing everyone ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

My credit journey started about 2 years ago. I was just a myFICO lurker and I only have 3 CCs back then: WF, Best Buy, and CareCredit. Then one day I realized that most fiancial decsions we would make in our life depends on how good our credit is. So I decided to read a ton about credit and I became a proud member of myFICO forums. Then on March of 2013, I apped for Amex Blue cash, then two months later, I did first app spree which cosist of Amex Blue, Discover More (now IT), Sallie Mae World Master Card, and WF LOC. A month later, I applied for my goal CC--Chase Sapphire Preffered and I was so joyed that I got it (I had to talk to a CSR). March of last year, I did my last (possibly) app spree and I got the Barclaycard Ring, Chase Slate, City Simplicity, and AAA BofA card. All was good after I started my journey to have a great credit score and knowledge about basic finance. Then the good/bad happened...

Mistakes I made: My spending habit became a mayhem when I met my now ex gf... I went from having an 8% util into 23% util as of today.. Lesson learned... haha lol. Aside from that, I haven't reallly made any major mistakes thanks to the great people of myFICO forums. ![]()

Here's my current CCs and limit:

Current Score: (10/18) TU-8: 813 EX-8: 808 EQ: 797

Goal Score: (7/20) 800+ for all three bureaus

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

what a great thread! i'm going to sit down and think about my credit journey over the last year and set up new goals for the year, great idea!!! thanks everyone for sharing their stories.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

My apologies, this is lengthy:

01/2007

Declared BK7. To be honest, I knew I should check my scores, but honestly, didn’t have the heart.

Paid off existing car loan to keep vehicle for work and life and continued making payments on CU Visa or they would release my car title.

Figured I was a goner to the credit world, so I just used cash or debit cards.

09/2008

Received pre-approved offer from WaMu for Platinum Visa. Assumed I would be denied but put app in anyway. Was approved for $2.5K CL and 11.99% APR. Woohoo – a sign of life!

05/2009 (I think)

Apped for Nordstrom card – denied.

Starting reading pages at myFICO shortly before I put app in. Must have read the wrong post because I distinctly remember reading that Norstrom was BK friendly. Totally not the case.

Later in 2009

WaMu consumed by Chase. End of the year received a letter cutting CL to $1.3K and raising APR to 22% or in that neighborhood. I wasn’t a happy camper but what could I do? Had always paid account in full except for 1 month that I carried over $2,300. Paid the whole thing in one shot. Letter I receive stated not using full available credit. Really? Guess I should have charged 99% instead of 92%.

Trudged along for a few more years with only the one card, which was fine because I learned great discipline and better spending habits. At least, I had something in case of emergencies.

Jump ahead to late 2012

After reading extensively on this wonderful site, I employed the SCT to grab a VS card. Only a $500 CL, but it was an additional TL.

02/2013

SCT for J. Crew – another $500 CL.

Auto finance through Honda at 2.95%. Chase and TD declined me, which is fine because their interest rates would have been higher.

03/2013

With a surge of confidence and a string of pre-approvals over the months, I apped for the Discover It. Instant approval for $6.5K. I was on my way!

Signed up for myFico to share my story, and started receiving advice and sharing experiences with the ever so helpful members.

So far, so good, right? Yes, except I spent a little too much time reading about the great benefits and all the approvals for the CSP and Marriott Rewards. Yep, you guessed it, I apped, although not at the same time. I put one in April 2013 and the other in January of 2014. Both apps were declined even on recon.

I learned a lot from those denials, so it wasn’t bad at all. In hindsight, neither of the cards was the best fit for my lifestyle. I also learned there are some woefully poorly trained reps at Chase.

Also in April, since I already had one HP I decided to put an app in for Amex – the green card. I knew going in I would not be approved but I wanted to know the reason for denial. If there was only an SP I would know I was still on the dreaded blacklist. Declined due to BK. Hmmm, there might be hope.

07/2013

Responded to pre-approval from Barclays for Reward MC. Instant approval for $1.3K, reconned to $3K. Six months later received auto CLI to $5.2K. Barclays has been great for me.

01/2014

Apped for Barclays Arrival. Had to recon this since my history with them was less than a year. Approved for $5K. Sometime later closed Rewards MC and moved CL to Arrival. Arrival was upgraded to Arrival+, then to the WEMC.

Stayed in the garden until December 5, 2014, when the 50K bonus points on US Airways became too much to resist. Approved on recon for $5K.

At this point, I was pretty pleased with my progress. I regularly refuse offers from cashiers to apply for store cards, and learned to analyze which cards best suit my needs/wants.

How I longed for an Amex card. I knew that having one would do wonders for my AAoA, but after the experiences with Chase, I knew in my heart I was a year or two away from grabbing that coveted prize. That is what the rational me knew. Then along came the happy holidays let’s over indulge in the Baileys me, who sat at the computer and said, “Let’s do it! It’s only one inquiry. App for the Amex ED. Screw the go for a charge first, then a revolving card philosophy.“

BAM!! Instant approval for $11.3K CL with a 13.99% PR after introductory rate. My shock was exceeded only by my elation.

It’s been quite the journey, and the success is due in large part to my finding these forums. I would not be this far along without the myFICO community.

I have no idea what my next steps will be. The approval for Amex ahead of schedule leaves me slightly at loose ends. But I will figure it out. Right now, I just need to manage and leverage the cards I have.

Current Cards/Limits

Love Loft $1,200

VS $2,250

J. Crew $5,100

US Airways $5,000

Discover It $6,500

Arrival+ WEMC $10,200

Amex ED $11,300

EDIT: With the focus on CCs, I completely forgot that I paid off all my student loans about 5 yrs ahead of schedule. So glad to have those monkeys off my back. Just one more year to go on auto loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

@FocusedAndDetermined wrote:My apologies, this is lengthy:

How I longed for an Amex card. I knew that having one would do wonders for my AAoA, but after the experiences with Chase, I knew in my heart I was a year or two away from grabbing that coveted prize. That is what the rational me knew. Then along came the happy holidays let’s over indulge in the Baileys me, who sat at the computer and said, “Let’s do it! It’s only one inquiry. App for the Amex ED. Screw the go for a charge first, then a revolving card philosophy.“

I can dig it! ![]() Dont really care much for that philosophy myself. Amazing story FocusedAndDetermined, congrats on coming such a long way!

Dont really care much for that philosophy myself. Amazing story FocusedAndDetermined, congrats on coming such a long way!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

@Anonymous wrote:

@FocusedAndDetermined wrote:My apologies, this is lengthy:

How I longed for an Amex card. I knew that having one would do wonders for my AAoA, but after the experiences with Chase, I knew in my heart I was a year or two away from grabbing that coveted prize. That is what the rational me knew. Then along came the happy holidays let’s over indulge in the Baileys me, who sat at the computer and said, “Let’s do it! It’s only one inquiry. App for the Amex ED. Screw the go for a charge first, then a revolving card philosophy.“

I can dig it!

Dont really care much for that philosophy myself. Amazing story FocusedAndDetermined, congrats on coming such a long way!

Thank you for starting this thread. It was a good exercise to recap and list all that has transpired in the last several years. I know my life would have been just fine without the line-up of cards I have, but with the increased flexibility and bonus rewards I am able to do so much more.![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

@FocusedAndDetermined wrote:

@Anonymous wrote:

@FocusedAndDetermined wrote:My apologies, this is lengthy:

How I longed for an Amex card. I knew that having one would do wonders for my AAoA, but after the experiences with Chase, I knew in my heart I was a year or two away from grabbing that coveted prize. That is what the rational me knew. Then along came the happy holidays let’s over indulge in the Baileys me, who sat at the computer and said, “Let’s do it! It’s only one inquiry. App for the Amex ED. Screw the go for a charge first, then a revolving card philosophy.“

I can dig it!

Dont really care much for that philosophy myself. Amazing story FocusedAndDetermined, congrats on coming such a long way!

Thank you for starting this thread. It was a good exercise to recap and list all that has transpired in the last several years. I know my life would have been just fine without the line-up of cards I have, but with the increased flexibility and bonus rewards I am able to do so much more.

That's a good mentality there. Unless you get one of those special targeted offers that the PRG is known to come with or really could justify having the Amex Plat, I wouldn't waste my time on those.

Current FICOS: Mid 640s-50s on all reports, Ch 7 BK D/C Aug 2019

Starting scores: EX - 534, EQ - 574, TU - 516 | Total TLs: $91k approx | Total Utilization: 17%, getting this back down

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How's your credit journey coming along?

@enxinas wrote:My credit journey started about 2 years ago. I was just a myFICO lurker and I only have 3 CCs back then: WF, Best Buy, and CareCredit. Then one day I realized that most fiancial decsions we would make in our life depends on how good our credit is. So I decided to read a ton about credit and I became a proud member of myFICO forums. Then on March of 2013, I apped for Amex Blue cash, then two months later, I did first app spree which cosist of Amex Blue, Discover More (now IT), Sallie Mae World Master Card, and WF LOC. A month later, I applied for my goal CC--Chase Sapphire Preffered and I was so joyed that I got it (I had to talk to a CSR). March of last year, I did my last (possibly) app spree and I got the Barclaycard Ring, Chase Slate, City Simplicity, and AAA BofA card. All was good after I started my journey to have a great credit score and knowledge about basic finance. Then the good/bad happened...

Mistakes I made: My spending habit became a mayhem when I met my now ex gf... I went from having an 8% util into 23% util as of today.. Lesson learned... haha lol. Aside from that, I haven't reallly made any major mistakes thanks to the great people of myFICO forums.

Here's my current CCs and limit:

Wow, you've done just great! ...and now that you are free of the excess baggage you'll be just fine.![]()

![]()