- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Rebuilding Milestone

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Rebuilding Milestone

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rebuilding Milestone

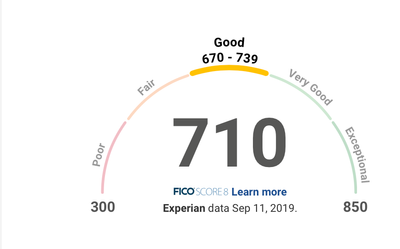

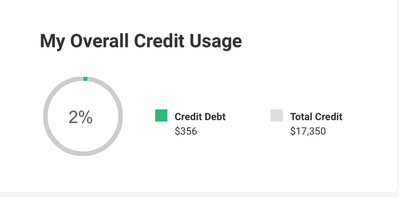

Good evening guys and gals. I started my rebuild about 2 years ago with Capital one. I also somehow got an American Express Everyday card. Before this time, I had NO good credit, I lived paycheck to paycheck, and no one would give me a loan. I ended up with subprime cards, $200 amazon, $500 walmart store card (synchrony). Well, My utilization has stayed around 95%. I kept trying to get credit, since I had excellent payment history for the last 2 years. My credit all together is about $10K. Well, yesterday, my wife took out of her 401K, and today I paid all $10K of my credit card debt down. Every last cent of it. Now i just got to wait till the companies start reporting to the bureaus. I would give that a month from now for everyone to report (since they all report on different days). I expect my scores to go from 616 to about 700. thats what the simulators all say. Does this sound about accurate to you guys? Im just excited everything is paid, hopefully i can get a big boy card soon, so i can get rid of some of thes subprime cards like Credit 1, or First Premier Bank, and Merrick.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Milestone

I’d put a $10 charge on one card though and let it report. There’s a known penalty for reporting 0 utilization which will cost you 10-15 points.

Going forward, use your cards all you want but pay them down so one bank card reports a small balance and any others report zero. That’ll max out what your profile will support.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Milestone

So, Just wanted to give an update.

As of today, All of my credit cartds are paid, with just $300 from somewhere not reporting.

Thank you for all your help and encouragement. Now hopefully i can get a big boy card.

I have one baddie which is a medical collection for $200 that was paid. It was only in collections for 3 months before i paid it, but it is on my credit reports. I sent a goodwill letter, but they denied it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Milestone

As for that medical, google the HIPAA Process - you can have medicals removed pretty easily. I used it and had mine removed in 5 days.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Milestone

Congrats! That's certainly a nice jump in scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilding Milestone

Hey Devil,

I looked up that HIPAA, and i was starting to write that letter, but i sent an email the other day, and this is the response. I dont believe they are willing to work with me to get the paid collection removed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content