- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Report Card Lost = 30 Point Drop

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Report Card Lost = 30 Point Drop

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report Card Lost = 30 Point Drop

So to make a long story short - had some small unknown charges (pending) on my BBVA Clearpoints CC.

Reached out to BBVA, their CSR recommended that I report the card Lost/Stolen and they would close that account and issue me a new card. I recall even asking the agent if they are sure this is the right process even though I had the card in hand, they said yes.

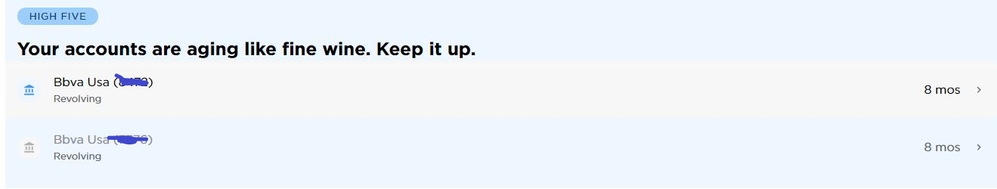

That was a few weeks ago. All of a sudden the last 24-hours or so, I am seeing all these TU Vantage Score drops (28-31 points), and from the look of things its like they are reporting the new BBVA card as an additional account, but I could be wrong on that.

I find it odd that TU Vantange is being affected, since BBVA pulled EX back when I got it.

Waiting to see if this eventually affects my FICO scores as well.

Has anyone else had this happen to them?

Potential Future Cards

Closed Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Report Card Lost = 30 Point Drop

Why is that weird?

A new account will cause score recalculation with each CRA, it has nothing to do with where the HP landed in the past. If a new account causes scoring change, you will see it on each CRA, not just the one with HP.

If it stays as new account, i doubt you will see much in terms of scoring change (if any) since you already have a bunch of accounts under a year, unless it impacts aging metrics.

Vantage going to Vantage. You can lose 50 points for logging in, gain 100 if you scroll long enough. It's temperamental.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Report Card Lost = 30 Point Drop

@Remedios wrote:Why is that weird?

A new account will cause score recalculation with each CRA, it has nothing to do with where the HP landed in the past. If a new account causes scoring change, you will see it on each CRA, not just the one with HP.

If it stays as new account, i doubt you will see much in terms of scoring change (if any) since you already have a bunch of accounts under a year, unless it impacts aging metrics.

Vantage going to Vantage. You can lose 50 points for logging in, gain 100 if you scroll long enough. It's temperamental.

It's just that its not a new account per se', just a replaced credit card. I would expect the drop if I opened another account with BBVA, but I didn't. It was a replacement for fraudulent charges. Hopefully this is only affecting Vantage score and nothing more.

Potential Future Cards

Closed Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Report Card Lost = 30 Point Drop

@Wavester64 wrote:

@Remedios wrote:Why is that weird?

A new account will cause score recalculation with each CRA, it has nothing to do with where the HP landed in the past. If a new account causes scoring change, you will see it on each CRA, not just the one with HP.

If it stays as new account, i doubt you will see much in terms of scoring change (if any) since you already have a bunch of accounts under a year, unless it impacts aging metrics.

Vantage going to Vantage. You can lose 50 points for logging in, gain 100 if you scroll long enough. It's temperamental.

It's just that its not a new account per se', just a replaced credit card. I would expect the drop if I opened another account with BBVA, but I didn't. It was a replacement for fraudulent charges. Hopefully this is only affecting Vantage score and nothing more.

Did you ask BBVA whether the new account number would inherit the history of the former account? In a variety of cases, what you see in Vantage may eventually correct itself once new replacement card is in hand and active. Then, only a notation will be in place with something along the lines of "account number changed... reported lost/stolen..." or something similar. I lost 40 Vantage points just for typing this reply 😬. But I'll get them back once I leave the thread.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Report Card Lost = 30 Point Drop

Your screenshot shows same age for both accounts.

CMS may call it new, but it's not since all the original data is there.

It's not new, it's "new".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Report Card Lost = 30 Point Drop

@FinStar wrote:

@Wavester64 wrote:

@Remedios wrote:Why is that weird?

A new account will cause score recalculation with each CRA, it has nothing to do with where the HP landed in the past. If a new account causes scoring change, you will see it on each CRA, not just the one with HP.

If it stays as new account, i doubt you will see much in terms of scoring change (if any) since you already have a bunch of accounts under a year, unless it impacts aging metrics.

Vantage going to Vantage. You can lose 50 points for logging in, gain 100 if you scroll long enough. It's temperamental.

It's just that its not a new account per se', just a replaced credit card. I would expect the drop if I opened another account with BBVA, but I didn't. It was a replacement for fraudulent charges. Hopefully this is only affecting Vantage score and nothing more.

Did you ask BBVA whether the new account number would inherit the history of the former account? In a variety of cases, what you see in Vantage may eventually correct itself once new replacement card is in hand and active. Then, only a notation will be in place with something along the lines of "account number changed... reported lost/stolen..." or something similar. I lost 40 Vantage points just for typing this reply 😬. But I'll get them back once I leave the thread.

LOL good stuff ![]()

Potential Future Cards

Closed Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Report Card Lost = 30 Point Drop

This is what I'm afraid of, @Wavester64. Did this replacement card actually end up affecting your other scores? Can you tell me which ones were affected? Thanks...

My card has been compromised again and I told them that I didn't want a replacement bc they stupidly report the credit card number on credit reports, which means that the replacement card will be reported, resulting in a "new acct" entry. An Experiean rep and my own experience confirmed this. CC companies that use a number other than your actual card # don't keep the old/lost cc on your report.

I'm glad that you mentioned the TU Vantage score drop bc ppl act as if I'm making stuff up when I tell them that replacing the card will result in a new acct and score drop, even though I experienced that ![]() . The rep that I tt swore that it wouldn't affect my credit, but I've been there with 2 cc companies.

. The rep that I tt swore that it wouldn't affect my credit, but I've been there with 2 cc companies.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Report Card Lost = 30 Point Drop

@cr101 wrote:This is what I'm afraid of, @Wavester64. Did this replacement card actually end up affecting your other scores? Can you tell me which ones were affected? Thanks...

My card has been compromised again and I told them that I didn't want a replacement bc they stupidly report the credit card number on credit reports, which means that the replacement card will be reported, resulting in a "new acct" entry. An Experiean rep and my own experience confirmed this. CC companies that use a number other than your actual card # don't keep the old/lost cc on your report.

I'm glad that you mentioned the TU Vantage score drop bc ppl act as if I'm making stuff up when I tell them that replacing the card will result in a new acct and score drop, even though I experienced that

. The rep that I tt swore that it wouldn't affect my credit, but I've been there with 2 cc companies.

Not all companies report a duplicate trade line when a card is compromised. Capital One, NFCU, and AMEX all updated the card number on the original entry rather than report it as a new trade line with the history of the old account. I have heard Synchrony is one that reports a duplicate trade line rather than updating the original but haven't had to replace one of their cards so I haven't experienced it.

Keep in mind though that it's actually good for your file thickness when this happens because you get credit for the same trade line twice which boosts your AAoA and also remember that new account dings aren't as big of a ding on FICO as they are on Vantage.

@Wavester64 Thanks for the heads up about this. I actually heard that BBVA handles fraud this way but I was reading it in an old post.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Report Card Lost = 30 Point Drop

@Anonymous wrote:I have heard Synchrony is one that reports a duplicate trade line rather than updating the original but haven't had to replace one of their cards so I haven't experienced it.

In for a DP:

My Paypal MC was lost/stolen in the mail just recently. I received a new one, and they reported a new TL, but still with the original open date. As for now, I've lost 23 points (FICO 8). We'll see where I end up after all the dust settles.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Report Card Lost = 30 Point Drop

@OmarR wrote:

@Anonymous wrote:I have heard Synchrony is one that reports a duplicate trade line rather than updating the original but haven't had to replace one of their cards so I haven't experienced it.

In for a DP:

My Paypal MC was lost/stolen in the mail just recently. I received a new one, and they reported a new TL, but still with the original open date. As for now, I've lost 23 points (FICO 8). We'll see where I end up after all the dust settles.

This has happened to me twice with Sync. I have 2 closed accts for the same card. I had unauthorized charges recently and I refused to let them do a dispute about the charges or reissue a new card bc I didn't want a THIRD closed card on my acct. A manager submitted the dispute to the bureaus, but when I contacted EX, they told me that lost cards must stay on for 2 years. I just let it go bc AFAIK, it's actually helping my AAoA.