- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- My First Score (FAKO VS FICO)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

My First Score (FAKO VS FICO)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My First Score (FAKO VS FICO)

Providing Data Points..

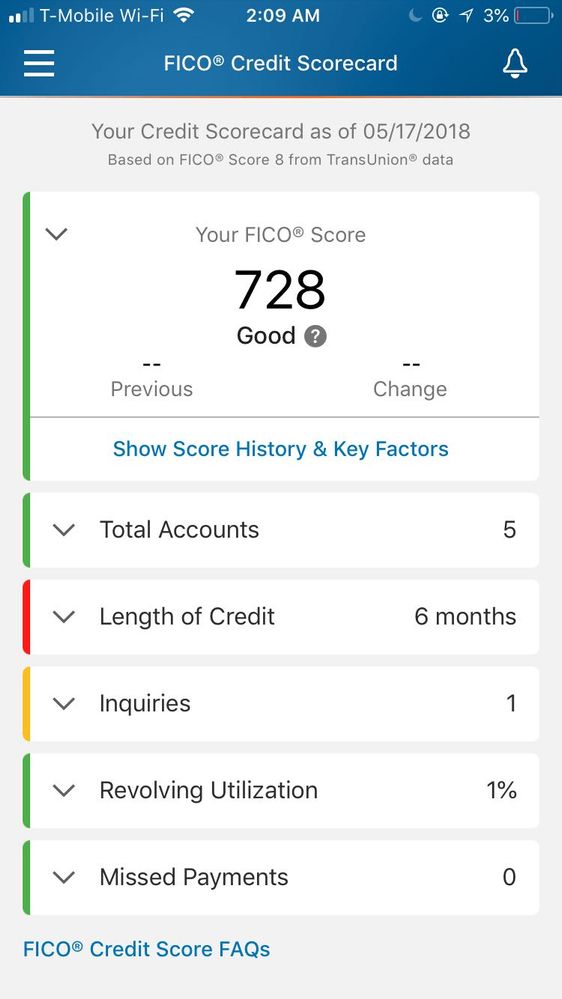

So today marks 5th month and 25th day since I first opened my CC (Discover IT) **Yaayiee, finally eligible for FICO**. Though Credit Karma, Credit Journey of Chase and Creditwise of Cap one which all are powered by Vantage 3.0 of TU provided me FAKO scores of mid 600's to upper 600's in last six months which gave me a perspective or sense of direction. Today, finally I was able to access Fico 08 of Discover scorecard (powered by TU) and it showed me a score of 728 - This made my Jaw drop.

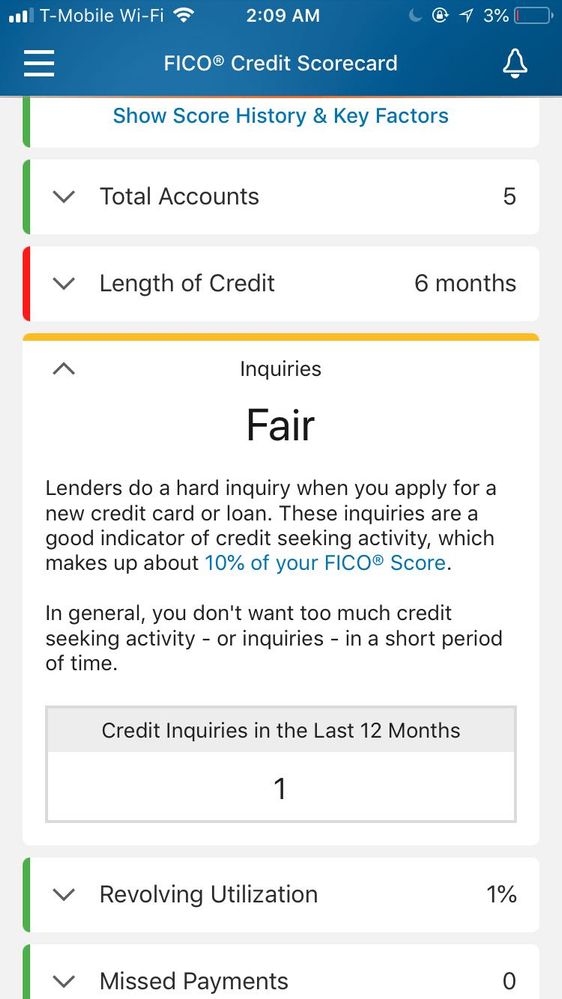

On digging deeper, I realized the number of inquiries in last 12 months shows 1 contradicting CK and other monitoring tools which has 5 on TU and 7 on EQ.

I believe that is the reason why it provided me high scores of 720+. Probably next month they will reflect all inquiries and I need to be prepared to see a drop of 30 - 40 points. ![]()

If anyone faced a similar scenario please reply. It would be nice to collect data points.

PS: I did read about that Discover Scorecard made mistakes earlier but not sure if they are still making mistakes in inquiries section.

note: If members with Discover card are using their scorecard tool they provide TU powered FICO 08, and If its non-members the Discover Scorecard uses EX powered Fico 08.