- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Reporting Dates

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Reporting Dates

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting Dates

Hi,

I've been reading posts relating to when you should pay your credit card balances and I don't think I understand the statement date versus the posting date versus the reporting date. This is such a basic question and it feels like it should be self explanatory, but I really want to master my credit and earn the highest scores possible. So, for example, if my statement date is the first of the month, is that the same date that the credit card company reports? Is the posting date the same as the statement date or does that have a different meaning? Finally, how do you know when your statement "closes"?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reporting Dates

@Wildflower wrote:Hi,

I've been reading posts relating to when you should pay your credit card balances and I don't think I understand the statement date versus the posting date versus the reporting date. This is such a basic question and it feels like it should be self explanatory, but I really want to master my credit and earn the highest scores possible. So, for example, if my statement date is the first of the month, is that the same date that the credit card company reports? Is the posting date the same as the statement date or does that have a different meaning? Finally, how do you know when your statement "closes"?

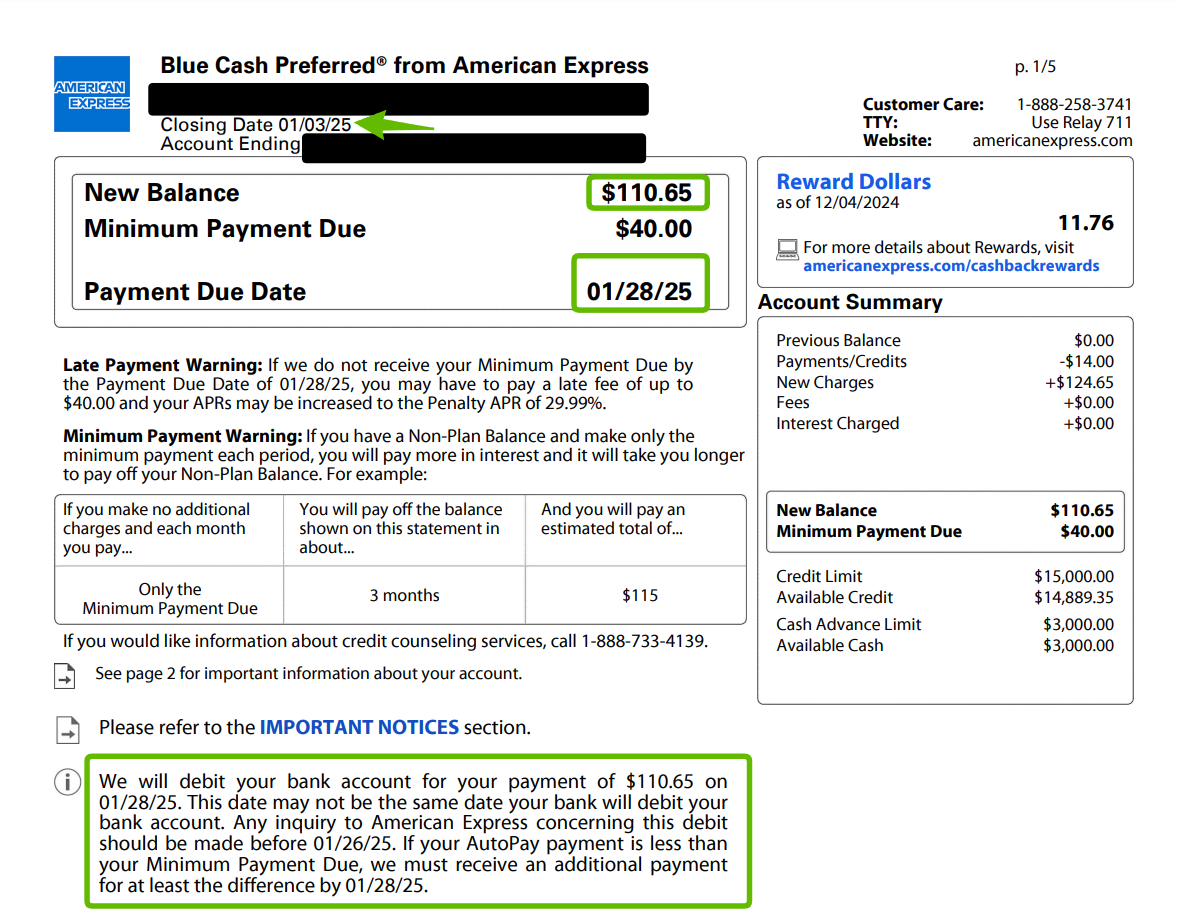

the statement date is when your credit card bill is published, this is typically the same day every month (for me it's the 3rd)

on this date, they make your bill, determine what you owe, and give you the due date for when you have to make at least the minimum payment (or what you should be doing is paying the entire statement balance in full by the due date).

and on that day, typically, is when a bank will send that information off to the credit bureaus.

so you can see January 3rd was the statement date

the statement balance was $110.65

the due date is January 28th, 2025

the minimum payment is $40.00

and my autopay will charge me the statement balance on the due date, per my autopay settings.

all you need to worry about is setting up auto pay and making sure it's set to pay your statement balance in full by the due date. that's it. your credit score will naturally go up and down depending on your balances, but that is completely fine. as long as you are paying your statement balance in full by the due date, you are perfectly set.

however, if you are applying for something in the near future, you can manipulate the information sent to the credit bureaus by paying the balance of the card prior to the statement date.

so in the example above, if I paid $100 towards the card on January 1st, 2025, the card would only report a balance of $10 instead of $100.

the ideal configuration of reported balances on your credit report is 1 card reporting a balance of > $0 but less than 9% of your credit limit ($20 is fine) and the rest of your credit cards reporting a $0 balance AZEO (all zero except one)

It helps to ask your issuers to change your due date so that all of your cards have the same or very similar due dates.

Current FICO 8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reporting Dates

Thank you so much! Your detailed response is super helpful and much appreciated!