- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Question about Equifax reporting

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Question about Equifax reporting

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Equifax reporting

On an Equifax credit report, if an account shows up in the "closed accounts" section and is PAID, shouldn't the actual "status" report as PAID? For example, a revolving account that went to internal collections and was paid in full after charge off, showing in closed accounts, with Charge-off in the status column, but then in comments it states: Paid, Charge off.

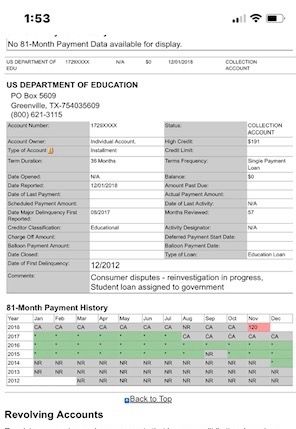

2nd Derog account is listed as an installment loan in account type, but the "status" says : collection account ... (account has a zero balance and was PIF in August 2018). CRA shows "CA" for Sept, Oct, and then added 120 for November 2018. The way this one is being reported seems a bit contradictory as it says it's an installment loan, but then a collection account as well.

So, I guess my main question is.... Shouldn't both show an actual status as PAID, and not reporting and further monthly updates as CA or 120?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Equifax reporting

Hopefully Robert will be along and post more details but those seem to be reporting correctly.

If they did get charged off, it will report as a paid CO. A loan that went to collections will also report as such.

It was once 120 days late? yes? If so that is correct info on their part.

Paying the lates & CO doesn't require the reporting to change back to paid, as that wouldn't reflect the actual status of what occurred with the accounts.

Sorry but I believe both of those are correct per the details you provided.

But check for a reply by RobertEG- he's the reporting Guru around here..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Equifax reporting

Thanks for your response Pikaboo...

I was just confused how an account can show that is an installment loan and listed under closed accounts, but then listed as a collection account in status. A collection is the correct account type that it is, and from 2013. It was changed by OC and now reports an installment loan with 36mo of on time payments, although there were never any payments made, then updating it in August as paid, then FP for Sept and October, THEN 120 day late in November. It just seems that if the account was reporting as a collection, they wouldn't be able to continue reporting FP after it was paid. I don't know what would cause my FICO more harm at this point either.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Equifax reporting

It can get confusing at times, but I think you are wanting to make sure your report isn't damaged any further, and that is okay. It never hurts to make sure the info is reporting correctly.

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Equifax reporting

bump

@robertEG

Do you have any of your good advice to offer. I literally have 2 derogs on my credit reports that are haunting me. Both of which, I feel are being reported wrong. Have disputed to CRA's and also directly to OC with results coming back as verified and correct. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Equifax reporting

The CRA reporting manual ("Credit Reporting Resource Guide") provides codes that permit a creditor to update the current status of an account that was previously charged off to either simply "Paid," or to optionally report the more detailed status as "Paid, was a Charge-off."

Both reflect a current status that the account is no longer delinquent, with the second including the special comments information that it was charged-off at the time it was paid.

Either is acceptable reporting.

As for the reporting of CA by a creditor, if the collection is being done by their own internal collection department, then they are not a debt collector, and thus their "collection" is internal, and not a third-party collection being reported by a debt collector.

They are only reporting that the loan was being pursued internally for collection, and it is not a debt collector collection.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Equifax reporting

@robertEG

So, are you saying that the above is being reported accurately then? My concern is that DofE is stating that this is a collection account and not an installment account. I've verified over the phone. Is this hurting my credit further, by reporting these very current derog payments and topping it off with a 120 day late in Nov 2018? I had the understanding that a collection account is reported and can be updated each month until paid, but didn't show 30,60,90,120 day lates etc. Like I said, I only have 2 derogs on my report now, and both seem to be reporting incorrectly. This one being the most incorrect. Bottom line is what will hurt more? The way its being reported now? Or a Collection reported 2/2013 for $183 and being paid in full in 8/2018? Thanks for your input. I really do appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Equifax reporting

It’s incredibly irritating that they get away with that garbage. It happened to me when Ford updated after I paid off my repo. They flipped my reporting upside down and made it look like the repo was in 2014 instead of 2012 when it happened and I never succeeded in getting it fixed. Since it didn’t change my DoFD though I just decided to stop fighting it (I got EE from TU this month and gained 54 points for it and I am going to ask EX in April).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Equifax reporting

I just don't see how this is accurate reporting. I never signed or agreed to a 36 mo installment loan, and for them to report it that way seems illegal.

According to the DoFd, It should be dropping off of my reports on 12/2019. What are the requirements for the EE with CB's?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Equifax reporting

@Sadie5150 wrote:I just don't see how this is accurate reporting. I never signed or agreed to a 36 mo installment loan, and for them to report it that way seems illegal.

According to the DoFd, It should be dropping off of my reports on 12/2019. What are the requirements for the EE with CB's?

You can ask TU 6 months in advance, EX 3 months in advance, and EQ 1 month in advance.

TU was dead simple. I went online and filed a dispute for them with reason code other, typed in I was requesting an Early Exclusion, got an email 3 hours later (on a Saturday no less) that they had deleted the 3 accounts.

As for the incorrect reporting, I’m sure RobertEG or someone else who is well versed in these things will weigh in on your picture.

At least they didn’t change your DOFD. On my EQ, my ACS student loans that I paid in full in 2014 have a DOFD of 3/2014 because they reported it as a new delinquency instead of a continuous one from 2012 when I first went delinquent because I was fighting for disability and couldn’t pay a dime. I disputed it because the dates are wrong and it’s currently off my report but I’m preparing for the next step when it comes back. Hopefully ACS agrees that it was delinquent in 2012 as I complained and it stays off.